Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Investors have been waiting to put a price on chat apps since Facebook bought WhatsApp two years ago for $19 billion. Today may be their day.

Line, Japan’s popular messaging app, is making its stock market debut today. Much has already been made about how this is the biggest initial public offering from a technology company this year — Line raised around $1 billion and is valued at up to $6 billion — which only serves to underscore a general excitement around messaging apps.

As more people live out their mobile lives in messaging ecosystems, the appeal for brands and publishers to reach audiences there grows. In a still-nascent landscape, Line is making a strong case to be a global player of significance. Here’s what you need to know about the messaging app in six charts.

Scale

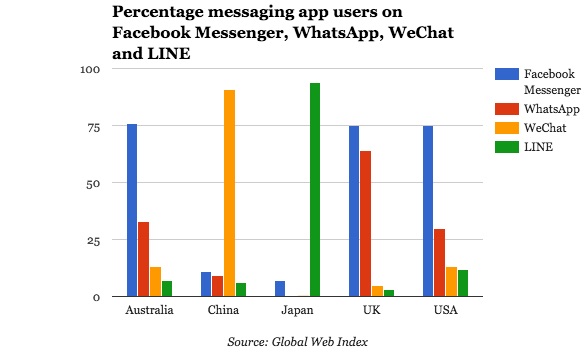

Line launched in 2011 in Japan as a way for people to communicate after phone lines crashed in the aftermath of the Tōhoku earthquake. In Japan, nearly 100 percent of people using messaging apps use Line; Thailand, Taiwan and Indonesia are almost as high. In the U.S., 12 percent of messaging app users are active on Line, according to Global Web Index data.

With the IPO, the company hopes to expand further into Asia and beyond, where other competitors like WhatsApp, Snapchat and Facebook Messenger already take up valuable space on people’s phones.

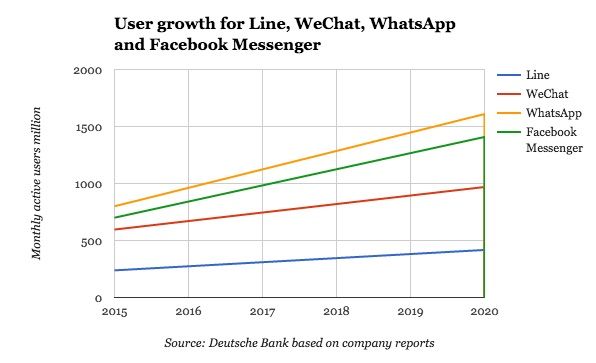

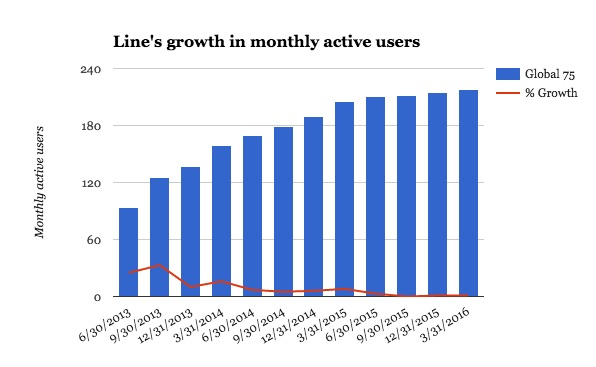

Line has roughly 218 million monthly unique users, and while it’s growing, it’s still dwarfed by more established competitors like WhatsApp with 1 billion monthly active users and Facebook Messenger with 900 million active monthly users.

Line’s user numbers are going up, but this percentage growth has plateaued, according to the company’s figures. Writing in Quartz, Josh Horwitz points out that the time for its IPO could have been two years ago, before growth slowed and Facebook got such a head start.

Functionality

But rather than compete with the huge global players, some, like Jack Kent, director, mobile at research firm IHS Technology, believe differentiation will serve Line better than scale. “Line has established a foothold in its main Japanese market by offering a platform of content and services beyond just messaging and communications,” he told Digiday. “It was one of the first to introduce personalization features and stickers; it then quickly moved on to integrating games and then other services such as music, payments and taxi services.”

There are numerous ways brands can fit into messaging app ecosystems, especially through chatbots. Line CEO Takeshi Idezawa said at the Tech in Asia Singapore conference in April. “There will be more and more bots present, and we are going to export them aggressively,” he said. “Anything with bots we think will give us a higher user rate.”

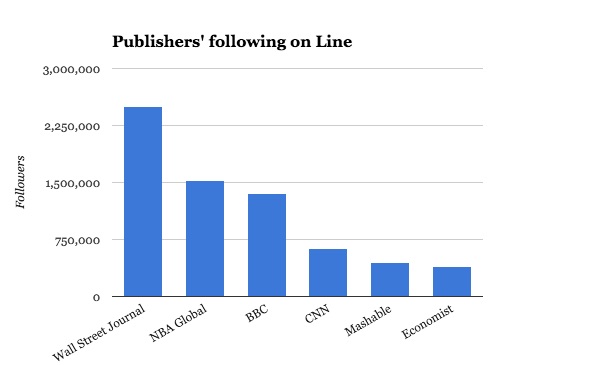

For publishers, Line offers much more functionality than other chat apps. The Economist uses it to share its weekly magazine cover, CNN uses bots on Line to deliver personalized news, and the BBC fills its Line feed with animated videos. The options for broadcasting a feed or talking to individuals through stickers, emojis and GIFs are much more developed on Line than on Facebook Messenger, for example.

As analyst Jack Kent points out, “For many tech companies, there is a shift from growth driven by user acquisition to a more pressing need to monetize and drive profitability.”

Revenue

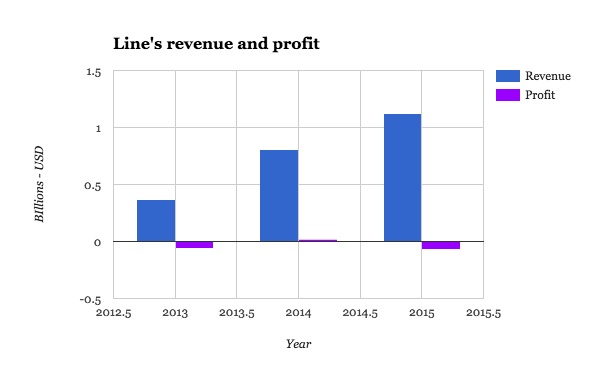

Line’s revenue grew 40 percent from 2014 to 2015. By comparison, Facebook Messenger has yet to make money and WhatsApp has made approximately $49 million, although these players are projected to reach higher revenue rates than Line by 2020, based on forecasts by Deutsche Bank ($4.8 billion for WhatsApp and $4.2 billion for Messenger). The bank also calculated that the amount of revenue that Line could drive from each monthly unique user is $9. For WhatsApp and Facebook Messenger, this falls to $3.

Line’s revenue may be reassuring to investors, but it hasn’t been driving a profit, according to data from the company. On the plus side, it has diverse revenue streams from physical and digital products as well as ads.

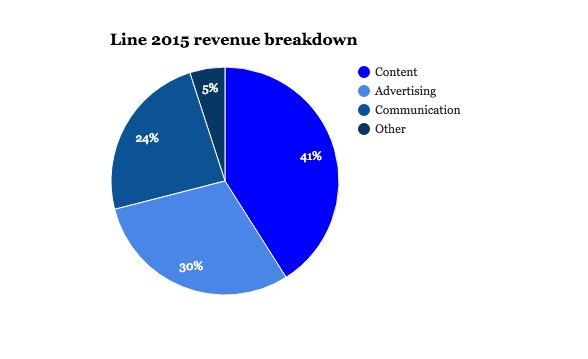

Content here includes payments users make in-app for games, like Line Music and Line TV. Communications include calls made in Line and stickers users buy to send to others. Other services include revenue from brand bots, Line Taxi and Line Pay (an offline payments system), as well as branded good sales from stores.

Providing all services globally will be costly, and driving revenue from sticker sales is more suited to a Japanese user base, so it’s hard to imagine replicating that relatively niche success in other markets. “Line must work to integrate locally relevant content and services targeted at specific markets in which it thinks it can compete,” added Kent.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.