Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Digiday Research: European publishers are less reliant on their owned sites for video revenue than U.S. counterparts

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

Digiday’s “Research in brief” is our newest research installment designed to give you quick, easy and digestible facts to make better decisions and win arguments around the office. They are based on Digiday’s proprietary surveys of industry leaders, executives and doers. See our earlier research on the pivot to video here:

At the Digiday Publishing Summit Europe in Berlin last month, we surveyed European publishing executives to compare their monetization strategies with those of their U.S. counterparts.

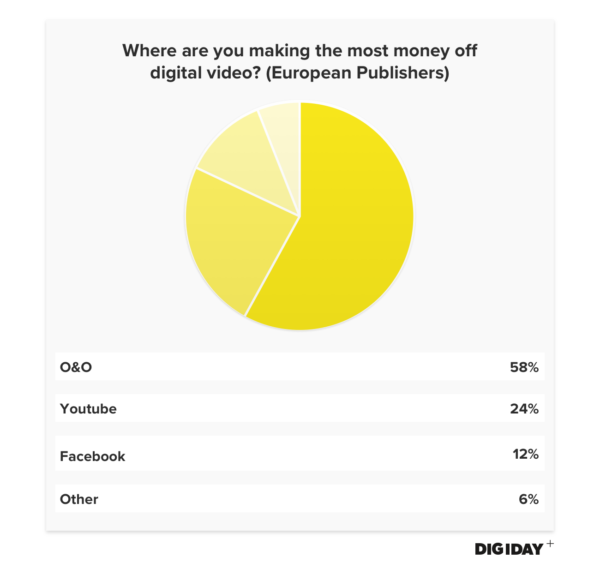

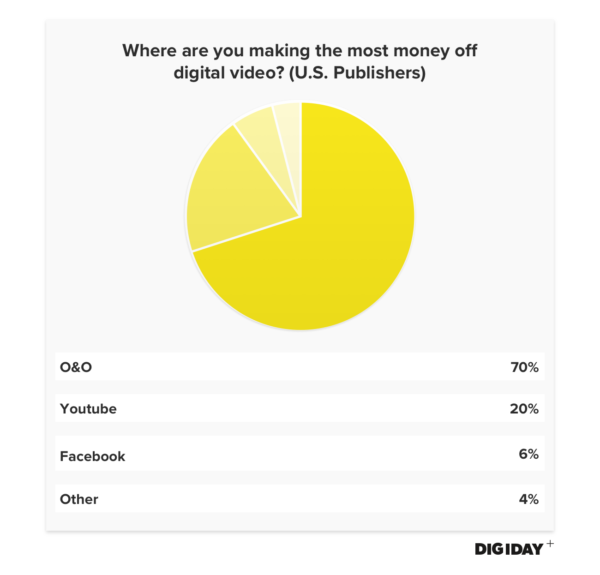

We asked 85 publisher executives in the U.S. and in Europe where they are making the most money off of digital video. European publishers are slightly less likely to rely on their owned and operated sites than publishers in the U.S. Facebook was also twice as likely to be the strongest revenue-producing platform for European publishers.

European companies faced with the upcoming enforcement of the General Data Protection Regulation are incentivized to have a more diversified income model. No one knows exactly how the GDPR will be enforced, but top concerns among European publishers were losing audience data and declining digital revenues.

These concerns go hand in hand for European publishers, especially if readers decline to give consent for their personal data to be used. Less audience data could make it harder for publishers to target and determine the value of viewers, depressing the value of their digital inventory.

Although major platforms aren’t free from the same concerns, they do have the advantage of scale to compensate. Publishers might feel that in the post-GDPR era, monetizing through revenue-sharing agreements with platforms and amassing video view counts is a safer strategy. Users might also be more likely to share their data with a few major platforms rather than a plethora of individual sites.

There will be losers when the GDPR is enforced in May. European publishers were equally split on whether distributing content to platforms is a viable monetization strategy.

Publishers’ status quo could change even before GDPR enforcement. Facebook holds considerable influence over publisher view counts, with dozens of publishers experiencing declines in their video view counts on the platform earlier this year. Facebook’s changes to its news feed algorithms, especially if they bring publishers’ organic reach to zero percent, could make the most impact on U.S. and European publishers.

More in Media

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.

Why more brands are rethinking influencer marketing with gamified micro-creator programs

Brands like Urban Outfitters and American Eagle are embracing a new, micro-creator-focused approach to influencer marketing. Why now?

WTF is pay per ‘demonstrated’ value in AI content licensing?

Publishers and tech companies are developing a “pay by demonstrated value” model in AI content licensing that ties compensation to usage.