Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Media Briefing: Publishers say private programmatic revenue is up – but open is a mixed bag

This Media Briefing covers the latest in media trends for Digiday+ members and is distributed over email every Thursday at 10 a.m. ET. More from the series →

Programmatic pulse check

The first half of 2024 was largely better for publishers’ direct-sold advertising businesses compared to the same period in 2023, but the programmatic market was a bit more of a mixed bag.

Of the four publishers who spoke with Digiday for this story, half said that the open market is soft or slow, particularly compared to their private marketplaces and programmatic direct business. Meanwhile, the other half said that revenue from the open programmatic market is growing.

The publishers experiencing an open market slowdown attributed this to clients favoring PMPs or direct programmatic deals, as well as macro pressures on the programmatic ad market, including marketers’ growing wariness of MFA sites and several instances of fraud that have been called out so far in 2024. But there are also purely page view issues resulting from the changes to social platforms’ and search engines’ algorithms, which have squeezed referral traffic pipelines a little too tight, leading to fewer monetizable eyeballs on publishers’ sites.

Those that have experienced growth in the open market, however, say they put in work to improve traffic this first half of the year, or tweaked their programmatic pipes as part of larger cookie deprecation efforts.

“You hear that about open [marketplace] and you hear all this shift to private [programmatic deals], but we don’t really see that on our end,” said one digital publishing exec who spoke on the condition of anonymity. “Our open marketplace is doing really, really well. Our PMPs are doing well too, but it’s not like we’ve seen this huge [shift].”

While they declined to share exact CPM rates or revenue trends, they said that their programmatic CPMs (both open and private marketplaces) are up “drastically” year over year.

Meanwhile, a second publishing executive, who also spoke on the condition of anonymity, said “I think some of the growth has slowed a little bit quarter over quarter, but the programmatic business has been, for all of its challenges, still rocking,” thanks more to its private programmatic business.

Open uncertainty

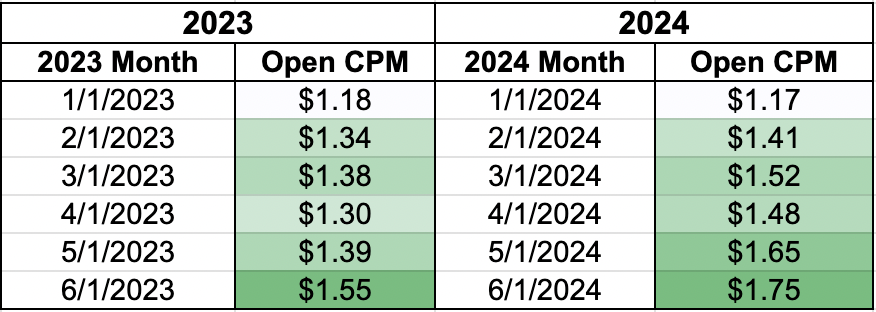

According to Operative’s STAQ Benchmarking Data, the monthly average CPM for the industry’s programmatic open market inventory was up by as much at $0.26 year over year in the first half of 2024.

However, publishers don’t agree that their own open programmatic CPMs followed a similar trajectory.

The second publisher said that while there has been some slowdown in the overall open programmatic marketplace, it’s not as much of a concern for them, given the fact that their PMP and PG business is significantly more important to the company as a revenue line.

A third publishing exec who spoke anonymously with Digiday for this story, said their open market revenue has been soft in H1, thanks to traffic declines, which have had the biggest impact on their open market revenue.

“Just based off of the Google [search engine result page] SERP changes, that page view depression is pretty commonplace across the Comscore numbers and … it’s getting harder for text-based, display-driven businesses to grow. And so that is a direct effect on the open exchange marketplace,” said the third digital publisher.

Dedicating last quarter to addressing referral traffic drop offs, Apartment Therapy Media’s president Riva Syrop said the company’s open programmatic revenue is pacing up this year. She declined to disclose how much the revenue stream has grown, but said ATM’s Kitchn brand, for example, has regularly been up 15-25% year over year every month this year.

In order to become less dependent on the winnowing external traffic sources, Syrop said her team spent the past three months heavily focused on increasing ATM’s newsletter offerings and improving its membership and retention programs, which have increased the amount of monetizable known visitors.

“The purpose of getting all these people as members is first-party data … It’s one, enabling them to have this very personal experience that serves the needs that they’re there for. And then the other piece is bringing [that data] back to the advertisers.”

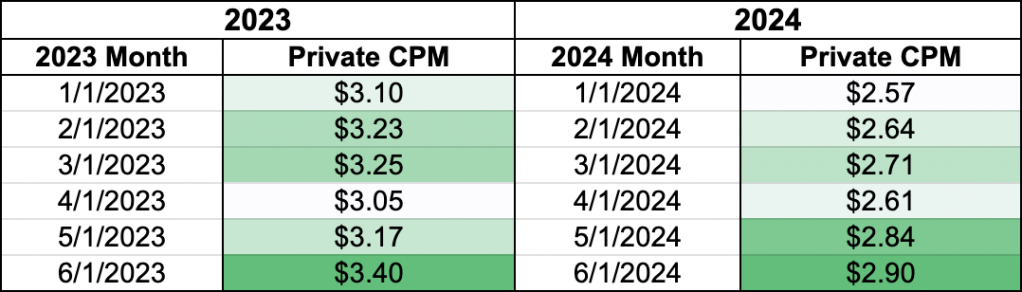

Publishers bet on private

Interestingly, Operative’s STAQ Benchmarking Data showed a steeper year over year decline in monthly average private programmatic marketplace CPMs between H1 2023 and H1 2024, with every month being about $.50 less than its counterpart the year prior.

But the publishers said their private programmatic businesses are on the rise.

It’s unclear whether it’s because their CPMs are higher than industry averages or their volume of deals are increasing.

While open market revenue remains “soft” for the third exec, they said their company’s private marketplace and programmatic guaranteed business is “healthy” and equal to its direct-sold advertising business. They continued that they’ve seen a shift in advertisers from open to PMP and PG deals in the first half as well.

The second exec echoed that their revenue from private programmatic deals in H1 was up, adding that “PGs and PMPs [are] the future of advertising. It just gives advertisers more control and frankly, we’d like it too because we can get better prices.”

Not to mention the renewal rates for programmatic direct and PMPs are significantly higher than direct-sold, highly custom campaigns, they said, which renew usually one-third of the time because they are typically pegged to a specific product launch or announcement from a client. They did not disclose the average renewal rate for the company’s PMPs or PG deals.

“I would almost rather do a really well targeted, well-performing PMP deal with somebody than a big branded content deal. I’d rather do a PMP deal half the size because there’s going to be five deals behind it when it works,” the second publisher said.

What we’ve heard

“[Amazon] Prime Day has lost a little bit of its power … The old Prime Day, which was once a year and it was this huge buying activity, has definitely diminished a little bit.”

– Riva Syrop, president of Apartment Therapy Media, discussing Prime Day’s impact on affiliate commerce revenue

3 Questions with Newsweek’s Jessica Awtry

Ninety-year-old news magazine Newsweek is looking for more modern means of connecting with audiences online. Especially at a time when social media platforms and search engines have changed the way they’ve historically partnered with publishers and distributed content.

Social platforms only represent 10% of Newsweek’s total referral page views, with the majority coming from Google, according to Jessica Awtry, Newsweek’s svp of audience development. But despite that, Reddit has emerged as an important audience touch point for her four-person social team to lean on.

“[Reddit] is a great opportunity for publishers, maybe not a pageview goldmine, but a great way to interact with people and show what your brand means,” Awtry said, declining to share exact page views coming from the platform.

Highlights from the conversation have been lightly edited and condensed for clarity.

Are there any other things you’re doing to lean into discoverability off platform?

Our social team is spending a lot of time on Reddit, not just sharing links as fast as they can, but engaging with those communities … We do have a good communicative relationship with Reddit, but more important than that is that we have a good communicative relationship with Subreddit moderators … So I think it’s trying to find the right Subreddits, talking with those Subreddit moderators to make sure we’re OK to post in there and then finding the right niches.

It’s not just about sharing all of your stories with the politics Subreddit. It’s about finding a Subreddit on urban chicken raising when you have a story about urban chicken laws [and then] finding those niche communities and working with them.

How many staffers are in charge of Newsweek’s Reddit strategy and staying in touch with Subreddit moderators?

Our core social team is four people, and … we do have one person who spends more of their time working on subreddit as a whole, but it’s a mix. Everybody does a little bit of everything.

For distribution on Reddit and your strategy there in general, why is it growing comparatively to other channels?

You can see in the Google [search engine result page] SERP rankings – obviously Google and Reddit have formed a partnership – but even predating that, over the past year and a half, it’s just been shooting to the top because people are appending Reddit to their searches. They’re looking for those signs of authentic communication and real people offering real things, instead of algorithms surfacing things for them.

Numbers to know

3: The number of new board members activist investor Vivek Ramaswamy said he wanted BuzzFeed’s leadership to add by July 15, though no repercussions seems to have happened now that the deadline for the demand has come and gone.

9: The number of BDG staffers that were laid off last week as part of a larger consolidation of the publisher’s lifestyle and parenting verticals, including the editors-in-chief of Romper and The Zoe Report.

28: The number of total staff positions cut from the LAist, 21 of which came in the form of buyouts while seven other positions were laid off.

37: The number of years Ozy Media founder Carlos Watson faces in prison after being found guilty of trying to defraud investors and lenders of his media start-up.

What we’ve covered

Publishers’ Privacy Sandbox pauses settle into a deep freeze following reports of poor performance:

- It’s been three months since Google delayed its third-party cookie deprecation deadline, but publishers have not restarted their independent tests of Privacy Sandbox in earnest.

- Recent studies from ad tech platforms Criteo and Index Exchange, haven’t assuaged publishers’ beliefs that the Sandbox simply is not worth their time.

Read more about why publishers aren’t investing in the Privacy Sandbox here.

Platforms struggle with misinformation and exploitation amid Trump assassination attempt:

- In the chaotic aftermath of the incident at Trump’s campaign rally, a chorus of opportunists rushed to cash in on the swirling hysteria, speculation, and conspiracy theories.

- Political advertisers on Meta platforms have already begun using the shooting to sell assassination-related merchandise ranging from T-shirts and shot glasses to trading cards.

Learn how social platforms are handling the latest wave of spreading misinformation here.

How talent managers see creators’ professionalism levels increasing:

- Eight years ago, less than 10% of the creators that talent management firm Whalar Group worked with were full-time creators.

- As of last year, that number has increased to 95%, signaling the level of professionalism among individual video creators has increased fairly dramatically.

See how the content creator side hustle has evolved into a full-time career here.

Senators propose new regulations for privacy, transparency and copyright protections:

- The U.S. Senate Commerce Committee on Thursday held a hearing to address a range of concerns about the intersection of AI and privacy.

- The latest AI Briefing looks at the proposed new federal transparency standards that would protect intellectual property and guard against various risks of AI-generated content.

Learn more about the suggested regulations here.

What we’re reading

Ziff Davis union wins protections against AI in new contract:

The union representing the editorial teams of Mashable, PC Mag and Lifehacker – all brands owned by Ziff Davis – came to a tentative contract agreement, which ensures members can’t be laid off or receive salary cuts due to generative AI, Nieman Lab reported. If the contract is ratified on July 24, it will set a new precedent for union protections against AI.

Many news publishers took a cautious approach to reporting out the assassination attempt of former President and current presidential candidate Donald Trump last week, not initially reporting a shooting occurred until it was known for sure. The Washington Post reported, though, that many online readers criticized publishers for saying “loud noise” in the initial coverage, likely deepening Americans’ distrust of the media in an election year.

YouTube creators are not exempt from AI companies using their content to train their technology:

According to a report by Proof News and Wired, several generative AI tech companies, including Apple, Anthropic and Nvidia, scrapped almost 175,000 YouTube videos for subtitles and other materials that were then used to train their tech. More than 48,000 YouTube channels had their content siphoned without knowledge, despite the fact that the platform’s rules and regulations include protections against the harvesting of materials without permission.

New Yorker journalist Masha Gessen was convicted in Russia of absentia:

Born in Moscow and now based in the U.S., Gessen is a staff writer for the New Yorker and a prominent critic of Russian President Vladimir Putin. This week, Gessen was convicted of spreading false information about the military and sentenced to eight years in prison, though they are unlikely to face imprisonment unless they travel to a country with an extradition treaty with Moscow, the Associated Press reported.

Apple signs an advertising deal with Taboola:

The Apple News and Apple Stocks apps will now feature ads sold by Taboola in-feed and in specific publishers’ articles, according to Axios. Often viewed by publishers as an easy additional revenue stream, Taboola’s “chumboxes” aren’t considered to be the most elegant ad placements.

Axel Springer considers dividing its media portfolio with private equity KKR:

German publishing conglomerate Axel Springer is in talks to split its media assets from its digital classified business, the Financial Times reported. CEO Mathias Doepfner and Friede Springer, widow of the company’s founder, would oversee the media assets, including Politico and Business Insider, while KKR and the Canada Pension Plan Investment Board would take over the digital classified operations.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.