Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Social TV is undoubtedly a hot topic in the media world, with every TV executive becoming more and more enamored with the thought of any potential ratings boost from viewers who tweet, Facebook chat, dutifully watch with their iPads on their laps or simply text about their favorite shows. But making sense of all that social TV activity is a tricky challenge — and whichever company can lay claim to owning social TV data should emerge a powerful player in the new TV world.

Cue the venture capital money train. Social TV analytics upstart Bluefin announced Tuesday that is had raised $12 million in series B funding, led by Time Warner Investments as well as new investor SoftBank Capital and return investors Redpoint Ventures and Lerer Ventures. That’s in addition to a $6 million series A funding.

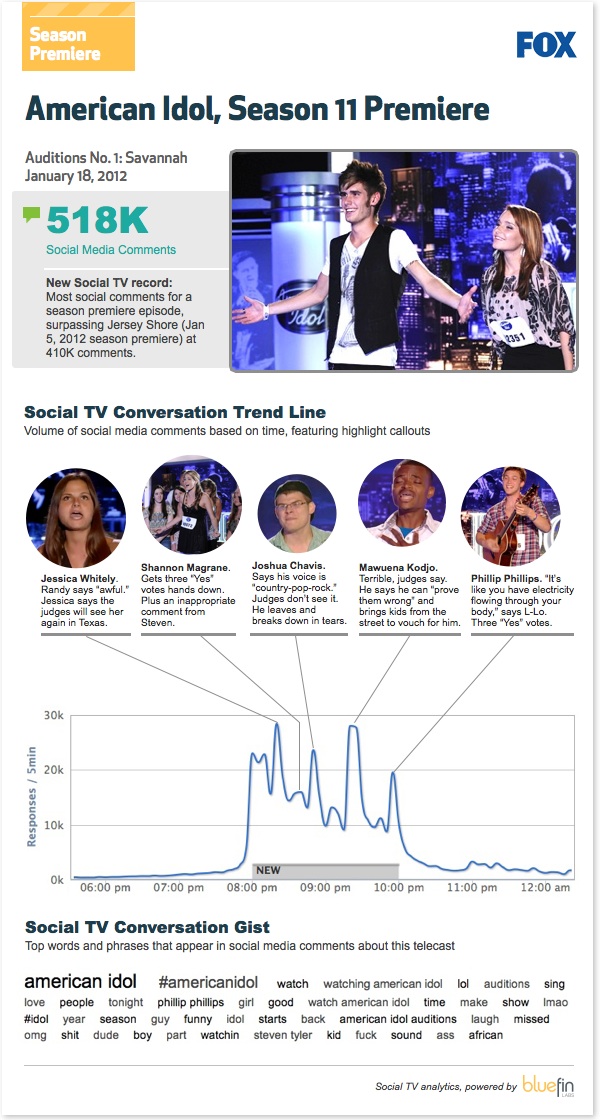

Bluefin, which was born out of MIT Media Labs, publishes a daily top ten list of the most socially engaged shows on TV from the previous night. For example, per Bluefin, the season premiere of American Idol earlier this month generated over 500,000 social media comments. That sort of data puts Bluefin, which rolled out its product suite in May of last year, up against other contenders in the space — including companies like Trendrr and new players like SocialGuide, which releases weekly social TV ranker.

But Bluefin’s core business appears geared around helping networks, advertisers and agencies use social TV analytics strategically. The company claims it can help clients drill down to find out how what sort of response specific shows are generating via social media, as well as shows on competing networks during a specific time period or daypart. Media buyers can theoretically use Bluefin’s data to target shows based on engagement rates or socially responsive audiences.

Bluefin’s clients include CBS, Discovery Communications, Fox, Starcom MediaVest Group, MediaCom and MTV Networks. Below is an infographic the company made from its aggregate data.

More in Media

WTF is a creator capital market?

What is a creator capital market, what does it mean for creators looking to diversify revenue, and why is it so closely tied to crypto?

Media Briefing: Publishers explore selling AI visibility know-how to brands

Publishers are seeing an opportunity to sell their AI citation playbooks as a product to brand clients, to monetize their GEO insights.

Creators eye Snapchat as a reliable income alternative to TikTok and YouTube

Figuring out the Snapchat formula has been very lucrative for creators looking for more consistent revenue on a less-saturated platform.