Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Bauer Media last week announced a new e-commerce platform, Dabbl, as part of its ongoing investment into digital products.

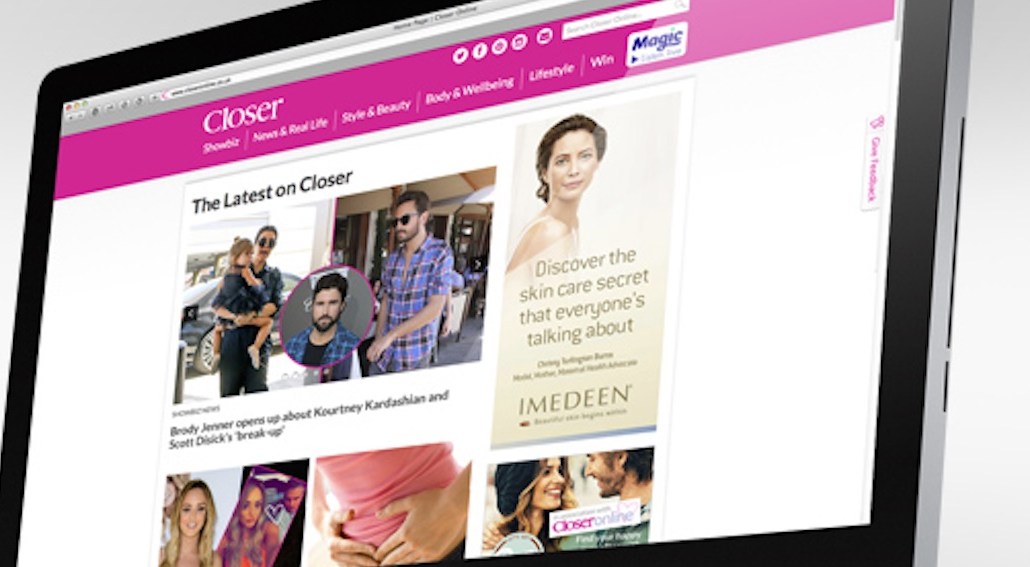

The media company encompasses print and online magazine brands, including Heat and Grazia, and radio stations Kiss FM and Magic. It also has a 50 percent stake in British TV company Box television, the other half of which is owned by Channel 4. With a reach of 22 million U.K. consumers, its audience rivals the BBC’s.

But with the state of readership declining, Bauer needs to diversify. Figures from comScore show that Bauer’s unique monthly visitors across its sites is 7.9 million. MailOnline remains its strongest competitor with 27.4 million unique monthly views (June 2015), ranking ninth in comScore’s Top 20 Digital Media Properties.

Bauer has responded by reshaping its digital strategy to develop more audience-centric products. Hence Dabbl, which hosts vouchers for restaurants, holiday breaks and shopping.

Sam Jones, Bauer Media’s digital managing director, admits that while Dabbl isn’t strictly e-commerce, it’s classified as a development of a “transactional ecosystem created through affiliates.”

It launched as an extension of RadioOffers, Bauer’s regional radio discount site, which according to the company has 150,000 subscribers who are highly engaged, with the site clocking 130,000 unique monthly views. Dabbl lets national brands like Zizzi, Pizza Hut, Toby Carvery and Reel Cinema, gain a slice of this pie.

Dabbl, which was a year in the works, is the latest product to come out of Bauer Media Xcel, the company’s division that has focused on commercial products and selling inventory and audience insights to advertisers.

Xcel, formed in the U.K. in early 2015, runs online-only women’s lifestyle publication the Debrief and InStream, its radio ad product enabling more targeting to registered listeners.

“Xcel Media was launched as an exercise to accelerate more investment in digital,” Jones said. “We wanted to recognize that digital deserved more focus from a corporate level. We knew we needed new processes, new talent and new ability.”

In recent months, Bauer has strengthened Xcel with four top-level execs including ex-Argos digital engineer Matthew Hobbs and Akhil Suchak from Viacom, among others.

Jones said the media company adopted a more bullish approach in diversification. “Other publishers looked at matching the business challenge with an incremental gain with digital,” he said. “Bauer took a different approach. We wanted new businesses; it’s a different cadence.”

As such, Xcel operates completely separate from the media company’s publishing efforts.

“We recognized that in order to be successful in our transactional businesses we need to treat them very differently [to our publishing properties],” he said. Business success where transactions are the outcome will be a quick journey, while publishers measure success on digital properties through increased dwell times. “They attract different audiences, different behavior, different metrics, different user experience, different ways of communicating.”

Jones described Bauer’s growth strategy as three-pronged: Create new products, scale existing products (as in this instance) and find new opportunities in new markets.

“The biggest challenge is how to measure up the opportunities and decide on which one to go for,” says Jones. “The key is marrying the creative Zeitgeist minds with pure-play product development.”

Next year the goal is to continue growing a “network effect,” said Jones, “stitching together audiences in a DMP [data management platform, so that Bauer can better supply its single-customer view to advertisers] that’s a network effect. Sharing products across borders, that’s a network effect.”

If the launch of Dabbl shows anything, it’s Bauer’s attempt to scale local opportunities nationally and with speed. Investment in Xcel will stand Bauer in good stead.

“We wanted to build it and grow it, not just incrementally scrape by.”

Image via Bauer Media

More in Media

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.

Overheard at the Digiday AI Marketing Strategies event

Marketers, brands, and tech companies chat in-person at Digiday’s AI Marketing Strategies event about internal friction, how best to use AI tools, and more.

Digiday+ Research: Dow Jones, Business Insider and other publishers on AI-driven search

This report explores how publishers are navigating search as AI reshapes how people access information and how publishers monetize content.