Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

As in-house innovation labs falter and the competitive landscape picks up, retailers are buying up technology companies to gain an advantage — and take back control.

- This week, McDonald’s purchased Dynamic Yield, a marketing technology and data processing company, for $300 million in order to get customers smarter product recommendations online and in the drive-thru lane.

- In February, Walmart purchased Aspectiva, an AI solution that collects product reviews to offer customers more personalized recommendations.

- In 2018, Nordstrom acquired two technology companies, BevyUp and MessageYes, two customer service messaging platforms, to connect store employees with customers to respond to questions and give styling tips in the Nordstrom app.

- In November, Ulta bought QM Scientific and GlamST, two AI and augmented reality startups, to build in new technologies into its digital experience.

- Kroger bought data technology firm 84.51 in 2015 to support its marketing business.

- Target bought last-mile delivery service Shipt in 2017 to help figure out localized deliveries and store fulfillments.

Analysts expect more retailers and retail brands to buy up tech players that have spent years establishing themselves as market leaders in categories like ad tech, big data processing, AI and machine learning, personalization, delivery and cross-channel capabilities — anything retailers and brands aren’t inherently skilled at, but need to master now to compete in an era where Amazon dominates the industry.

“The activity of acquisitions reinforces the point that retailers of all shapes types sizes are trying to leverage technology as a competitive advantage, close any customer experience gaps,” said Brian Cleary, vp of marketing at RedPoint Global. “Then comes the question of buy vs. build — building takes time and timing is everything. The pace of the market is moving fast enough that buying technology and integrating it into a company becomes the better choice.”

The vendors that retailers are now eyeing as potential acquisitions were always available to hire for their services. But now, retailers want to have more control over their data and the tech innovation they used to be okay outsourcing. Acquiring a technology company means that the retailer can tailor its services to its own needs, rather than share its resources with a laundry list of other clients.

What retailers and brands decide to buy gives clues to what tech and expertise are competitive priorities. This can vary between retailers, from fast delivery times to augmented reality makeup application, but a unifying factor is to better understand customer data and behavior to improve in-store and digital experiences, personalize marketing messages and make decisions based on insight that’s been collected.

“For retailers, online and offline retail was treated as separate entities and now companies are working to integrate these systems and getting them to talk to each other,” said Kelly Davis-Felner, the head of North America marketing at Bazaarvoice. “E-commerce was a hobby for a lot of these companies, and that’s when they thought they could build a lab and hire a few engineers. Now, it’s a substantial part of business, and that means substantial investments.”

Who could be next? Cleary anticipates we’ll see copy-cat acquisitions from tech-forward fast-food chains, like Dominos. Walmart has been reportedly eyeing RichRelevance, a personalization technology platform.

“Personalization — which really just means serving customers the right messaging and recommendations at the right time — is top of mind. Retailers haven’t been able to crack this on their own. They’ll start paying,” said Davis-Felner.

Athleta makes a wellness push

Athleta, Gap’s women’s athleisure brand, announced Thursday that it’s teaming up with Well+Good to host monthly wellness-related events in its stores around the country. Its first event, to be held on Saturday in New York, will feature talks focused on “four key elements of holistic wellness that fuel overall health and athleticism: mind + body, finance, self-care, and community.

It’s emblematic of the push being lead by brands like Nike and Lululemon, to re-envision athletic wear stores as “community spaces,” that offer more than just free workout classes. Athleta only has 160 stores compared to Lululemon’s 440, one of its biggest competitors. The event push will give Athleta more insight into how much foot traffic it can drive to stores, and how to position them as community spaces. Gap said during its fourth quarter earnings call that it planned to open more Athleta stores, but didn’t exactly say how many. “We continue to see tremendous market share opportunity and runway for growth in 2019 and beyond by leveraging the [Athleta’s] differentiated positioning and purpose-driven mission,” CEO Art Peck said during the earnings call. — Anna Hensel

Amazon v. Google

According to Digiday research, the robust growth of Amazon’s ad business could be bad news for Google.

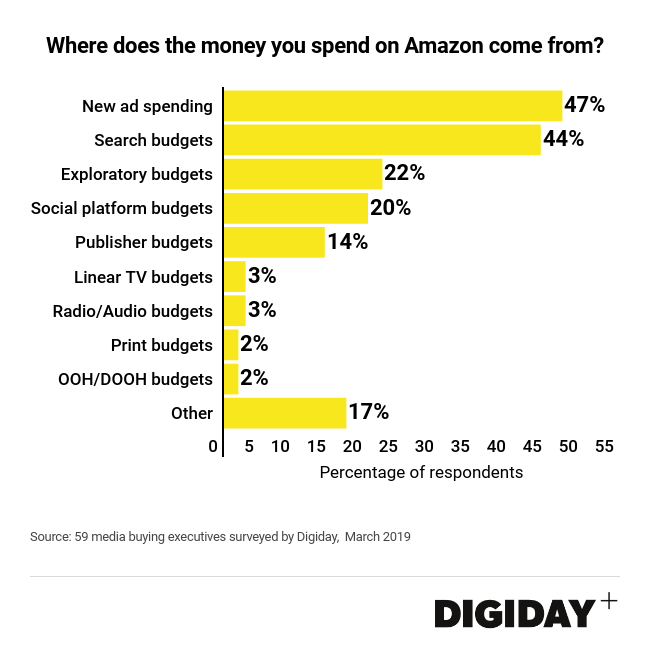

In a survey of media buyers conducted by Digiday this March, 44 percent said their spending on the platform was, to some degree, coming from the reallocation of existing search budgets. That doesn’t mean buyers are yanking spending from Google, but half of all product searches begin on Amazon, meaning that, for retailers and brands, the platform is rivaling Google’s importance in figuring out where to spend.

Other news to know

Other news to know

- Radar, an automated inventory management and analytics company, has raised $16 million in funding.

- Lululemon’s fourth-quarter earnings beat estimates on Wednesday, with revenue climbing to $1.2 billion.

- Walgreens will join CVS on the CBD bandwagon, selling infused products in select stores this year.

- Simon Property Group will test an online shopping platform for its outlet stores.

What we’ve covered

Shop this pin: Ahead of its IPO, Pinterest has big ambitions to finally nail commerce on its platform.

Unilever-approved: The CPG corporation has built a network of trusted publishers that have to follow guidelines in order to buy ads with them.

Amazon Pay hits the big time: Amazon has big ambitions for its payment platform.

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.