Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Vox Media’s roll-up of Recode shows the limits of its vertical approach

Vox Media bet it could solve the puzzle of making digital media work by having distinct editorial verticals, underpinned by a common technology and sales backbone. That approach may be approaching its limits, as Vox Media has rolled tech news site Recode into its news site, Vox.com, after doing the same with fashion site Racked.com last summer.

By folding sites into Vox.com, the company grows the audience of its flagship site. Vox’s verticals represent the high-quality, safe havens that would seem to appeal to advertisers at a time when brand safety is all the rage to talk about. But for all the talk of “well-lit environments,” ad buyers still crave scale.

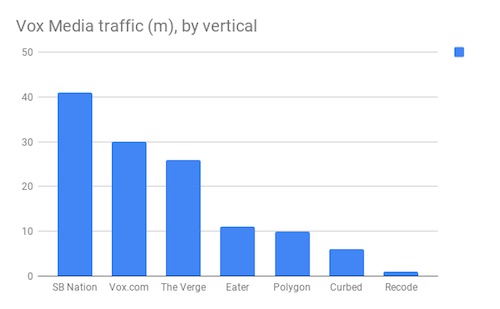

Vox Media reached nearly 90 million uniques in September, putting it just behind Hearst and ahead of The New York Times and The Washington Post. But Vox.com, with 30 million uniques, ranked only 31st in the news category. The volatile news cycle also has advertisers steering clear of news, and most of Vox Media’s non-news sites are small individually. Recode itself is just over 1 million in uniques, down 51 percent year over year. (All figures are from comScore)

The company recently conducted a content audit of its sites to identify potential areas to save money and has tried to have the sites work more closely together to promote content-sharing, people familiar with the matter said. The company said Eater and Curbed have worked together on editorial content. But such opportunities are limited.

“It’s hard to be an independent publisher these days,” said John Wagner, group director of published media at PHD. “Even if you set up your programmatic exchange, direct is where you make your money. It’s definitely harder to build content around news because of the volatility in the news cycle. It’s way easier to build content around sports, food, home, etc. So that’s the challenge — how do you monetize the audience outside the exchanges?”

The Recode case also points to the risks of a personality-driven site. Recode was founded in 2014 by veteran tech journalists Kara Swisher and Walt Mossberg, and was bought in 2015 by Vox Media, particularly for its conference business. But Mossberg has since left, having retired, and Swisher is doing other things in addition to Recode; she recently became a contributing New York Times opinion writer.

Web traffic is not everything. Vox Media has pointed out that while Recode’s traffic has declined, its podcast and conference business has grown and includes live conversations that air on MSNBC.

Vox Media reportedly was in danger of missing its $200 million revenue goal for this year, another sign that digital upstarts are struggling to live up to the high (possibly unrealistic) expectations of its investors. In February, Vox Media laid off 50 people (it employs around 900 now). Lindsay Nelson, who was recently named chief commercial officer, is leaving the company for a role at TripAdvisor. With the Recode skake-up, editor-in-chief Dan Frommer is leaving the company.

Vox Media is reliant on digital ad revenue at a time when investors are increasingly enamored with subscription- and reader-revenue-driven companies. It’s just started developing a commerce business and has no significant subscription revenue.

Vox Media has done video licensing deals with Netflix and PBS, but deals like that typically have limited upside. In Netflix’s case, the streamer wants to own original shows, which curbs the amount of money the programmer can make.

A company spokesperson said Vox Media has had “a strong year in terms of audience and revenue growth,” with a comScore audience at an all-time high. “We are confident in our ad-supported digital content, as well as a growing network of successful podcasts (62 shows to date); a rapidly rising non-fiction TV production studio (producing shows for partners including Netflix, CNN, and PBS); an ad marketplace that offers trust and scale (Concert), and developing the leading technology to enable other publishers to scale (Chorus, which recently announced the Chicago Sun-Times as a new partner).”

Concert is Vox and NBCU’s 40-company ad platform that it pitches as a way for advertisers to buy high-quality publisher content at scale. Such co-selling deals have their limits, though. Condé Nast left Concert after less than a year. Other publishers participating in Concert said its appeal is limited by the revenue cut Vox Media takes (about 30 percent).

Joy Robins, chief revenue officer of Quartz, said Quartz likes its partnership with Concert because it lets Quartz deliver senior decision-makers at scale without having to rely exclusively on the platforms.

“That said, it is a product that has a rev-share attached and, as a result, we’ve been careful to make sure it enhances and not replaces our current offering, which means we leverage it more to help create additional targeted audience extension for larger programs we create on behalf of brands,” she said.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.