Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

The state of brands taking marketing in-house, in 5 charts

Marketers are starting to question the decisions agencies have made on their behalf. Consequently, marketers of the likes of Procter & Gamble, Unilever and Royal Bank of Scotland believe they should be the ones, not agencies, to make decisions about how their budgets are spent. It has meant more marketers are trying to control more of what they spend on programmatic advertising, and there are signs that they want to create more ads themselves.

Here are five charts that show why advertisers are in-housing their marketing and what skills they’re prioritizing.

Brands are clueless about media’s effectiveness

A study released in March by media consultancy Ebiquity on behalf of Radiocentre, the marketing body for commercial radio, backs Wheldon’s comments. The report, which surveyed 116 senior marketers working for brands and agencies, found that marketers consistently overvalue online media channels while undervaluing the traditional ones.

Advertisers aren’t cutting agencies entirely

In a survey of 149 marketers by the Association of National Advertisers late last year, more than a third (35 percent) said they had reduced the work they brief to agencies after they had bolstered their own in-house programmatic expertise. Like Pritchard, those marketers want to run the strategy for programmatic campaigns, leaving their agencies to manage them by performing tasks such as post-campaign reporting.

Data has increased importance

In China, P&G is using one of the country’s largest data-management platforms alongside its own proprietary measurement system to do better propensity modeling and frequency capping on more nuanced audience segments. According to brand chief Marc Pritchard, the setup slashed P&G’s waste online by 30 percent last year and increased reach by 65 percent. Other advertisers like RBS, Jaguar Land Rover and Pernod Ricard are realizing they need to leverage their own data wisely if they’re to properly take ownership of their marketing. An Ascend2 study of 233 marketing professionals conducted in January found that most are prioritizing data management this year.

Advertisers face competition for talent

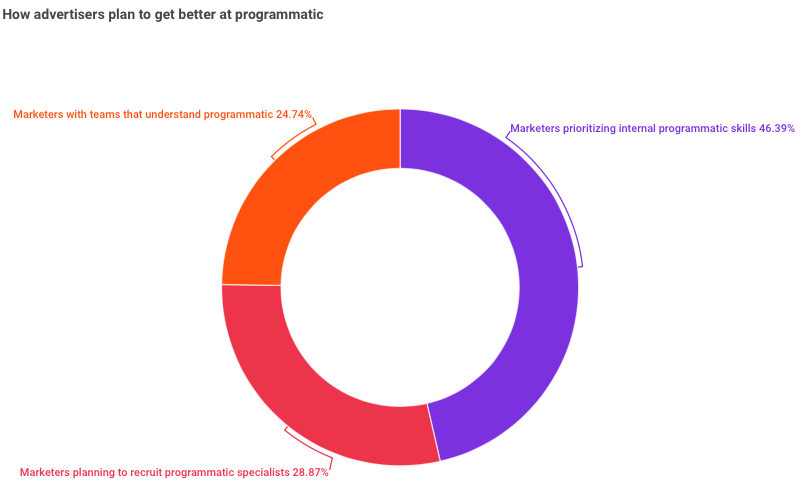

It’s easy for an advertiser to talk on a stage about taking control from agencies. It’s harder to find people who can do that and have a direct impact on the business. Agencies, on the other hand, can offer talent jobs across multiple clients and at a scale that many brands can’t. Advertisers acknowledge the talent challenge and have made recruitment and internal development a priority in 2018. A study released last month by the World Federation of Advertisers found that nearly half (46 percent) of the 28 advertisers surveyed that spend over $50 billion (£36 billion) globally on marketing have made strengthening their own programmatic skills a priority over the next year.

Brands are producing creative in-house

In its annual report, Unilever said its in-house teams are creating content faster and around 30 percent cheaper than external agencies. Like other big brands, Unilever thinks it can save considerably by in-housing more of the production of its ads and reducing the number of agencies it works with. Three, Lucozade, RBS and others are trying to replicate Unilever’s efforts, attempting to create more of their ads internally. These advertisers aren’t alone, according to a global study of 4,198 marketing professionals by Adobe and Econsultancy that found that more advertisers plan on bringing content production in-house in 2018.

More in Media

Digiday+ Research: Dow Jones, Business Insider and other publishers on AI-driven search

This report explores how publishers are navigating search as AI reshapes how people access information and how publishers monetize content.

In Graphic Detail: AI licensing deals, protection measures aren’t slowing web scraping

AI bots are increasingly mining publisher content, with new data showing publishers are losing the traffic battle even as demand grows.

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.