Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Bleacher Report’s House of Highlights is starting to build a business from its Instagram base

House of Highlights has steadily grown a strong community around young NBA fans to the tune of 10 million Instagram followers, but now the question is whether it can replicate that success elsewhere.

Turner’s Bleacher Report bought House of Highlights in 2015 and after a few years of letting it grow naturally, it decided to turn on the monetization tap this year. So far, House of Highlights has sold 21 campaigns around its Instagram account to advertisers including Under Armour, Gatorade and Taco Bell. Most of them were existing Bleacher Report clients; two, Takis and Paramount, were new to the company.

House of Highlights benefits from parent Bleacher Report for various shared services. But even accounting for that, the account turned a profit earlier this year on the branded content deals, said Doug Bernstein, gm of House of Highlights. Bernstein wouldn’t say how much money the business is making, but it’s enough to give the company confidence to plan on doubling the staff by the end of the year.

“This year, [the goal] was proving we could make money off House of Highlights. I think we’ve proven the ability to monetize House of Highlights very successfully,” Bernstein said.

It’s tricky to introduce branded content to any publication in a natural way. Branded content also often entails promotional costs, which cuts into the publisher’s profits. “While a strong follower count for any social page is always a good indicator of interest and awareness, traditionally there still needs to be a paid investment by the page on any sponsored content in order to get the reach needed for the advertiser,” said Lisa Cucinotta, vp of accounts at Adaptly, which helps advertisers scale campaigns on social media.

Bleacher Report’s polished branded videos wouldn’t work on House of Highlights, which has a raw and relatable quality. So House of Highlights has shown videos with people wearing Under Armor clothes or carrying bottles of Gatorade, two of the sponsors. In other instances, the content was “brought to you by” the brand. Judging from the comments, there hasn’t been much pushback from fans to the encroachment of advertising. So far five of the branded Instagram Stories posts have outperformed its non-branded Stories posts by 30 percent, the company said, citing Brandtale data.

“The question was, how do we create content with the brands that’s not super commercial,” Bernstein said. “We have a community that has a deep, deep affinity with House of Highlights that you just don’t see with other brands.”

Every platform has its natural limit in how much advertising users will support, so to keep growing, House of Highlights has to expand beyond Instagram. House of Highlights is planting seeds on YouTube and Twitter, which are appealing for their ability to monetize and build community (YouTube) and promote live viewing (Twitter).

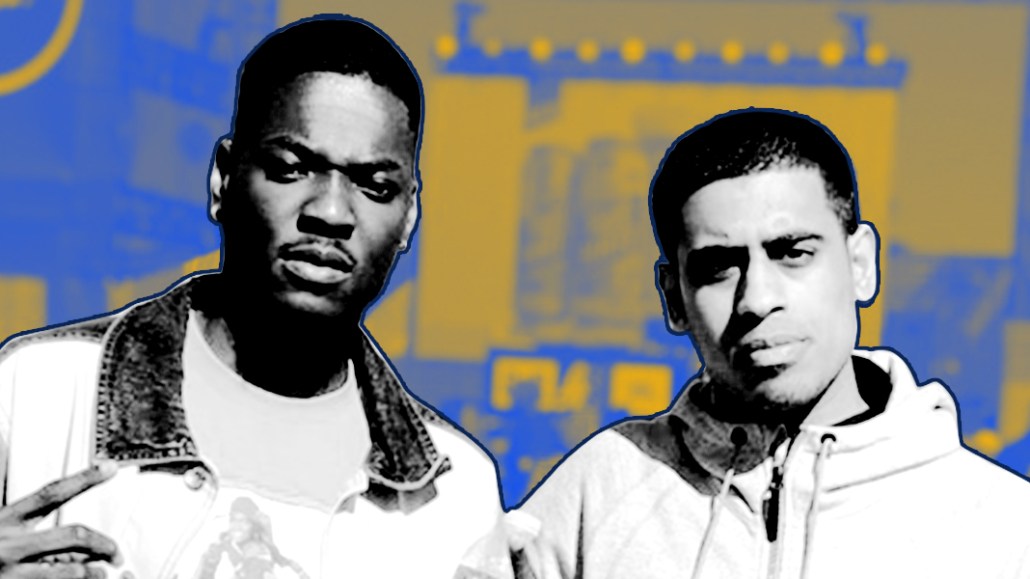

House of Highlights launched two shows on YouTube this year: A sketch comedy video show called “Supreme Dreams Show” and “Through the Wire Podcast,” featuring four guys sitting around riffing about sports. Two more YouTube shows are in development, likely centered around Gen Z culture like gaming or comedy. Come October, House of Highlights plans to launch a live Twitter show starring the account’s founder, Omar Raja.

To support all this expansion, House of Highlights is getting more people. Today, it has a staff of seven full-timers, including its first salesperson; by year’s end, that figure will be at 14 full- and part-timers, including two people dedicated to the forthcoming Twitter show.

Instagram still accounts for the vast majority of House of Highlights’ business, but over time, Bernstein would like to see YouTube and other platforms become significant contributors. He’s encouraged that while House of Highlights only has about 260,000 followers on YouTube and the first three episodes of “Through the Wire” averaged 20,000 views — the podcast, which runs around 50 minutes, has an average watch time of 20 minutes.

“We are aware Instagram can only support a certain level of monetization; that’s why scaling across other platforms is so important,” Bernstein said. “We never want to be at the whims of any one platform.”

More in Media

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.

Why more brands are rethinking influencer marketing with gamified micro-creator programs

Brands like Urban Outfitters and American Eagle are embracing a new, micro-creator-focused approach to influencer marketing. Why now?

WTF is pay per ‘demonstrated’ value in AI content licensing?

Publishers and tech companies are developing a “pay by demonstrated value” model in AI content licensing that ties compensation to usage.