Last chance to save on Digiday Publishing Summit passes is February 9

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

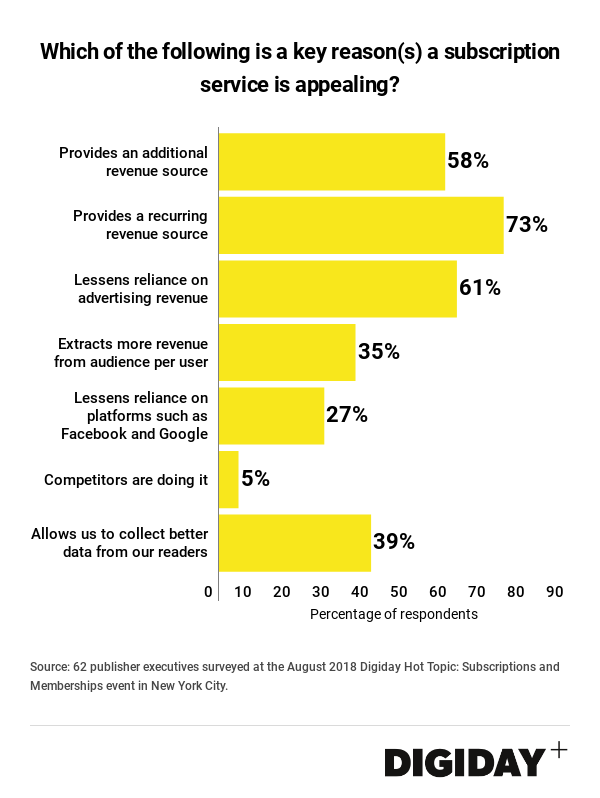

Publishers are flocking to subscriptions and membership programs for a variety of reasons, but chiefly because of the advantages associated with recurring revenue, Digiday research found.

Seventy-three percent of the 62 publisher executives surveyed at the Digiday Hot Topic: Subscriptions and Memberships event held last week in New York City said a recurring revenue stream was a key reason subscription products appeal to them.

Recurring revenue has obvious advantages: It’s predictable, stable and easy to forecast and plan against. But perhaps more important, it’s less exposed to external factors the way advertising revenues can be. Forty-four percent of publishing executives in a Reuters Institute survey say digital subscriptions are their most important revenue source.

Publishers’ renewed focus on consumer revenue is largely a reaction to their reliance on advertising for the majority of their revenues. Sixty-one percent of publishers surveyed by Digiday at the event said they view subscriptions favorably because they help lessen their reliance on ads, while only 35 percent of respondents said they expect subscriptions to be more lucrative than advertising.

In recent years, it’s become increasingly challenging to run a sustainable publishing business with advertising revenue alone. Google and Facebook are sucking up the vast majority of online ad dollars with highly accountable ad products, making it harder for publishers to compete. Meanwhile, meaningful video ad revenue remains elusive for many publishers, and the rise of programmatic buying has depressed prices and increased reliance on industry middlemen.

Despite the power Facebook and Google wield over publishers, only 27 percent of respondents said that they’re attracted to subscriptions as a way to lessen their reliance on the duopoly and other platform intermediaries. For their part, Facebook, Google and Amazon are piloting ways to increase subscriptions for publishers, which could go a long way to smoothing over tensions with publishers if those tests prove successful.

More in Media

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.

Why Walmart is basically a tech company now

The retail giant joined the Nasdaq exchange, also home to technology companies like Amazon, in December.

The Athletic invests in live blogs, video to insulate sports coverage from AI scraping

As the Super Bowl and Winter Olympics collide, The Athletic is leaning into live blogs and video to keeps fans locked in, and AI bots at bay.