Secure your place at the Digiday Publishing Summit in Vail, March 23-25

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

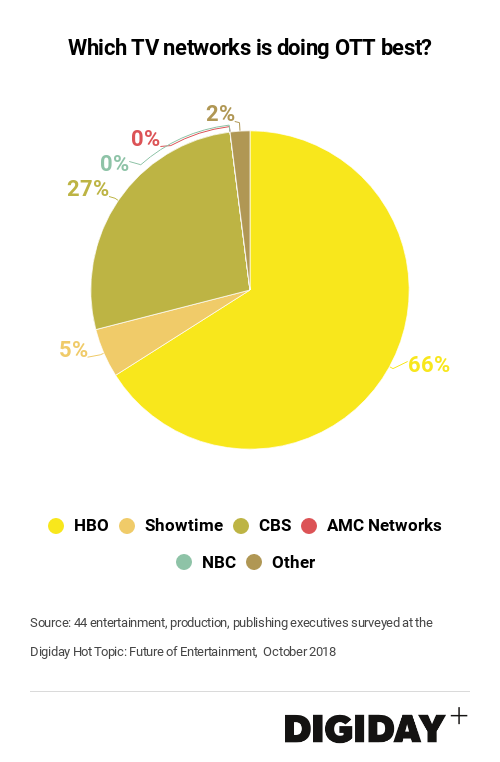

HBO Now is leading the pack when it comes to TV networks operating over-the-top video services, according to a survey of entertainment, studio, and publishing executives at the Digiday Hot Topic: Future of Entertainment last week in Los Angeles. Of the 44 executives polled by Digiday, two-thirds selected HBO Now.

A survey of similar audience members said the same in a survey at the Digiday Hot Topic: Future of TV event in February this year.

The number of HBO Now subscribers is nearly double the subscriber count of its nearest competitor, CBS all access, and far outpaces those of NBC, AMC Showtime and others. HBO executives said Now had 5 million subscribers in February of 2018, double the 2.5 million subscribers CBS All Access had four months later in August.

Industry executives expect HBO to continue to strengthen its OTT offering. HBO’s parent company Warner Media was acquired by AT&T earlier this year, and soon after, Warner Media executive John Stankey told HBO staff that he expected to “see more investment in product and platform.”

HBO doesn’t spend as much as some of its OTT competitors on content, and has previously been critical of the $8 billion Netflix spends on content. HBO spent around $2.5 billion on content in 2017. Additional resources from AT&T could help close the gap and the company pursues more quality programming like its hits Game of Thrones, Silicon Valley or Westworld.

Warner Media has already announced it intends to launch it’s own streaming service to compete with Netflix and Hulu. Including HBO content as part of that service could help new attract new subscribers.

But HBO Now faces it’s share of challenges, too. Despite HBO Now hitting 5 million digital subscribers earlier this year, recent research by Juniper Research found that HBO Now faces incredibly high churn rates of 19.2 percent in some markets.

Additionally, TV networks are increasingly launching their own OTT channels to re-engage cord cutting consumers. Though CBS-All Access has half the number of subscribers – 2.5 million – than HBO Now, consumers can access expanded news coverage from CBSN’s OTT app. Meanwhile ESPN, owned by Disney, released ESPN+ and quickly amassed 1 million subscribers, which may eat away at HBO Sports’ audience.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.