Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Digiday Research: The changing business model for publishers, in five charts

This research is based on unique data collected from our proprietary audience of publisher, agency, brand and tech insiders. It’s available to Digiday+ members. More from the series →

For publishers, the biggest priorities heading into 2020 are how to grow revenue they can control: Both through direct-sold ads and subscriptions. Digiday Research this year found that those priorities, along with figuring out how to hire the right talent for those needs, are top of mind for publishing execs.

Highlights:

- Direct-sold ads were the brightest spot of revenue for publishers this year.

- In 2020, the biggest focus for all publishers was on growing subscription revenue and revenue from direct-sold advertising.

- Publishers’ relationship with platforms continues to be rocky, even as they rely still on platforms to drive ad impressions and new audiences that can funnel down into subscribers.

- Product roles have increasingly become the must-have job capabilities inside publishers. Behind this issue is one of a changing business model.

- But overall, talent is a sore spot for most publishers, with the majority of them finding it difficult to find the right people for their needs.

Where they make money

Direct-sold ads were the brightest spot for publishers’ online revenues in 2019, according to Digiday Research.

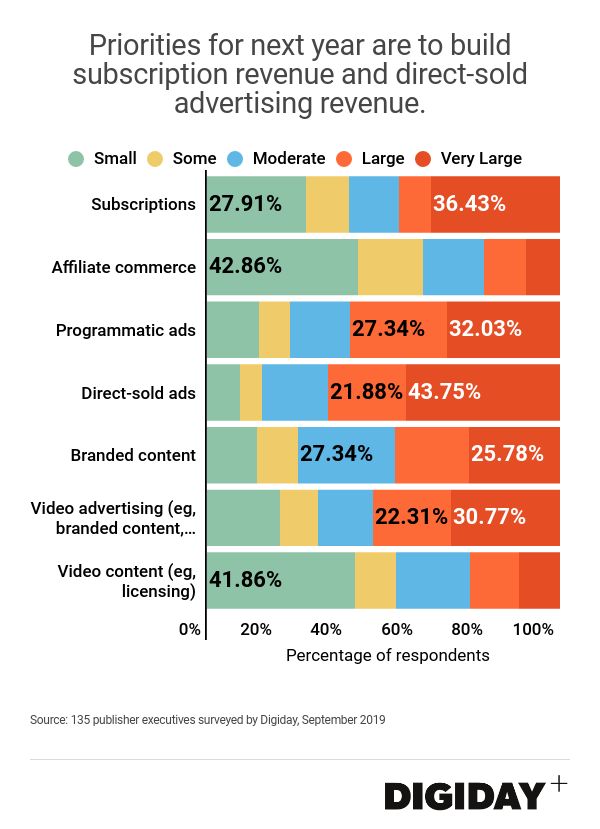

Of the 135 publishers surveyed by Digiday more than 50% of publishers reported that direct-sold advertising was a large or very large source of revenue for them. Video advertising is also another bright spot, with 28% of publishers reporting it as a large or very large source of revenue, as were programmatic ads, with 35%.

Things have slightly changed from a year prior when branded content was a major source of revenue for publishers surveyed: 76% said their companies had seen branded content revenue grow from 2017. There are certain challenges with branded content, and turning that revenue into profit — it can be hard to make, loaded with hidden fees and brands are increasingly skeptical of branded content’s effectiveness.

Despite all the noise with the pivot to paid, subscriptions aren’t a source of revenue for 40% of publishers. Affiliate commerce is either a small source of revenue or not at all a source of revenue for the vast majority of publishers — 82% of them. This is in line with last year’s benchmarking research, which found that revenue streams via affiliate links were nascent and small parts of the business. Last year, less than 10% of publishers said e-commerce was responsible for more than 25% of their revenue.

Where they’re focusing next year

Despite this, growing direct reader revenue remains the biggest priority for publishers heading into 2020. Almost 46% of respondents said growing subscriptions were a major focus for them over the next six months.

Other major priorities are building direct-sold ads: 64% of publishers said that was either a large focus or a very large focus area for them.

Neither comes as much of a surprise. Subscriptions are an important and controllable way to generate revenue. Sometimes that even comes at a lower resource allocation cost — Digiday Research conducted last year found that 75% of publishers surveyed allocated less than 25% of their company’s resources to subscription products. In an increasingly unstable digital advertiser landscape, any way to have sustainable revenue streams is a priority.

Platform relationships

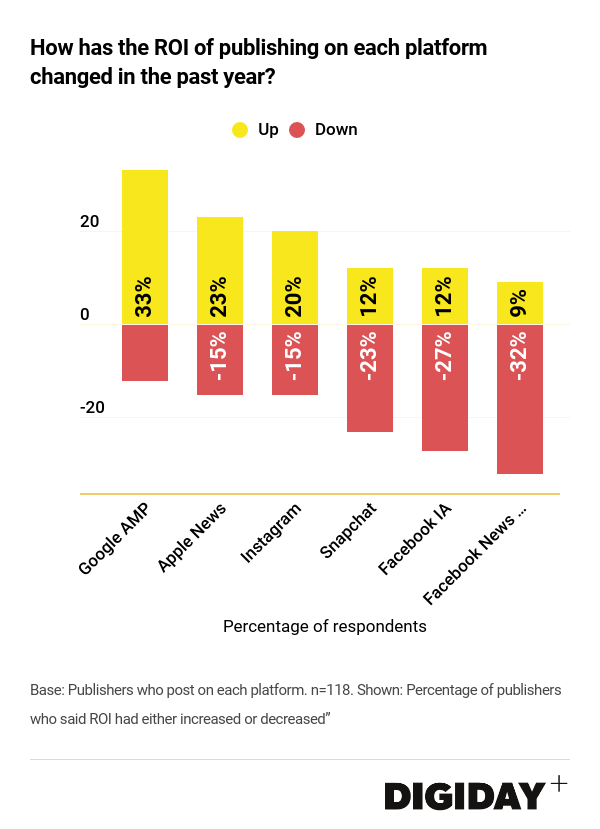

Publishers’ relationship with platforms continues to be rocky, even as they rely still on platforms to drive ad impressions and new audiences that can funnel down into subscribers. Publishers report that platforms delivered even less value in 2019 than they did in 2018.

Barely half of publishers surveyed say platforms create value. Only 55% of publishers who post to platforms say they’re happy with any platform partner. Just 38% say they’re satisfied with the traffic increase they get from Google AMP, and only one-third of publishers who post to Facebook News Feed say they’re satisfied. Publisher satisfaction falls to around 20% for the other platforms we surveyed. For 2020, publishers surveyed say they plan to invest in smaller platforms and scale down relationships.

Hiring and talent concerns

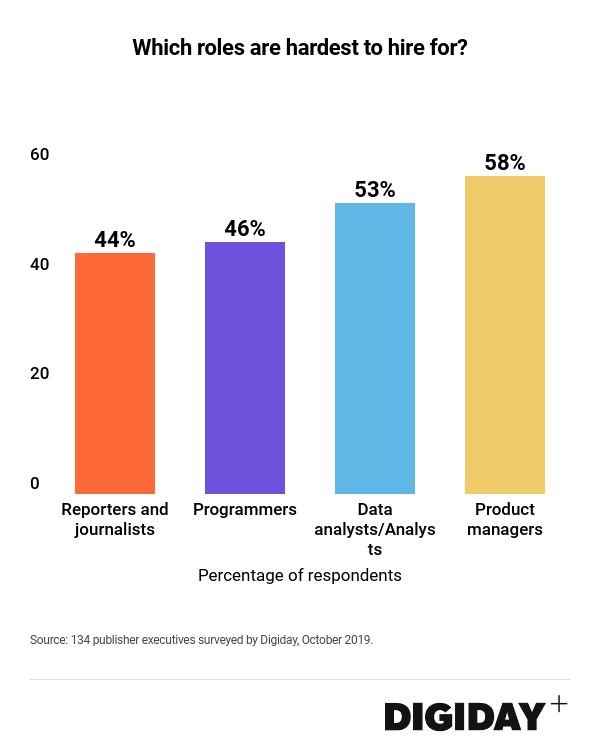

Product roles have increasingly become the must-have job capabilities inside publishers. Behind this issue is one of a changing business model: Publishers are increasingly looking for people who can work with both business and editorial (especially as subscription revenue becomes more important) and also work on diversifying revenue opportunities by developing new products, such as new events, new newsletters and new multimedia opportunities.

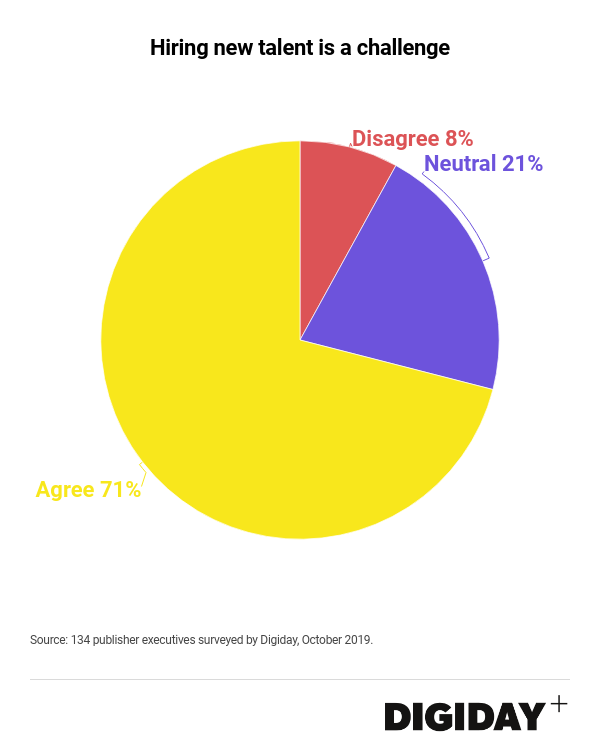

And while hiring is a challenge for the vast majority — 71% — of publishing executives surveyed by Digiday, hiring for product roles is the hardest. Fifty-eight percent of respondents said that hiring product developers and managers was very important or important. The second most important was data analysts which 53% of respondents said was important. Journalists came in third, followed by programmers.

And while hiring is a challenge for the vast majority — 71% — of publishing executives surveyed by Digiday, hiring for product roles is the hardest. Fifty-eight percent of respondents said that hiring product developers and managers was very important or important. The second most important was data analysts which 53% of respondents said was important. Journalists came in third, followed by programmers.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.