Secure your place at the Digiday Publishing Summit in Vail, March 23-25

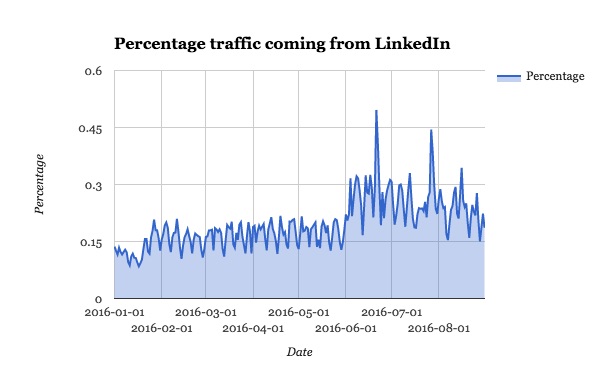

Referral traffic to publishers from LinkedIn has had its ups and downs, but for the last eight months, it has been on a steady uptick as publishers tweak their editorial strategies.

In January, publishers saw traffic to their sites from LinkedIn explode, in some cases tripling. Since this spike, referral traffic has continued growing steadily. The spike was attributed to a change in attribution: Traffic formerly credited to dark social was confirmed as actually coming from the social network. Here are four charts on the state of publisher traffic from LinkedIn.

According to data from analytics firm Chartbeat, since January the amount of traffic to publishers referred from LinkedIn has grown from 0.15 percent to 0.25 percent. (Before the spike in January, it was closer to 0.011 percent of total referral traffic).

This may seem tiny — by comparison, 40 percent of publisher referral traffic comes from Google, 30 percent from Facebook — but it’s a significant amount, according to Josh Schwartz, chief of engineering and data science at Chartbeat, and it puts LinkedIn into the top-10 referrers of the web.

“You can’t optimize what you can’t measure,” Schwartz points out. “Previously, publishers didn’t know how much to post, how frequently, whether certain content topics were more successful. Publishers are now in a better position to make decisions on LinkedIn editorial strategy, even though it may be difficult to find that direct causal relationship.”

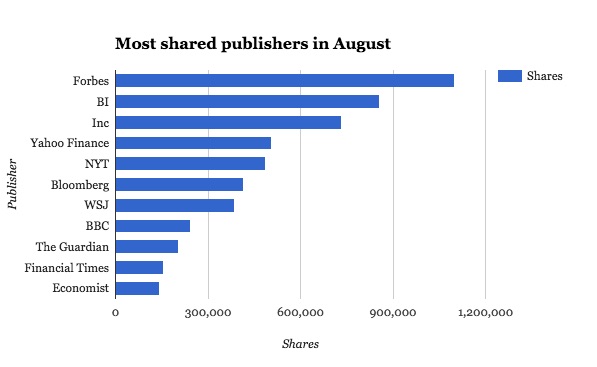

LinkedIn is a very particular traffic driver for specific publishers, largely those producing business, technology and media content. According to Schwartz, some publishers are seeing 15 percent of their traffic come from LinkedIn.

A selection of the top performing publishers on LinkedIn in August from Newswhip data show Forbes and Business Insider are globally shared widely.

The Economist uses LinkedIn for more of a brand-awareness tool, compared to sure-fire traffic drivers like Facebook and Twitter. According to the publisher, traffic from LinkedIn has tripled year-over-year, albeit from a low base, although it wouldn’t give specifics. This is in line with what the platform is seeing among other publishers. Since last September, The Economist has been more tailored with its LinkedIn posts. It now posts 12 items a day to its 2.2 million followers: a mix of articles, blogs, films and audio, testing formats and “What do you think?” question cards — such as “Should companies force employees to be happy?” — to encourage discussion and debate.

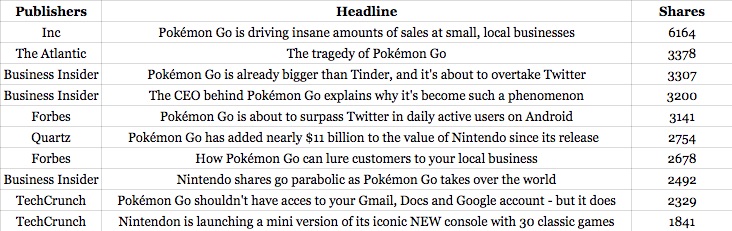

Posting content to social platforms allows publishers to take advantage of current trends, even while still covering business business. In July, Newswhip pulled data on the best-performing Pokémon Go articles. Three of the top 10 came from Business Insider, and there were two apiece from Quartz, TechCrunch and Forbes.

“These top performers didn’t cover more lifestyle-y angles, like how to master the game, or the crazy things people were doing as they played it,” writes Meena Thiruvengadam, head of audience development for Business Insider. “Instead, they were about the success of the game itself — and the impact of that success on Nintendo.”

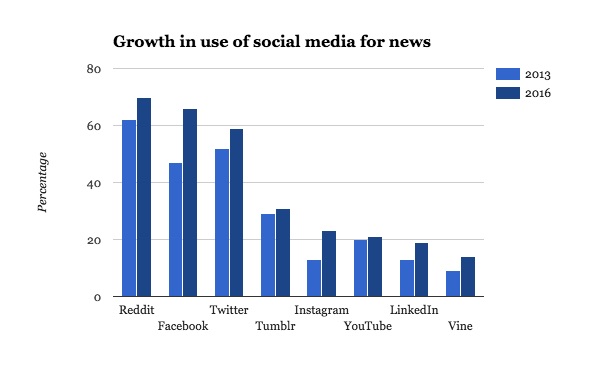

According to Pew Research, looking at U.S. internet users only, publishers should not overlook LinkedIn for a place to publish news. Of the sites the research company tracked since 2013, only Facebook, Instagram and LinkedIn, out of eight in total, showed a statistically significant increase in the portion of users who get news there.

More in Media

The case for and against publisher content marketplaces

The debate isn’t whether publishers want marketplaces. It’s whether the economics support them.

Urban Outfitters shifts its influencer strategy from reach to participation

Me@UO is Urban Outfitters’ new creator program leverage micro-creators with smaller, engaged communities that are passionate about the brand.

Media Briefing: Without transparency, publishers can’t tell if Google’s Preferred Sources feature benefits them

Six months in, Google’s Preferred Sources promises loyalty-driven visibility, but leaves publishers guessing at the traffic impact.