Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Digiday Research: GDPR has not reduced programmatic ad revenues for European publishers

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Concerns that the General Data Protection Regulation would negatively impact digital ad revenues haven’t materialized, publishers say.

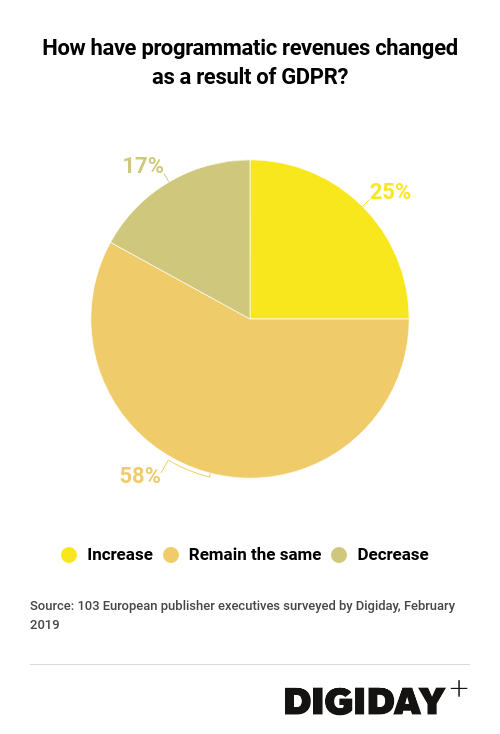

Of 103 publishing executives polled by Digiday in February, 25 percent said they have seen programmatic revenues increase since GDPR was enacted last May, while 17 percent reported a decrease. Fifty-eight percent of respondents said their programmatic revenues have remained unchanged.

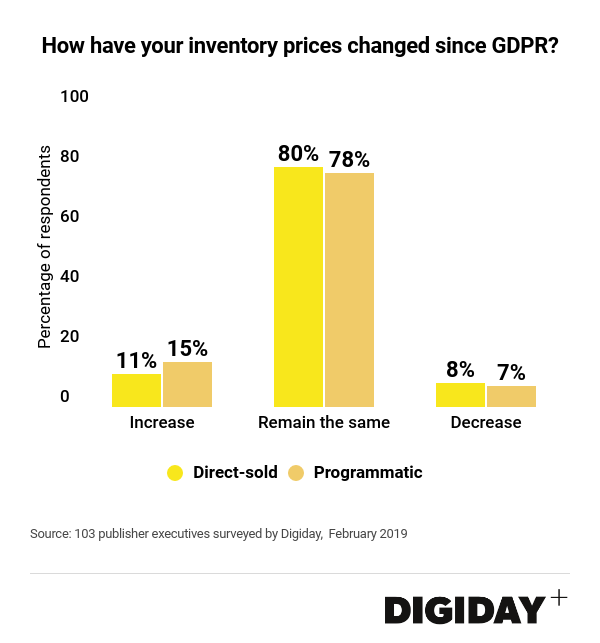

Meanwhile, programmatic inventory prices have remained relatively stable, with 78 percent of respondents reporting that their prices have remained consistent since May, while 15 percent said they increased. Eight percent of respondents said prices for their programmatic inventory decreased.

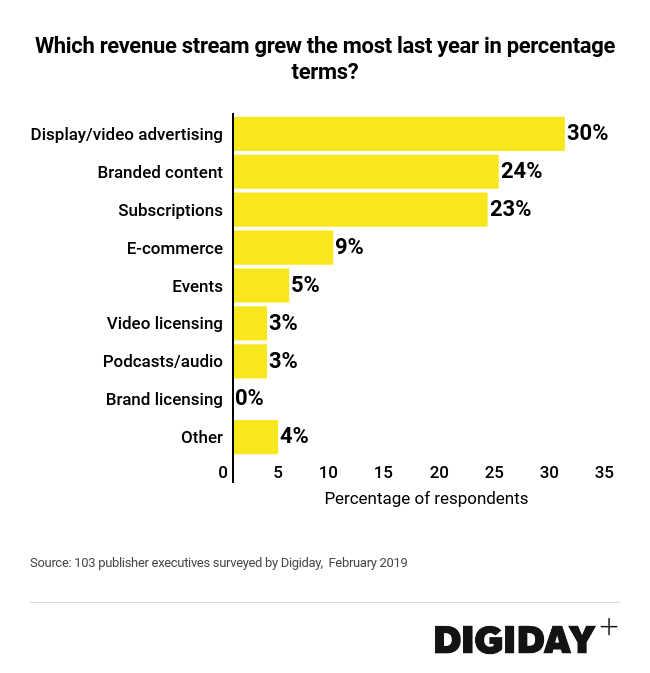

Thirty percent of the European publishers also said display and video advertising was their fastest growing revenue channel in 2018, ahead of other channels such as branded content and subscriptions.

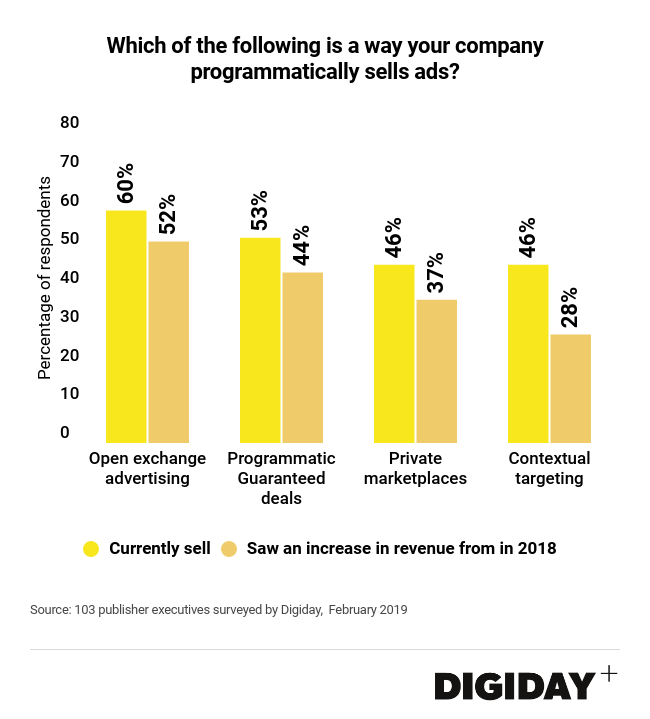

Part of the digital advertising revenue growth publishers are seeing can be attributed to the success of some key programmatic sales strategies, including programmatic guaranteed deals and private marketplaces (PMPs).

Eighty-percent of European publishers conducting programmatic guaranteed deals said those deals provided higher revenues in 2018 than the year prior. Additionally, 70 percent of respondents selling inventory through PMPs saw increases.

One of the concerns publishers had prior to GDPR was that the regulation would limit their ability to collect audience data, thereby decreasing the value of their programmatic ads. But that hasn’t happened. A study from Quantcast last year found that 90 percent of internet users were opting into publishers’ GDPR consent requests.

Now that the dust has settled over GDPR, many publishers are finding themselves in a stronger position with advertisers thanks to GDPR, according to Paul Gubbins, head of programmatic at News UK-owned video marketplace Unruly, who believes that GDPR forced publishers to exert greater control over their audience data. “Publishers cleaned up of a lot of the tags and data leakage, which allowed buyers to target premium audiences in longer tail environments leveraging third-party data, buyers are forced to go back to publishers as the source of the premium audiences” he said.

With less third-party data available, buyers are increasingly looking to programmatic-guaranteed deals and PMPs to access publishers’ first-party audience data instead.

For U.K.-based Dennis, GDPR brought a lot of hype without much tangible change. “We didn’t see a specific impact to our display business as a result of GDPR” noted Pete Wootton, chief digital officer at Dennis.

Rather than GPDR, other outside factors have put greater pressure on Dennis’ digital ad business. “Some car advertisers have reduced their spend for now due to the uncertainty around Brexit,” said Wootton. “They’re still waiting to see what cars they’ll be able to sell in the U.K. and don’t want to spend needlessly.”

More in Media

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.

Overheard at the Digiday AI Marketing Strategies event

Marketers, brands, and tech companies chat in-person at Digiday’s AI Marketing Strategies event about internal friction, how best to use AI tools, and more.

Digiday+ Research: Dow Jones, Business Insider and other publishers on AI-driven search

This report explores how publishers are navigating search as AI reshapes how people access information and how publishers monetize content.