Snapchat isn’t the newest kid on the social media block and is losing some of the spontaneity that made it unique in social media. Along with picking up older users, the messaging app this week started offering an option to preserve photos and videos.

Snapchat is going mainstream. While that might ruffle hardcore users, brands and advertisers should find the app more welcoming. As Fleetwood Mac once sang: Even children get older. And Snapchat’s getting older too.

Here are the winners and losers of this more mature Snapchat.

Winners

Olds

Snapchat’s new Memories section lets users save their Snaps and share their archive with friends. It basically turns Snapchat into your default camera app, because photos don’t automatically disappear like they used to.

“The fact that Snapchat can now easily store photos and videos may very well bring in more older users, who are currently Instagram- and Facebook-centric — platforms that are much more permanent than Snapchat has been,” said Orli LeWinter, svp of social at 360i.

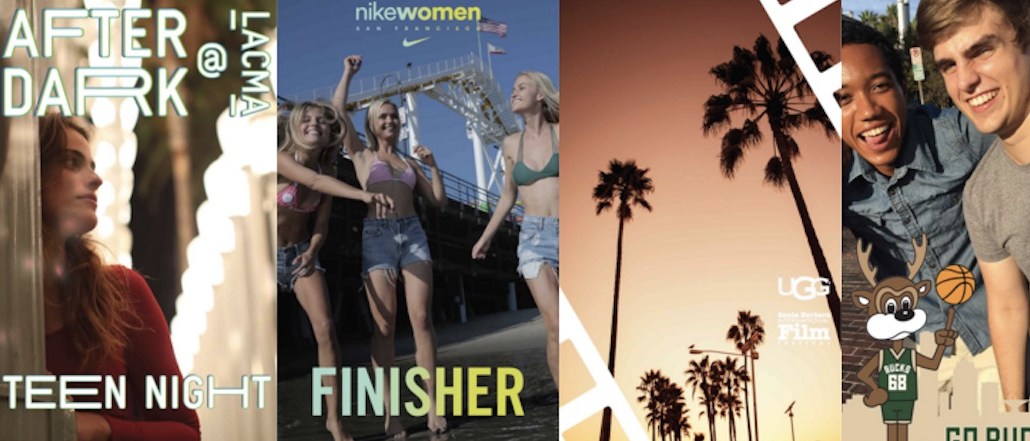

Brands

Snapchat makes it hard to accumulate followers, and once you have fans, it’s hard to see how engaged they are. Also, the content disappears in 24 hours. That has deterred brands from jumping aboard.

Memories could make it easier for brands to use Snapchat to create content that lasts. And when brands hire popular Snapchat personalities for promotional campaigns, that branded content can have a longer shelf life.

Snapchat ads

Snapchat will now host photos and videos designated as Memories, giving it more insight into its users than before, when photos were fleeting. More data could help Snapchat with its ad-targeting potential. Also, Memories gives Snapchat another section where users can be shown ads.

“We do expect that Snapchat will one day monetize Memories in some way, although to what extent or degree is still unknown,” LeWinter said.

Losers

Instagram and Twitter

The more Snapchat evolves into an established media player, the more it takes from rivals like Instagram and Twitter. Every minute and every dollar brands spend on their Snapchat marketing are time and money that could be spent elsewhere. There already are signs Snapchat has caught up to Twitter; both reportedly have about 150 million daily users. Instagram would be the next app in Snapchat’s crosshairs.

Purists

One of the core tenets of Snapchat was the idea that photos and videos would disappear. That let people create with a sense of freedom, not worrying about getting the perfect shot. “It strikes me that Memories will help create use cases for Snapchat that are less immediate,” said Richard Guest, president of Tribal Worldwide North America.

In going mainstream, Snapchat may put off original users, who joined the app when there were no ads and there was a sense of anarchy in the unpolished product.

“My only concern is that in the process of growing up, there will be some backlash. There already is a little,” said Azher Ahmed, director of digital at DDB Chicago. “Fortunately, most users are resigned to the fact that change is inevitable.”

Kids with parents

With Snapchat adulting, the first generation of adopters are starting to see add requests from their moms. It’s exactly the type of community that Facebook encouraged, which eventually turned the social network into more of a chore than a fun place to hang. With an older crowd comes the baby pictures and food portraits. “What’s happening now is Snapchat is becoming more of a canned product,” Ahmed said.

More in Media

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.

Why Walmart is basically a tech company now

The retail giant joined the Nasdaq exchange, also home to technology companies like Amazon, in December.

The Athletic invests in live blogs, video to insulate sports coverage from AI scraping

As the Super Bowl and Winter Olympics collide, The Athletic is leaning into live blogs and video to keeps fans locked in, and AI bots at bay.