Secure your place at the Digiday Publishing Summit in Vail, March 23-25

‘Not just one thing’: How Thrillist plans to rebound from a nearly travel-free 2020

Thrillist spent most of 2020 thinking differently about its purpose. At the start of the new year, it is hoping to take what it learned operating through the disruptions of the coronavirus and social unrest and use it while slowly returning to its core area of expertise.

This month, the Group Nine travel and lifestyle brand will launch a new editorial package, the Roaming 20s, which will highlight people taking advantage of this year’s unusual circumstances: a person quitting their job and moving upstate to build tiny houses, for example, or how younger people are embracing the opportunity to work remotely.

For readers in the greater New York area, the Roaming 20s has an experiential element too. Thrillist will offer RV travel packages, called Thrillist Caravans, where small groups of up to six people can rent fully stocked RVs for weekend getaways in the Finger Lakes region.

The move is part of a nuanced return to travel coverage following a year when ad spending in the category almost completely disappeared. While Thrillist didn’t abandon travel and hospitality recommendations, it had to rethink them substantially while leaning more heavily into adjacent areas, such as entertainment.

Those changes helped Thrillist avert a total disaster and positioned them for what they’re hoping is a bounce-back year: After exceeding its Q4 revenue goal in 2020, Thrillist is targeting 61% revenue growth for 2021.

“We took our licks as an organization, but it wasn’t separate and distinct from what was happening to the rest of the industry,” said Geoff Schiller, Group Nine Media’s chief revenue officer. “But we were able to walk in and already be in a position where we’re trending ahead of where we need to be.”

Thrillist recorded 26 million monthly unique users in January 2021, the most it had drawn in a single month since October 2019, according to Comscore.

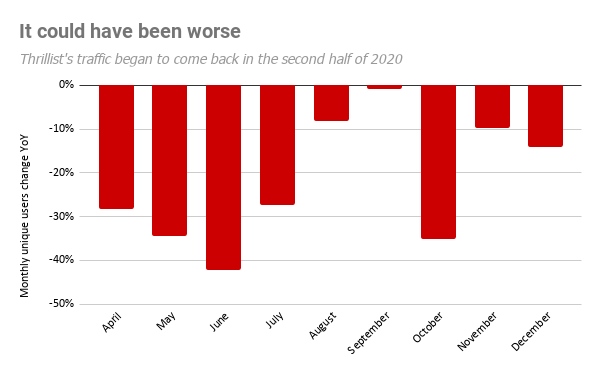

That peak marked the end of a long march back from the depths of last year’s second quarter, when the entire country locked itself down and advertisers slammed the brakes on their ad spending. “The bread and butter of our traffic was local,” said Meghan Kirsch, Thrillist’s chief content officer. “And that traffic was down 45%.”

Layoffs followed shortly thereafter. While all of Group Nine’s sites lost staffers — the company laid off 7% of its staff in April amid a whole host of other cost-cutting measures, including CEO Ben Lerer foregoing any pay for six months — the cuts were felt most by Thrillist.

Thrillist’s editorial staff responded by leaning more into entertainment topics including streaming video and gaming; one of the highest-trafficked stories on Thrillist last year was about the mobile game Animal Crossing.

“It just kind of morphed into what fun looks like [under quarantine],” Kirsch said of the site’s changed coverage.

As the summer wore on, Thrillist found ways to produce travel and experience content that readers could do without using public or mass transit. During the summer, the content that drew the best open rates on Thrillist’s newsletters focused on things readers could do less than two hours away from their respective cities.

“We also saw a lot of success with local-adjacent recommendations,” Kirsch said. “People were really into hiking, national parks, road trips.”

After seeing visitors drop by more than a third for most of the second quarter, Thrillist’s monthly unique users largely remained within ten percentage points of where they had been the previous year, according to Comscore data.

It’s unclear when Thrillist or its competitors will see travel advertising start to look normal again. Fourth-quarter spend in the category was less than half of what advertisers spent in 2019, according to Standard Media Index data.

But Thrillist is confident that it will rebound. Some recent audience research concluded that one in two Thrillist readers plans to travel in 2021.

And until it does, Thrillist will be able to rely on the ground it gained in other categories; last year, its revenues from advertisers in the technology category shot up more than 120%, Standard Media Index data showed.

“I think we just need to make sure we’re not just one thing,” Kirsch said.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.