Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Publishers’ ad revenue rebounded in the first half, but H2 is looking even brighter

The crisp autumn breeze is not the only breath of fresh air washing over the media industry this season.

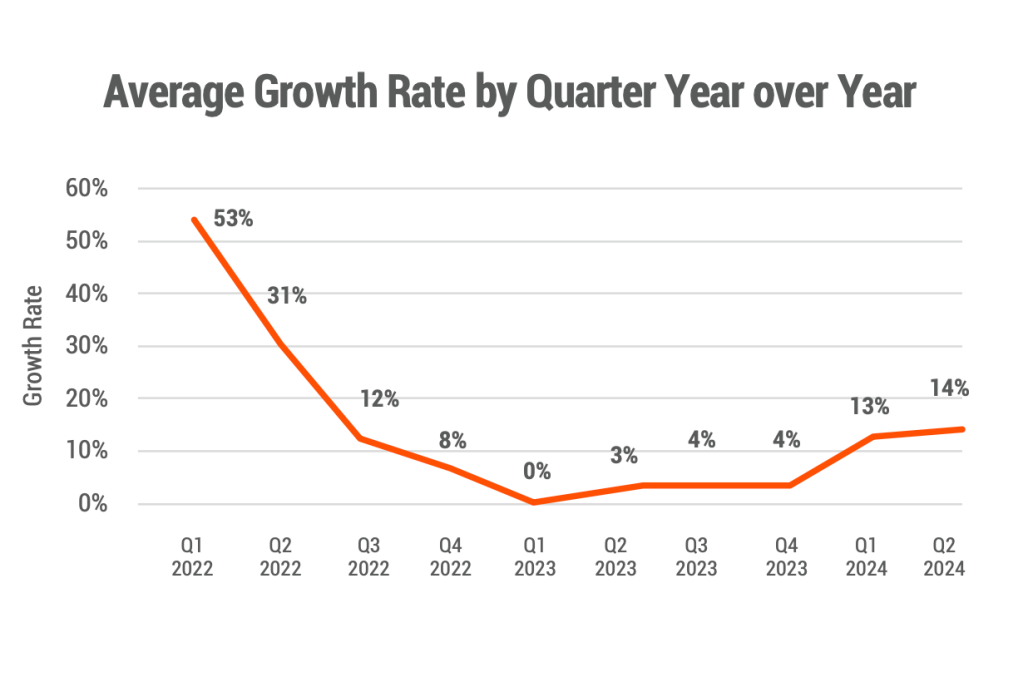

According to the latest Media Ad Sales Trend Flash Report from publisher ad management provider Boostr, focused on the first half of 2024, there are many positive ad sales trend lines showing that the doldrums of 2023 might be over — at least for now.

Deal size of direct-sold advertising campaigns (ranging from custom content to programmatic guaranteed) and RFP volume were both up in Q1 and Q2 this year. Meanwhile, positive rebounds are happening with revenue retention and overall average ad revenue growth rates, among the more than 100 U.S.-based digital publishers surveyed for this report that use Boostr’s platform.

“There’s a lot of good news, which it’s good to see the industry starting to rebound. I think we hit an inflection point for a lot of media companies this year,” said Patrick O’Leary, CEO and founder of Boostr.

But three publishers told Digiday that while Q1 was strong, Q2 was still a bit “soft,” meaning slight declines in ad revenue year over year, though they’re anticipating a bump in the second half to make up for that. One publisher exec, who spoke on the condition of anonymity, said that pre-booked revenue in H2 is up year over year and by all accounts it looks like the ad revenue earned in Q4 will make up for “a lot of the gap” in Q2 this year.

Here’s a look at how the digital media industry fared in the first half of 2024.

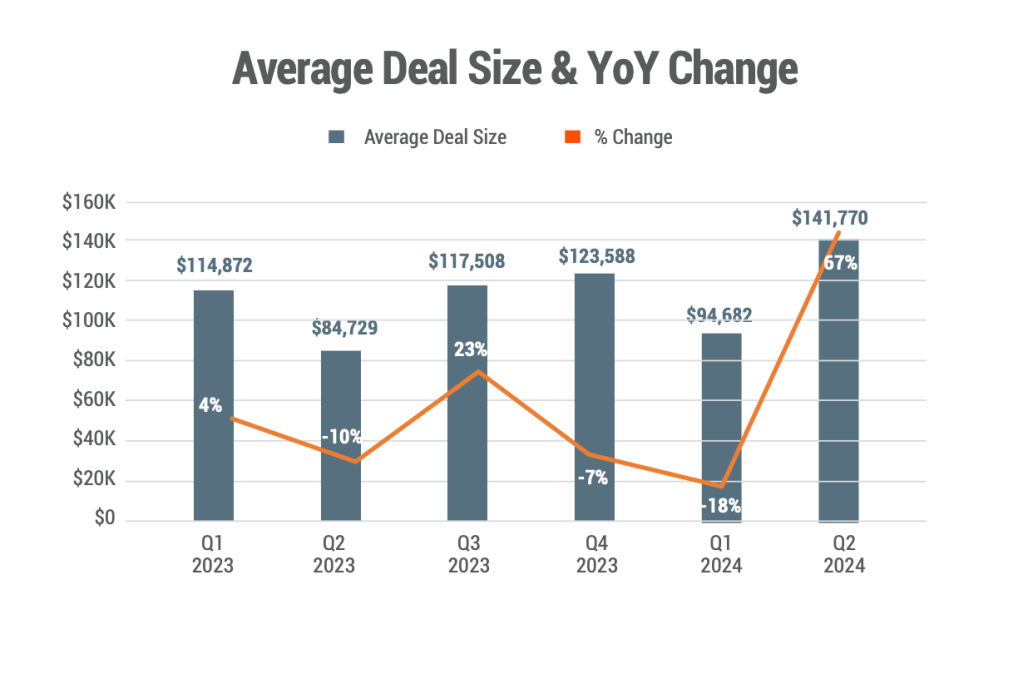

Deal size is on the rise, but overall ad growth still has room

While there is still a rebound with average ad revenue growth rates, one of the standout stats from the report was that the second quarter of the year had the highest average deal size since Q1 2023, at $141,770, up 67% year over year. The average deal size in the first quarter, however, was down 18% year over year at less than $95,000.

Some of this is seasonal in nature, according to O’Leary. But a second media exec, who also spoke on the condition of anonymity, said they were seeing overall growth in deal sizes not just in the first half of 2024, but a continued trend in the back half of the year as well.

“A bigger percentage of our revenue is coming through programs driven either by event sponsorships or custom content. So those are bigger overall deals to begin with,” said the second media exec. “Whether that means their overall budgets are up or I’m taking share, I don’t always know.”

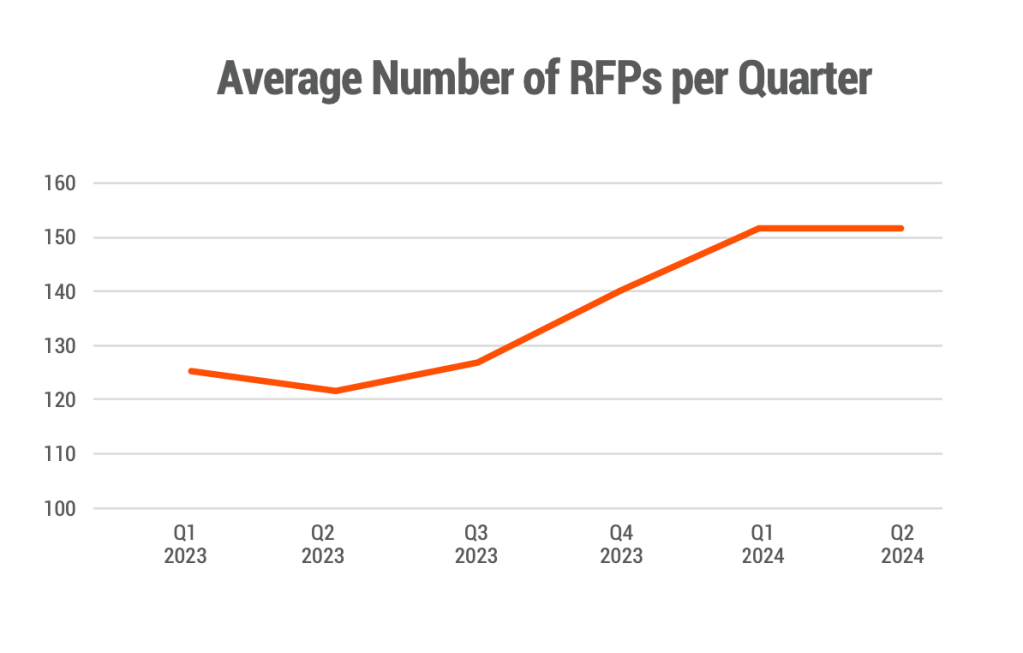

RFP volume & category breakdown

Another upward trend in the report was RFP volume in the first half of the year. In Q1, the number of proposal requests that the surveyed publishers received from advertisers was up 9% year over year and up 17% year over year in Q2.

O’Leary said most of the advertiser categories slightly increased their RFP volume in Q1, with specific year-over-year upticks in utilities and power (up 123%), real estate (up 93%) and professional services (up 70%) in the quarter.

In the second quarter, top year-over-year growth categories for RFP volumes included utilities and power (up 100%), tech and telcomm (up 68%) and professional services (up 63%), but a couple categories saw slight year-over-year decreases: adult and gambling (down 36%) and real estate (down 13%).

The second media exec reported that tech, professional services and luxury were three strong categories so far this year, though they’re anticipating a decline in luxury come 2025 based on some of the companies’ recent earnings.

“RFP volumes were up … but [advertisers are] giving [publishers] less time to launch these things,” said O’Leary. “More of it is happening in-quarter and they’re bigger … There’s just a lot of additional pressure to execute things.”

Booked-in quarter stats were high, but that looks to be changing in H2

One trend that’s held, pretty much since the pandemic, has been the in-quarter booking.

O’Leary said that 65% of the deals that happened in Q1 were booked and started within the quarter, and in Q2 that number increased to 71%, which means far fewer deals were booked ahead of the quarter starting.

Because there are heavier lift campaigns being booked in the second half of the year, like custom content and event sponsorships, the second media exec said their sales team is allotted longer lead times to plan and execute the deals. “We’re way ahead in bookings for Q4 but [I’m still] tendering my excitement at this point, so we are seeing that sort of early booking trend [come back into the fold],” they said.

Given it’s an election year as well, the push of political advertisers is causing some pressure on non-political advertisers to scoop up ad inventory, particularly in the back half of the year, which is allowing for more clarity in media execs’ revenue forecasting.

A third media exec, who spoke anonymously for this story, said, “All media sources rise in a political climate, and the people that actually struggle are the advertisers that are trying to find inventory to buy that the political campaigns have left available. Which is why I think you’re seeing … more direct spend happening in the second half of the year, because they know if they don’t buy it up, that it won’t be available come that final push of the election.”

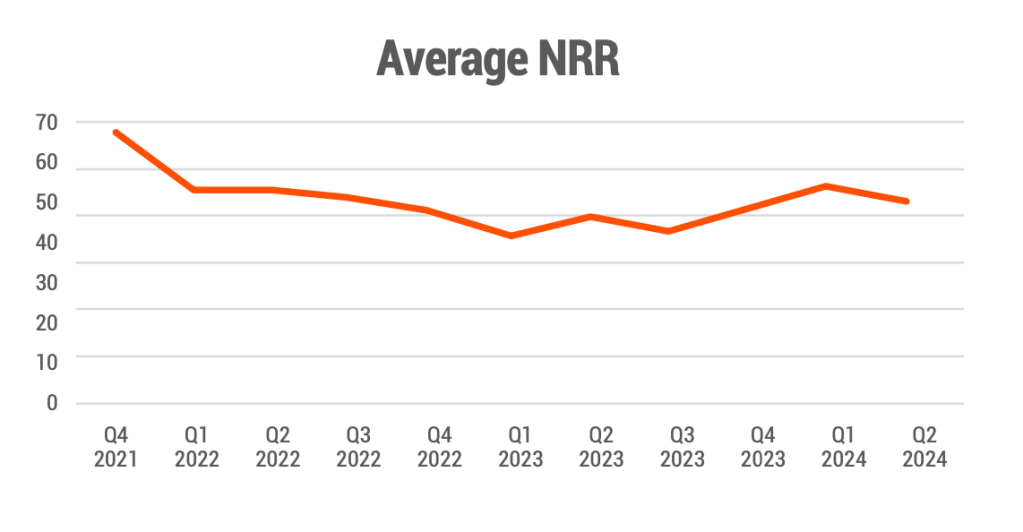

Revenue retention is taking a turn for the better

Net revenue retention (NRR) — which measures ad revenue coming from existing clientele versus new advertisers — has improved in the first two quarters of the year compared to 2023, but it’s still relatively flat from the past two years. This stat showed an uptick of 13% year over year in Q1, with 55% of publishers’ ad revenue, on average, coming from existing advertisers in the quarter. And in Q2, NRR was 51%, up 4% year over year.

“Everyone was waiting for a recession last year, sitting on the sidelines. It seems like that fear is over,” said O’Leary.

“The first half of the year, I think some budgets were being held back or reserved, and I think we’re starting to see those budgets get unlocked in the second half of the year,” said Amanda Martin, CRO of Mediavine, which sells ads for more than 11,000 digital publishers. Q2 in particular was a bit soft, she reported.

And while some of this is due to the seasonality upswing of the back half of the year being stronger for a primarily programmatic publisher, Martin said “we see the second half of 2024 to be trending in a strong direction.”

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.