Secure your place at the Digiday Publishing Summit in Vail, March 23-25

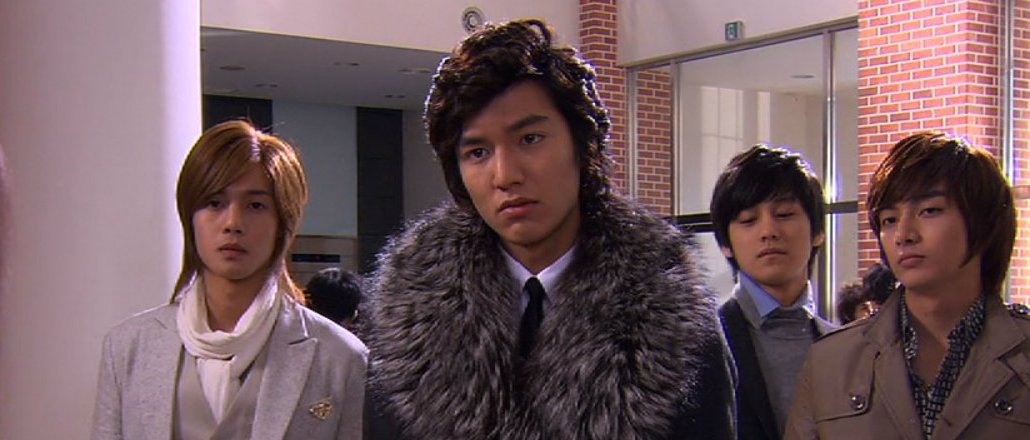

Latin Americans apparently love Korean soap operas.

DramaFever, the SoftBank-owned video streaming platform best known for Korean films and TV shows, saw its watch time in the region increase by 250 percent in 2015 — going from 80 million to 280 million monthly minutes streamed between January and December. Latin America now accounts for 30 percent of DramaFever’s total audience, making it the video platform’s second-biggest market after the U.S. (Overall, DramaFever, which offers both a free ad-supported version as well as multiple ad-free subscription tiers, claims a monthly audience of 21 million uniques.)

Several factors were key in driving DramaFever’s growth in the region. Chief among them were the hiring of professional translators, the launch of local-language mobile apps and an affiliate marketing program that leveraged Korean fansites in the region, according to Carlos Espana, DramaFever’s business manager overseeing Latin America.

“We have plenty of competition from piracy sites and people who are downloading bootleg copies of [Korean] content,” said Espana. “By quickly offering shows with translated subtitles, it helped differentiate our product.”

DramaFever now offers 270 translated titles on the Spanish version of its platform, and 240 on the Portuguese version. It went from four full-time translators in 2014 to 30 by the end of 2015. Some of these staffers are able to translate from Korean to Spanish and Portuguese (as opposed to the previous roundabout method of translating from English subtitles), which helped speed up the process of getting titles ready for streaming.

Mobile played a vital role. DramaFever launched Spanish- and Portuguese-language iOS and Android apps in 2015. Mobile now accounts for 40 percent of its viewership in the region.

DramaFever was also helped by the fact that Latin American viewers have a cultural affinity for Korean soap operas, which are commonly referred to as “KDramas.”

“There are very clear cultural differences between KDramas and Latin telenovelas, but there are also some elements that tie them together,” said Espana. “They both have a lot of melodrama and storylines involving true love and betrayal, and even evil mother-in-laws who everyone loves to hate.”

It’s led to the popularity of local fansites like Hablemos de Doramas, Mundo Fama Corea and SIG. Similar to a marketing initiative it used to grow in the U.S., DramaFever launched an affiliate program, which paid these sites when they drove traffic to its platform.

Even with these efforts, perhaps DramaFever’s growth in the region was inevitable. Streaming video revenue is expected to grow to $2.9 billion in Latin America by 2020, up from only $37 million in 2010, according to a report from Digital TV Research. Plus, DramaFever’s U.S. audience is 30 percent Latino, which is second only to whites who make up 40 percent of viewers.

“Our focus has always been about becoming a global company, and Latin America was certainly a region of interest,” said Espana. “Sometimes that leads you to places that surprise you — no one expected [Latin America] to be the fastest-growing region.”

Images via DramaFever

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.