Last chance to save on Digiday Publishing Summit passes is February 9

Walmart is seeing its e-commerce investment pay off.

On Thursday, the company reported that 40 percent U.S. e-commerce sales growth in the second quarter, up from 33 percent in the previous quarter. Beyond enhancements to physical locations, the company’s e-commerce growth is also the result of revamps to its website and app, and its online marketplace. The company expects e-commerce sales to be up 40 percent for the full year. Total revenue was $128.03 billion.

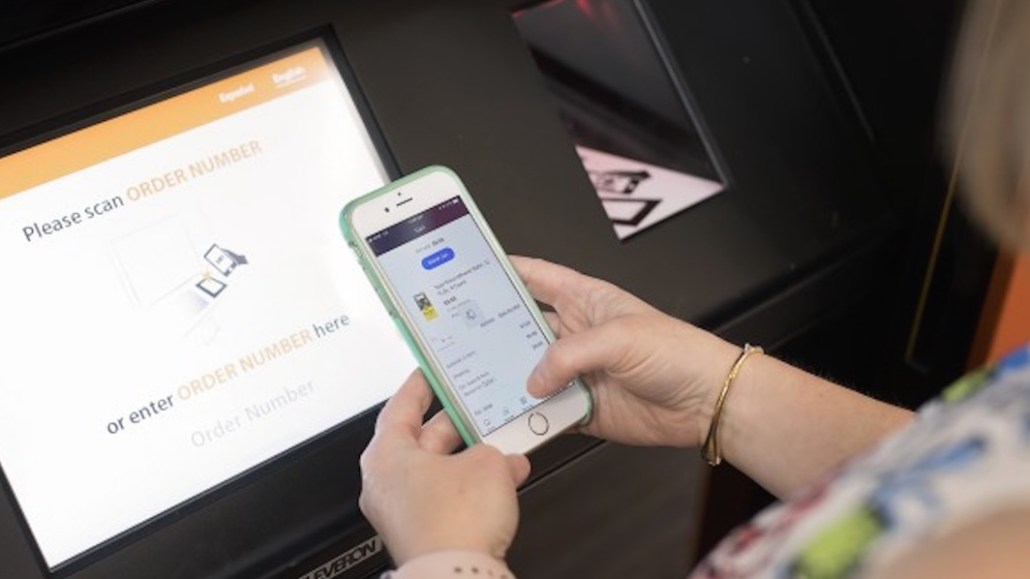

But even as e-commerce becomes more important (more brands are selling on Walmart.com, according to e-commerce CEO Marc Lore) Walmart sets itself apart from online-only retailers through added benefits of physical stores, letting customers buy items online and pick them up at physical locations or get products delivered to their homes. By the end of this year, Walmart said it aims to install 700 automated in-store pickup machines called towers where customers will retrieve pre-purchased goods. It’s building out its grocery delivery and in-store pickup capabilities for customers, currently available at 1,800 Walmart locations across the U.S. It’s also experimenting with virtual reality through an acquired company called Spatialand, which is part of its startup incubator, Store No. 8. While growing its online presence, it’s also adding digital capabilities inside stores, said CEO Doug McMillon on a call with investors.

“Differentiation is definitely going to be in omnichannel [and] in-store pickup,” said Sucharita Kodali, principal analyst at Forrester Research. “It’s being competitor-aware and doing what they need to do — Walmart very early on experimented with customers taking things home [to online buyers] and having associates [deliver], with mixed success. They were doing things that were unique that even Amazon hadn’t rolled out.”

Pickup at physical locations offers customers a level of control that they wouldn’t otherwise have compared to the experience of ordering an item online and getting it delivered, she added.

Walmart has made significant headway keeping its digital interface on par with other major companies in the home category. As others like Home Depot, Lowe’s and Wayfair grow their augmented reality web and app-based capabilities, during the second quarter, Walmart rolled out a three-dimensional virtual tour, offering customers the option to “buy the room” based on their preferences, McMillon said.

Walmart is growing its online product marketplace, adding 1,100 brands to Walmart.com, including Zwilling J. A. Henckels cutlery and cookware, Therm-a-Rest outdoor products, and O’Neill surf and water apparel.

At the same time, it’s also growing its own online-only brands to acquire new kinds of customers, such as Allswell, a new home brand launched in February aimed at millennials.

“With [acquisitions like] Bonobos and Jet.com come different customer bases, and you get a different perspective from the traditional Walmart customer,” said Jonathan Smalley, CEO of Yaguara, a data analytics company that serves e-commerce brands.

Building a marketplace of offerings has become a necessity, largely due to industry standards set by Amazon, said Kodali. Walmart intends to grow its brand partnerships to expand its online marketplace.

“We have more work to do on our e-commerce assortment to get to the margin levels we desire and we’re in discussions to bring more key brands to our site,” McMillon said.

Get more exclusive coverage, research and interviews from the modernization of retail. Subscribe to our weekly retail briefing now.

More in Marketing

GLP-1 draws pharma advertisers to double down on the Super Bowl

Could this be the last year Novo Nordisk, Boehringer Ingelheim, Hims & Hers, Novartis, Ro, and Lilly all run spots during the Big Game?

How food and beverage giants like Ritz and Diageo are showing up for the Super Bowl this year

Food and beverage executives say a Super Bowl campaign sets the tone for the year.

Programmatic is drawing more brands to this year’s Winter Olympics

Widening programmatic access to streaming coverage of the Milan-Cortina Games is enabling smaller advertisers to get their feet in the door.