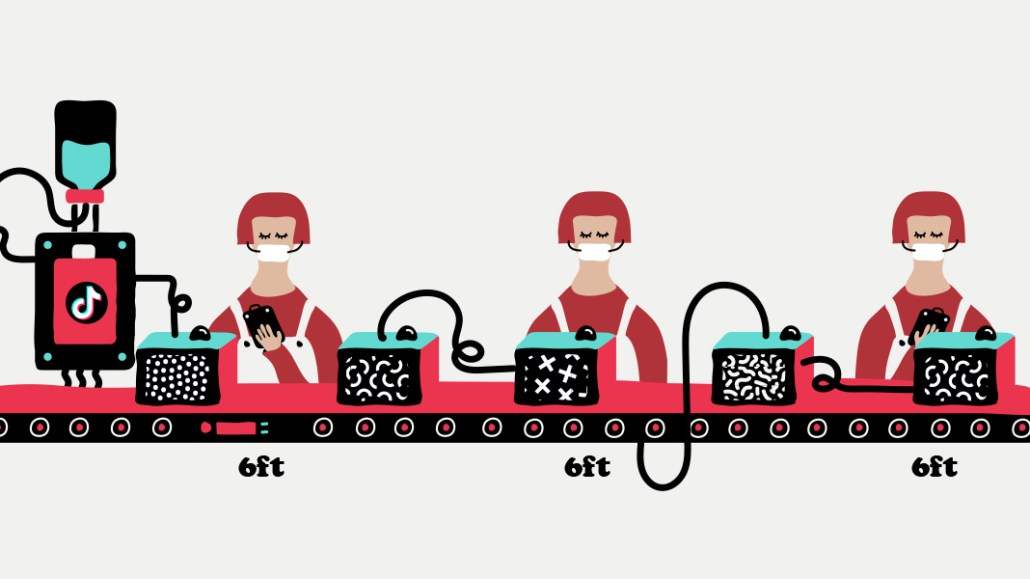

TikTok’s large and growing audience is high on the radar of marketers at Procter & Gamble, Kellogg’s, Converse and Crocs who are intrigued by how it has become a form of light relief during lockdown.

While it’s not the first place those advertisers are spending their media dollars, the few campaigns they do produce on TikTok have the potential to spread in a way that’s harder on other platforms thanks to an algorithm that surfaces content not by who you follow, but by content that trends quickly.

The challenge format, whereby TikTok users will make videos attempting to do the same thing, lends itself to user-generated content which is highly coveted by advertisers now. Indeed, Procter & Gamble’s Distance Dance sponsored challenge with dancer Charlie D’amelio on TikTok last month has generated over 14 billion views since it launched last month. That’s on the back of ad format that costs $150,000. Savvier brands have started combining TikTok’s ads with influencer content to really generate significant ROI, said Claude Zdanow, CEO of Stadiumred Group.

“On the advertising side, when you look at TikTok ads, the platform has a lot of supply and a relatively small demand when you compare it to Facebook,” said Yuval Ben-Itzhak, CEO at SocialBakers. “This means that brands advertising on the platform should theoretically get a broader reach at a smaller cost.”

TikTok’s media is cheap compared to other platforms, with cost-per-thousand impressions as low as $1 whereas they can go as high as $4 on Facebook’s news feed and Stories formats, according to two media buyers interviewed for this article. Despite those low rates, TikTok’s click-through rates are far lower and therefore can be more expensive for advertisers to drive conversions. The bigger barrier to entry now isn’t an advertiser’s relevance to the TikTok audience, but whether they can afford the cost, which seems to be growing as rapidly as the app’s user base, said Miranda Haynie, associate director of social media at PMG.

“We’re seeing a reduction on ad spend on TikTok expected with the drop in advertising spend across social media platforms and brands that were planning to test it, are also deciding not to experiment TikTok as a new media channel,” said Andre Artacho, managing director of media consultancy Two Nil.

While TikTok has several high-impact placements that come with a hefty price tag, there are other options to test the waters. If the aim is to drive awareness or short-term buzz for a new campaign, then the social network is one to explore, as Kellogg’s did for its Pringles brand last month.

“People were making videos of themselves dancing with our cans so we felt there was an opportunity to test out the platform,” said Roisin Devine, digital manager for Pringles in Europe.

It launched the #PlayWithPringles challenge on TikTok in Germany where fans could share videos of themselves using the can in creative ways, from dancing to comedy sketches. There have been over 151,000 videos created in response to the challenge, which has generated over 230 million views.

“We’ve had a successful test so now it’s about working with other markets to see if there’s a way to build a strategy for TikTok at a global level,” said Devine. “If our colleagues in the U.S., for example, decided to use the #PlayWithPringles hashtag moving forward then we could potentially create a global footprint.”

TikTok may be untested now but that doesn’t mean it won’t work. In fact, research from Fullscreen’s panel of more than 500 Gen Z and Millennial Americans, who were between 18- to 36-year-olds, found that 45% of respondents are browsing social media to cope with stress. It points to a unique opportunity to generate engagement on a deeper level than a like or share, said Yann Le Bozec, marketing director of Crocs Europe. Being able to mine this relationship is key to Croc’s social media strategy, which starts with advocacy, not awareness.

“A few months ago we created a global TikTok page,” said Le Bozec. People were already creating content featuring our brand on TikTok without us having to plant that seed in their minds. We see the potential to continue that conversation because this is where they’re sharing content featuring our brand.”

To capitalize on this interest from marketers, TikTok will need to make it easier for advertisers to see what good engagement looks like. When campaigns are managed via TikTok’s own team, the reports are harder to audit. The metrics look good on paper, said one agency exec on condition of anonymity, but there were differing metrics for each placement, making it virtually impossible to cross analyze the campaign.

“Whether brands are in a place to spend now or are instead optimistically planning for future campaigns, TikTok is now in consideration alongside always-on media channels, especially for driving awareness of big brand moments,” said Haynie. “As advertising budgets begin to recover post-pandemic, I expect we’ll see more and more brands ready to claim their share of voice on the platform.”

More in Media

Digiday+ Research: Dow Jones, Business Insider and other publishers on AI-driven search

This report explores how publishers are navigating search as AI reshapes how people access information and how publishers monetize content.

In Graphic Detail: AI licensing deals, protection measures aren’t slowing web scraping

AI bots are increasingly mining publisher content, with new data showing publishers are losing the traffic battle even as demand grows.

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.