Secure your place at the Digiday Publishing Summit in Vail, March 23-25

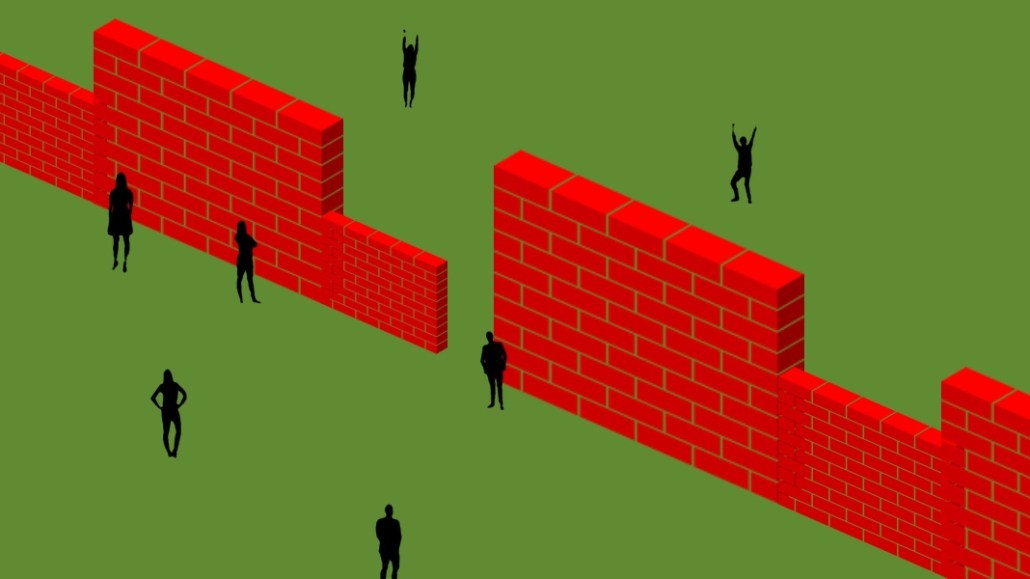

Hearst Newspapers has replaced its one-size-fits-all paywall with a customizable one. The newspaper group, with 24 daily and 64 weekly papers, including the Houston Chronicle and the San Francisco Chronicle, has been tinkering with a paywall whose permeability changes depending on who’s visiting and what they’re reading.

The new paywall replaces a system where editors chose which content was paywalled and which wasn’t. Under the new system, first-time readers can consume as much content as they want, and the amount they consume dictates when they hit the paywall and if or when they are shown a subscription offer.

“The whole approach is: ‘I want to win your trust,’” said Esfand Pourmand, svp of revenue at Hearst Newspapers Digital.

The subscription offers that engaged readers receive will be framed differently (though the cost will be identical). For example, sports fans might get an offer oriented around staying up to date on a team they follow, while the out-of-towner would get one telling them that a subscription will keep them connected to the goings-on of the market. The audience segments, which the papers also use for lead-generation campaigns designed to grow newsletter subscribers, are revised on a monthly basis, based on how much content a paper’s readers have consumed.

At the Albany Times-Union, the first paper to test the flexible paywall, the total number of subscribers has doubled since it started tests in September, and the overall number of new subscriber numbers for Hearst Newspapers has jumped 10 percent. The company declined to provide raw subscriber numbers.

“We’ve found that each market has different DNA,” said Rob Barrett, president of digital media at Hearst Newspapers. “We’re trying to find the optimal place for the paywall based on the interests of the consumer.”

The aim of the flexible paywall is to grow reader loyalty, a key metric for publishers that are looking to move past their obsession with scale and lead readers to become paying customers.

To get a clearer picture of what its readers were spending the most time with, Hearst reindexed every article on its sites using Google’s natural language processing tool. It then layered on reader information such as geographic location, device type and other audience data from third parties. Barrett stressed that none of the data it has on its reader base, which he says totals 90 million unique visitors across Hearst Newspapers, is personally identifiable.

At the Times-Union, knowing which stories were being read most and by whom let the paper identify the most engaged segments of readers. Many of the segments they identified confirmed assumptions that Barrett and the Times-Union’s consumer marketing staff had: Sports page visitors were among the most loyal, as were people who read lots of stories about local business.

Some surprises emerged. Barrett said that before the test began in October, he’d assumed the paper’s coverage of local crime stories would not attract a loyal audience. That turned out to be incorrect.

Learnings from Albany were applied to San Antonio and Houston next. Today, the consumer marketing heads at every Hearst newspaper participate in a weekly conference call to compare notes and share best practices.

While a tactic that works in one market might not work in another, the data framework that each system has set up gives each title the flexibility to try them all. “The idea is to put ourselves in position to be surprised,” Barrett said.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.