Last chance to save on Digiday Publishing Summit passes is February 9

It was April 2014, and spirits at The Guardian U.S. were soaring. The U.S. digital offshoot of the British newspaper, along with The Washington Post, had just won the highly coveted Pulitzer Prize for public service for their articles on NSA surveillance, a week after winning a Polk award for the same reporting. Alan Rusbridger, then the Guardian’s legendary editor-in-chief, had flown to New York to accept the prize, and led the staff to an evening celebration. It was a crowning moment for the Guardian, doing what the Guardian is supposed to do — spread its independent journalism to new corners of the globe. Emmy and Edward R. Murrow awards followed for its reporting on U.S. immigration and killings by police, respectively.

But the ebullient mood didn’t last. Today, the Guardian U.S. is flailing at best. Last summer, the Guardian said it would have to slash its U.S. staff by 30 percent, to 100. Last week, in another blow, staffers were told that costs would be cut by 20 percent. Whether because the U.K. has grown tired of the U.S. losses, small as they are relative to the entire company, or because the U.S. has to share in the overall company pain, the U.S. would be part of the three-year plan by parent Guardian Media Group to stanch its losses, which are expected to exceed $100 million this year.

The Guardian story is in some ways the story of all digital and legacy news organizations that are struggling to find a sustainable business model, with the print reading habit declining and the difficulty of replacing print dollars with digital ads as Facebook and Google swallow up almost all new digital ad spending. Guardian Media Group is protected by the Scott Trust endowment, but the company has been depleting the trust to make up for revenue shortfalls everywhere, fueled in part by heavy spending on expensive reporting like the Edward Snowden-fueled NSA coverage.

“The key thing for the Guardian U.S. is, it’s not immune to what’s happening with every other premium publisher in the U.S.,” said Evelyn Webster, who became interim CEO of the Guardian U.S. in January, succeeding Eamonn Store. “The traditional display model is not going to continue to grow at the same pace it has historically. The ad market is changing, so the business model has got to change.”

A tough sell

Webster said the Guardian has been growing programmatic and branded content to offset its reliance on display advertising, while growing reader-paid membership and philanthropic revenue. She maintained the Guardian still has a strong story to tell advertisers. “We have a very clear point of view on the world. We talk to progressive, liberal thinkers. That’s an opportunity.” But that’s a harder sell in the time of Trump. The Guardian also is late to the game in chasing reader revenue, and branded content is notorious for being a low-margin and unpredictable revenue source.

But former employees and observers said the Guardian U.S.’s problems also had to do with a lack of overarching business strategy, the comfort of the endowment to fall back on and a slowness to charge readers. As a result, while U.S. revenue was growing, it wasn’t nearly growing fast enough to keep up with the costs. The U.S. operation took in $15.5 million in revenue, but lost $16 million in revenue in the year that ended April 2016. There were also frequent leadership changes, which didn’t help.

“There was a clear mandate to grow, to become part of the U.S. media landscape, to do great journalism,” said Aron Pilhofer, who held digital roles for two years at the Guardian and was a member of its executive committee until leaving in October. “But the lack of strategy around the business strategy sort of stunted that side of the operation.” The cost structure, he said, “was completely out of control.”

Soaring traffic, soaring optimism

The Guardian landed in the U.S. in 2007 with Guardian America, hiring American journalist Michael Tomasky to bring Guardian news to an American audience. Guardian America was replaced by Guardian U.S. in 2011, with Guardian vet Janine Gibson at the editorial helm. ‘They seemed like they had little doubt the Guardian would be received in the U.S. with some amount of rapture,” said the media writer Michael Wolff, who used to have a column for the Guardian and has written critically of the company. “They were very unconcerned anytime someone wanted to talk about the business model.”

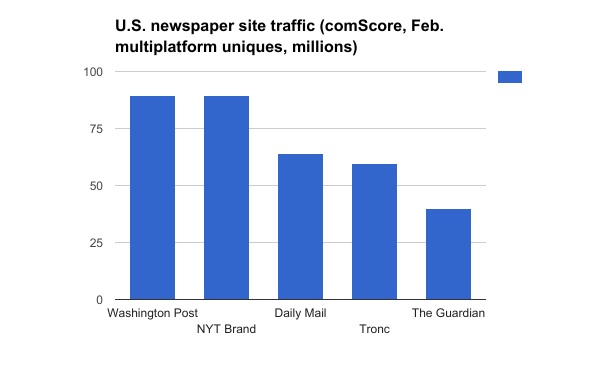

Nevertheless, for at least a certain portion of U.S. readers, the Guardian met a demand. Its U.S. traffic soared, eventually hitting 40 million uniques in February, per comScore, ranking fifth in its newspaper category behind The Washington Post, New York Times Brand, Daily Mail and Tronc.

Employees remember the first years as a period of optimism, even if they openly expressed doubts about the U.S.’s ability to make it work. The edit staff chased scoops, then basked in them over drinks at Mother’s Ruin, a local cocktail bar near the SoHo offices, at the end of the week.

But the revenue didn’t follow. Not only was display advertising hard to come by, but the Guardian had trouble selling itself to ad buyers in the U.S. Its audience still lagged heavy hitters like the Times and Washington Post and wasn’t differentiated enough to justify paying a premium for direct-sold ads. Trump’s election made the news category especially toxic to advertisers, who fled for safer territory, which put the liberal Guardian at a particular disadvantage.

Still, the Guardian kept hiring up until 2016. It had moved into a sprawling space in lower Manhattan, on dreams of future growth. “You just walked in there and it’s over two floors, studios, a bar with free beer,” a former editorial employee said. “It screamed, ‘I am a tech bubble.’” The NSA coverage won a Pulitzer but cost a huge amount of money and attention, which polarized the staff.

Then there were leadership changes, with Rusbridger and CEO Andrew Miller stepping down and Gibson returning to the U.K. “There was a lot of distraction,” Pilhofer said. “It took Kath [Viner, editor-in-chief] and David [Pemsel, CEO] a long time to get in place.”

Scaling back

Things have started to change. The Guardian was philosophically opposed to a paywall. So in 2014, it launched a membership program, where people pay anything from around $6 to $76 a month for perks like discounts on events. It’s turned its focus to building stronger reader relationships, recognizing audience scale in and of itself isn’t a compelling enough sell. In February, the company said it had gotten nearly 200,000 supporters globally in a year, which was impressively fast but to many inside the company at the time, the whole initiative was painfully overdue.

“It drove me nuts,” said one. “When you take a radical turn on strategy from ad to reader revenue, you’re trying to turn two ships,” Pilhofer said. “They were staffed to pursue an ad-based business model. It’s very difficult to transition when you don’t have tons of tons of resources.”

Elsewhere, the Guardian is bringing costs in line with reality. The U.S. headcount has been diminished by layoffs. And as for the cavernous workspace, the remaining staff is moving to more modest quarters near New York’s Herald Square that are more appropriate for its reduced size (plans to move to Brooklyn were scuttled because the building there had ties to Jared Kushner).

“It’s so big, it’s ridiculous,” Webster admitted of the current digs. “We are paying for space we do not use.”

More in Media

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.

Why Walmart is basically a tech company now

The retail giant joined the Nasdaq exchange, also home to technology companies like Amazon, in December.

The Athletic invests in live blogs, video to insulate sports coverage from AI scraping

As the Super Bowl and Winter Olympics collide, The Athletic is leaning into live blogs and video to keeps fans locked in, and AI bots at bay.