Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

‘The sky hasn’t fallen’: Publishers’ programmatic revenues vault back up in June and July

Summer is usually a suboptimal time to sell advertising. But for publishers that rely on open exchanges for their programmatic ad revenue, the past two months have been among the hottest of the year.

The news and politics publisher Salon is likely to close out June and July with its revenues up year over year for both months, thanks to weeks of sustained highs in CPMs for its site inventory and RPM for its pages. Through the first 23 days of July, Salon’s programmatic revenues are up 25% year over year over the same period, chief revenue officer Justin Wohl said, though he declined to share specific dollar amounts.

“We saw some of the best rates we’d seen since the beginning of March in the last two weeks of June,” Wohl added.

Salon’s second quarter revenues are still projected to be down, year over year, because of the industry-wide plunge in ad spending this past spring. But its results the past seven weeks have Wohl feeling cautiously optimistic about the second half of the year, and they are far from atypical.

Thanks to a surge of spending by advertisers that had to cut back or pause their spending in the second quarter, demand in the open exchanges has leapt, according to sources at two different advertising agencies focused on programmatic advertising.

Ben Hovaness, the managing director of marketplace innovation at Omnicom Media Group, said that ad spending volumes were mostly back to where they had been in the first quarter of 2020, and that on some days in June, the volume actually exceeded Q1 peaks. July, while slightly lower, was “a lot stronger than when things were in the doldrums,” Hovaness added.

Still, there are signs that the recent good times may not last forever: some of the spending is coming in from sources such as NBC Universal, which is pouring money into promoting Peacock, and many buy- and sell-side sources worry that lawmakers’ failure to approve a new economic relief package to replace the one that expired this week could undo a lot of the progress the economy has made.

But for now, publishers and agencies have both benefitted from ad buyers acting according to an old adage.

“I joke around about it internally, but the thing that’s hurt marketing in the past is that old saying: ‘If you don’t use it, you lose it,’” said Tyler Bishop, the CMO of ad optimization platform Ezoic.

Publishers took a beating in the programmatic markets in March and April as traffic surged and advertisers paused their spending while they figured out how to respond to a looming pandemic. The result was traffic spiking to 30% while CPMs dropped by as much as 20%.

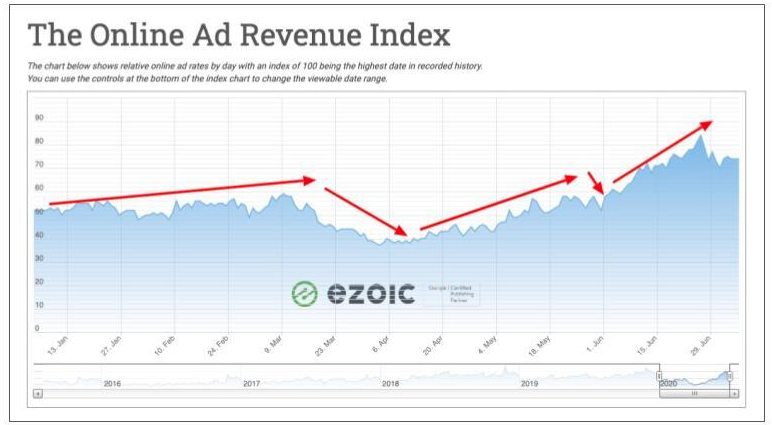

But after hitting the bottom of the trough at the end of March, programmatic spending has begun to creep back up. The Ezoic Ad Revenue Index, which tracks the value of online ad inventory relative to a historic high across thousands of websites, showed that the value of inventory has been trending back upward since, with values in June and July largely beating their 2019 counterparts.

Some of that spending has come from advertisers adjusting their media mix, siphoning money away from areas like out of home, which continues to struggle as consumers continue to work remotely and travel less.

“You have to look at where the eyeballs are,” said Ray Jenkin, the North American CEO of programmatic agency Hybrid Theory, who noted that some of his agency’s clients have been putting more of their budgets into programmatic advertising in the past several weeks.

Jenkin cautioned that the good times are unlikely to last. “I don’t think we can look at June and July and say it’s a forward-looking trend,” Jenkin said, noting that the expiration of the unemployment benefits paid by the federal government could cause a drop. “I don’t think we’re going to see a return to full-blown pause, but we will see some cautiousness,” Jenkin said.

Clark Benson, the CEO of Ranker, said CPMs for his site’s inventory on open exchanges are still down “about 10%,” year over year in July. But a flush of site visitors — Ranker’s traffic has risen every month since March, according to SimilarWeb data — as well as some cautious projections Benson and his team made earlier in the year, have left him feeling good about those results.

“I feel like that’s a godsend compared to what I was expecting,” Benson said. “We’re feeling relief that the sky hasn’t fallen.”

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.