Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future of TV Briefing: 6 charts that sum up the state of streaming subscriptions

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at how deceleration in streaming subscription growth and steady subscriber churn have coincided with a rise in people subscribing through aggregators.

- Streaming’s aggregation era in graphic detail

- Fox & ESPN vs. Nielsen & YouTube, WBD vs. Midjourney, Amazon’s video ad sales exec exits and more

Streaming’s aggregation era in graphic detail

Irony is the NFL finally being fully available to cord-cutters just as streaming has begun to bundle itself a la traditional TV.

You’re probably already aware of streaming being in its aggregator era. I mean, former WarnerMedia CEO John Stankey declared his intent to make HBO Max an aggregator back in 2019 – the media company has gone through three name changes and two corporate restructurings since then.

But maybe you’re fuzzy on what’s driving this streaming aggregation trend. Or perhaps you’re unsure how much aggregation is actually happening. Or possibly you’re wondering what impact the NFL crossing the streaming rubicon could have on the streaming subscription market.

Me too. Which is why I’ve pulled six charts that seem to surmise the current conditions facing subscription-based streaming services.

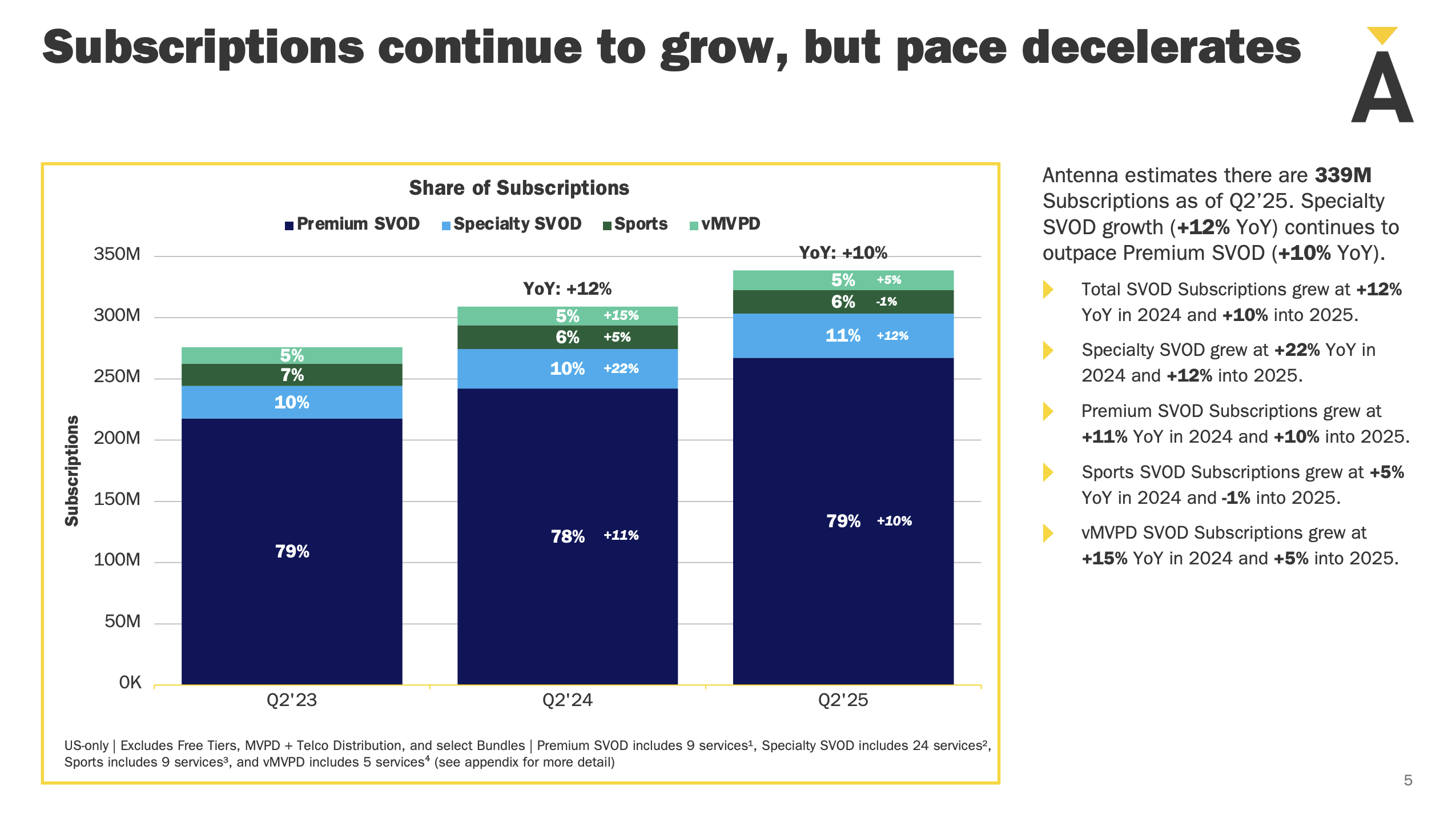

Streaming subscription growth is slowing

Source: Antenna Group, Q3 2025 “State of Subscriptions” report

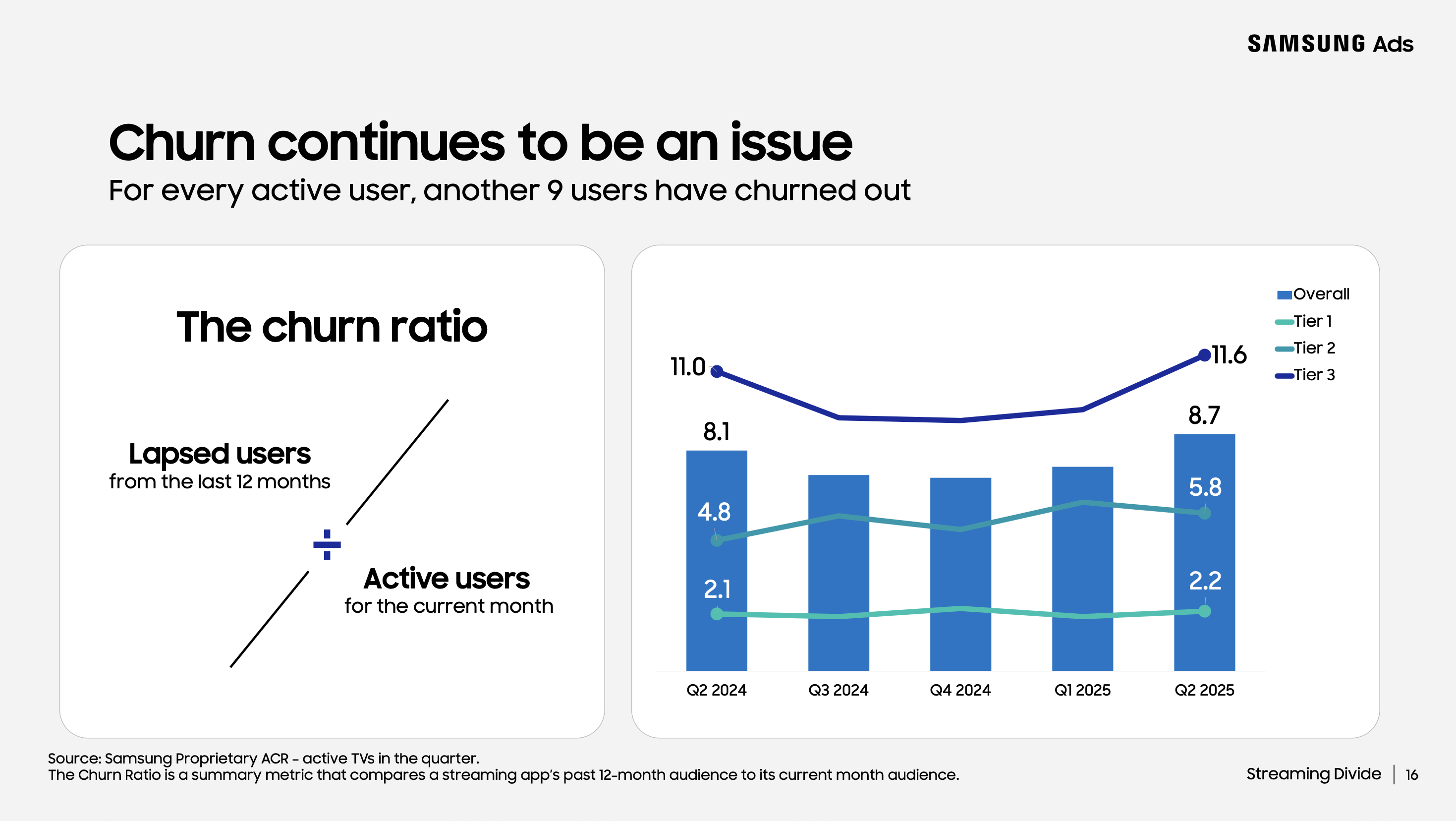

Streaming subscriber churn has held steady

Source: Samsung Ads, “State of CTV July 2025”

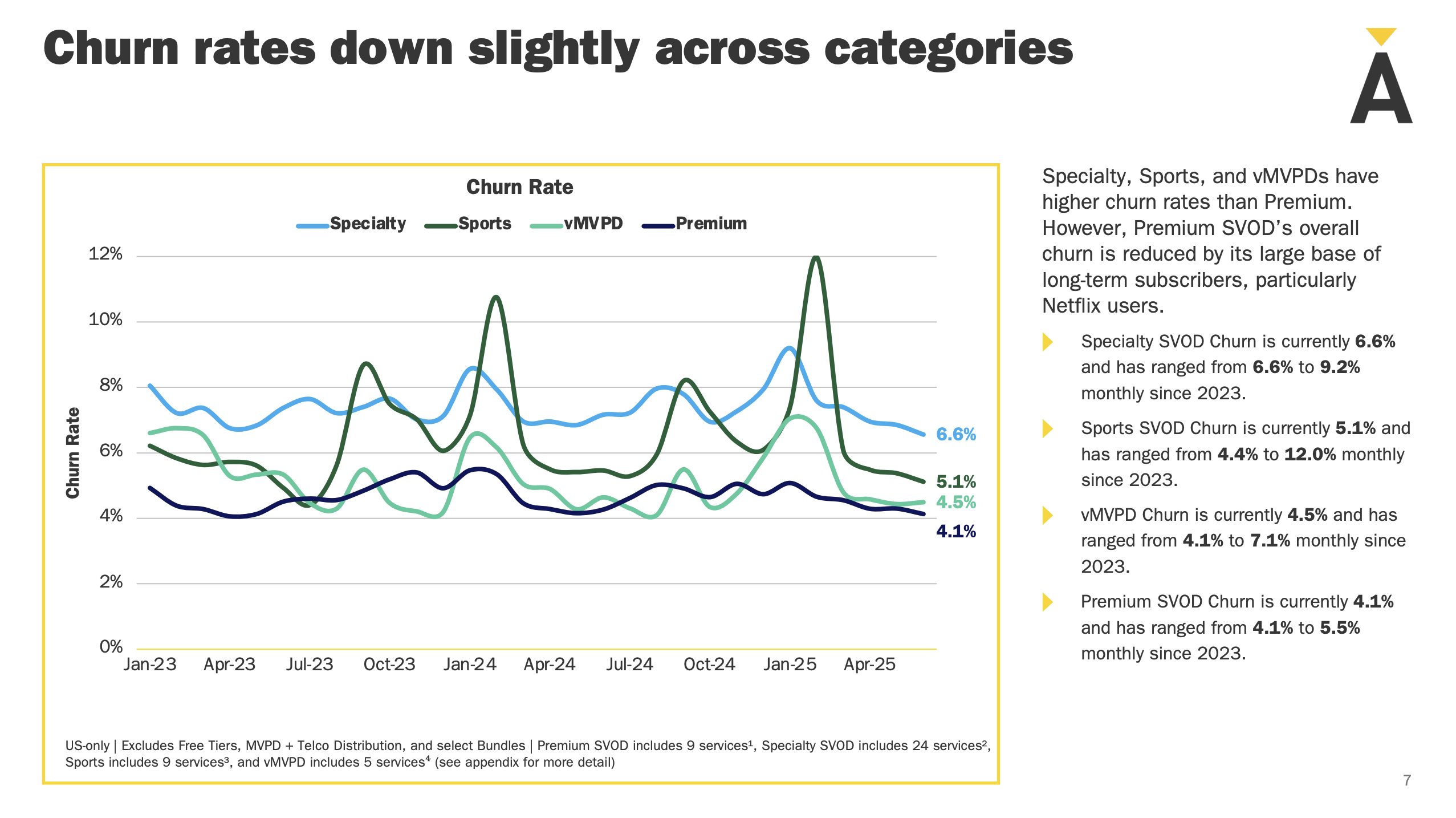

Subscriber churn is most acute among specialty streamers and sports-centric services

Source: Antenna Group, Q3 2025 “State of Subscriptions”

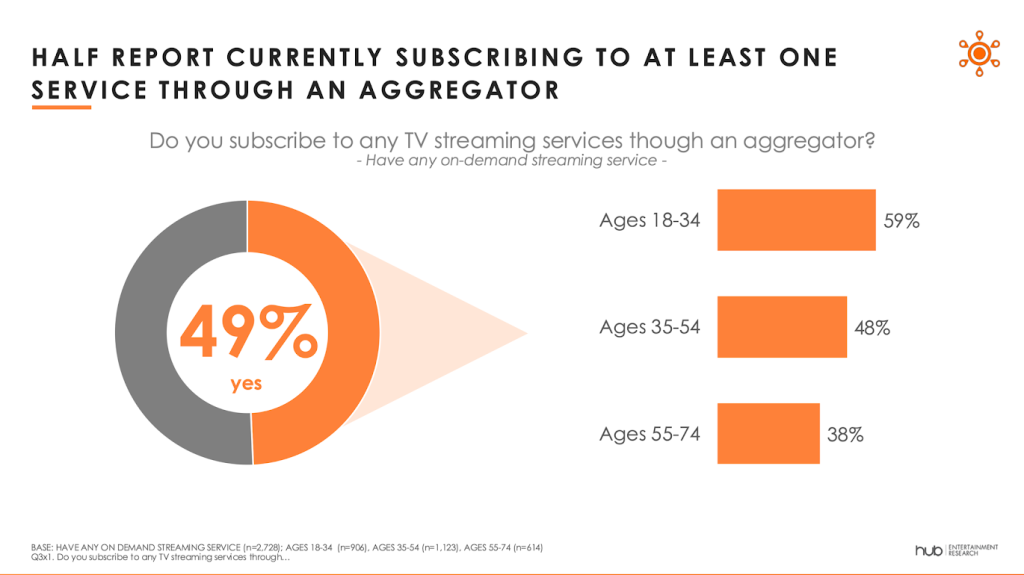

Most young people are subscribing to streaming services through aggregators

Source: Hub Entertainment Research, 2025 “TV Advertising: Fact vs. Fiction”

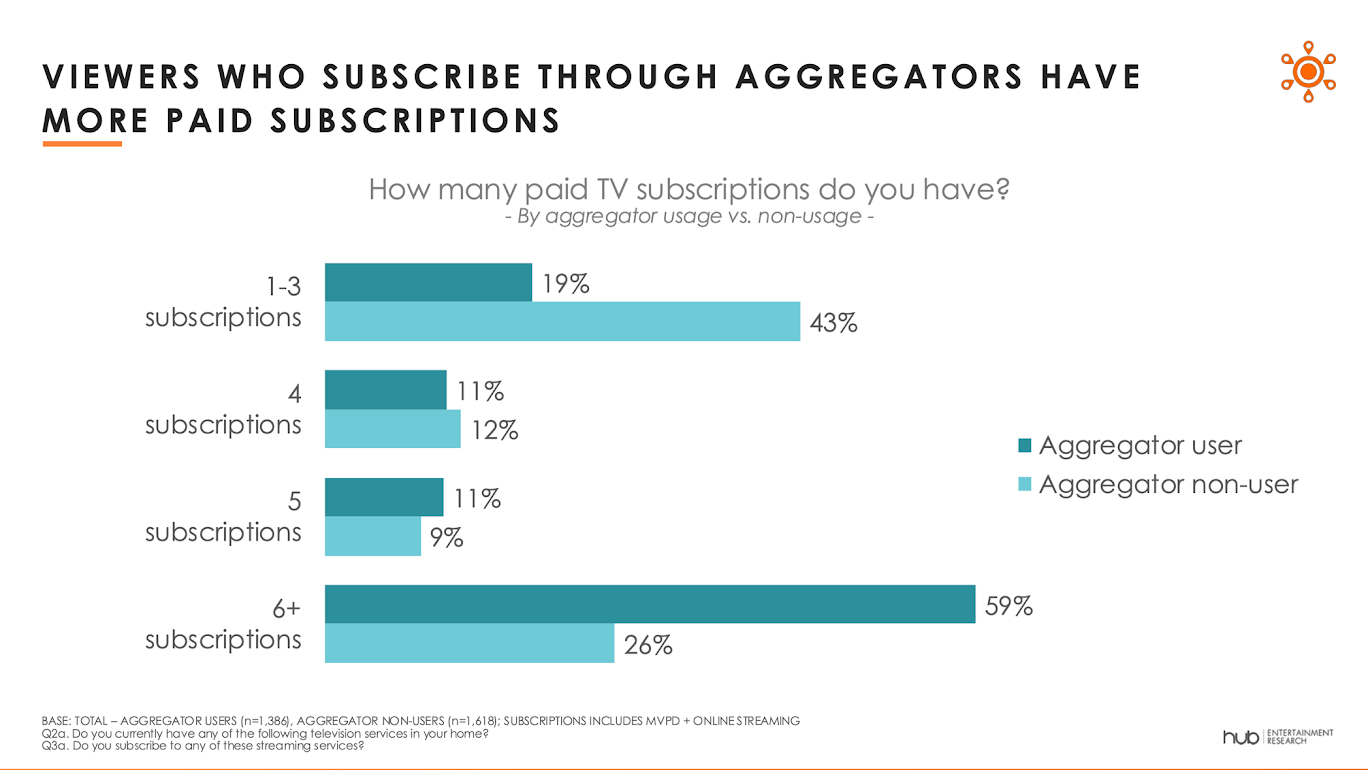

People who subscribe through aggregators subscribe to more streamers

Source: Hub Entertainment Research, 2025 “TV Advertising: Fact vs. Fiction”

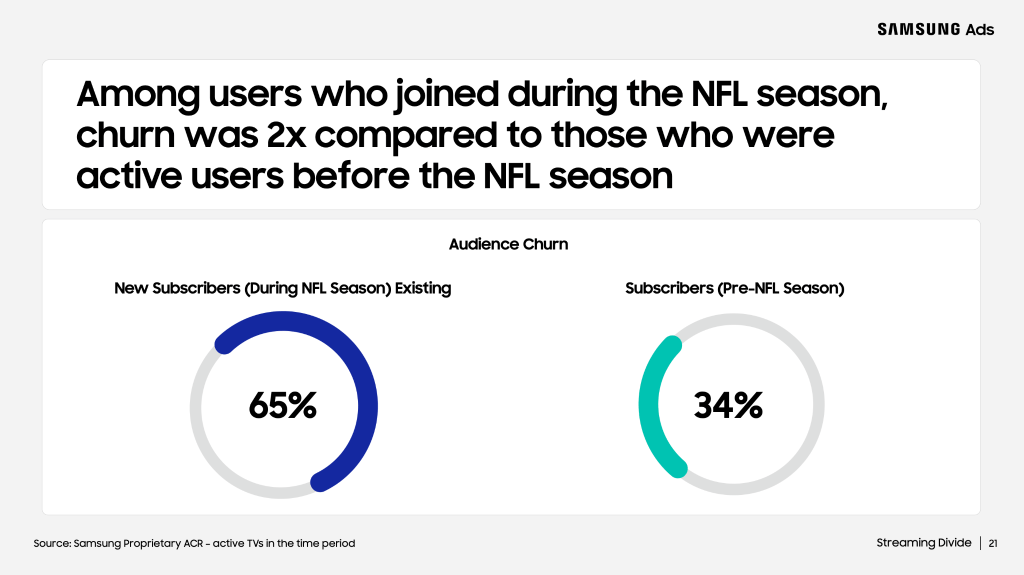

Subscription sign-ups during NFL season are more prone to churn

Source: Samsung Ads, “State of CTV July 2025”

What we’ve heard

“It’s volume over rate. We’re capitalizing on that where we can.”

— An agency executive on current streaming ad pricing economics

Numbers to know

17.3 million: Average number of people worldwide who streamed YouTube’s broadcast of the Chiefs-Chargers NFL game on Friday.

200 million: Number of users that TikTok claims to have in Europe.

158: Number of days ahead of next year’s Super Bowl that NBCUniversal announced it had sold all available ad inventory for the game.

What we’ve covered

Creators are leveraging CTV channels as added value for sponsorship deals:

- Creators are licensing their video back catalogs to be distributed on streaming services, like free, ad-supported streaming TV channels.

- They’re hoping the additional distribution will create a halo effect to make them more attractive to sponsors.

Read more about creators’ CTV strategies here.

Why one exec thinks creators is a real key to Snap flourishing:

- The platform claims that more celebrities and digital-native creators have enrolled in its Snap Stars program.

- The program gives creators a share of revenue from ads run adjacent to their Snapchat videos.

Read more about Snapchat’s creator strategy here.

Transparency is fueling a surge in creators’ sponsorship rates:

- Some creators are sharing with one another what they are being paid by sponsors.

- This transparency is leading creators to recognize if they have been undervaluing themselves.

Read more about creators’ sponsorship rates here.

The hidden costs of creators:

- Creators’ overhead costs including hiring a team and thumbnail designers.

- Renting studio space and film equipment also counts against their income.

Read more about creators’ overhead costs here.

Streaming investments are rising, but media buyers drive hard bargains over CPMs and fees:

- Advertisers have increased their streaming budgets by double-digit percentages this year.

- The increased overall spending has correlated with advertisers paying less on a per-impression basis.

Read more about streaming ad prices here.

What we’re reading

Fox & ESPN vs. Nielsen & YouTube:

The TV networks and NFL rights holders preemptively complained that the Nielsen-measured viewership numbers YouTube would announce for last Friday’s NFL game (see above) would not be based on the same MRC-accredited methodology that Fox and ESPN use in their viewership pronouncements, according to Front Office Sports.

Paramount isn’t cutting the cord:

Unlike NBCUniversal and Warner Bros. Discovery, Paramount Global is looking to bolster its cable TV networks instead of sell/spin them off — though the enhancement would likely make them more for attractive for potential buyers/investors — according to The Wall Street Journal.

Former NBCUniversal exec Krishan Bhatia is stepping down as Amazon’s vp of global video advertising and partnerships after less than two years at the company, according to Ad Age.

Warner Bros. Discovery vs. Midjourney:

Roughly three months after Disney and NBCUniversal sued Midjourney over copyright violations, WBD has decided to follow suit with its own suit against the generative AI image and video maker, according to The Hollywood Reporter.

Among the AI-generated videos being uploaded to YouTube is a growing number of ones that purport to recap history but are full of errors and are burying trustworthy history videos on the platform, according to 404 Media.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Long-form creators eye taking over TVs – and chasing bigger brand budgets

Long-form episodic creator content is drawing in large numbers of highly engaged viewers, but ad budges are lagging behind. We explore why.

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.