Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Advertisers can’t resist Snapchat’s highly concentrated young audience. But the messaging app has been losing favor with marketers who want the same campaign reporting data and targeting they get from Facebook and Google.

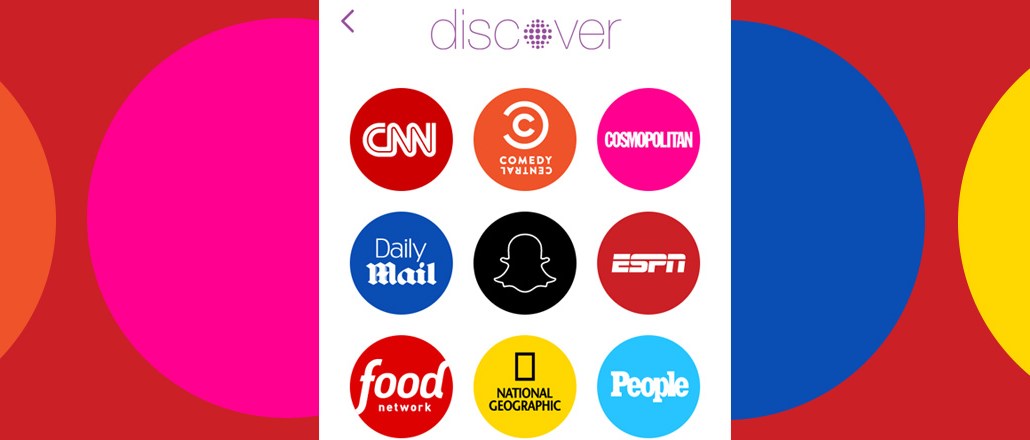

Snapchat has cracked open the door to targeting, though. For the past month, it’s been letting advertisers buy audience bundles that package different publisher channels in Snapchat’s Discover section, grouped by theme. The “audience bundles” as the packages are simply called, are designed to let advertisers match their creative to specific themes.

So a “world news and culture-themed package” would consist of ads in CNN, Mashable, Vice and National Geographic. An entertainment package would include channels including People and iHeart. Snapchat wouldn’t talk on the record about the strategy.

Snapchat’s Discover section launched earlier this year and there are now 17 publisher channels in the section. With that growth has come concerns among agencies and participating publishers that there’s a dilutive effect, though. Agencies also have been grumbling about Snapchat’s limits as an ad platform, from the scarcity of data provided on campaigns to the inability of ads to be shared.

Anita Walsh, associate director of social strategy at Horizon Media, who has seen an RFP from Snapchat that described an entertainment audience, said Discover ad campaigns that her agency has placed continue to overdeliver. But there’s a sense that advertisers feel that the practice of buying by channel is too limiting.

“This does seem like a sign some advertisers feel it’s pigeonholing their viewerships,” Walsh said. “I don’t think it’s an answer to viewership declining but [advertiser] concern about being pigeonholed. This cross-publisher approach could be a move to be more efficient.”

The audience product also probably lets Snapchat bring more of its ad buying in-house and rely less on publisher teams to sell, said Nick Cicero, CEO and founder of Delmondo, an influencer network that frequently works with Snapchat. “That way they can tap the entire network if campaigns underdeliver, too.”

The audience targeting would seem to fall short of the demographic targeting advertisers would like, but it’s a sign Snapchat is trying to make itself (and Discover) more advertiser-friendly.

Brands still see Snapchat as a way to build awareness and as a channel that’s powerful enough to be called “the new TV,” said Victor Pineiro, vp of social media at Big Spaceship. But it’s a “black box; there’s very little data on how the channels are performing.” Sure, advertisers can use geo filters to target ads by location, but they’d like more demographic data on the people they’re reaching.

There’s a feeling that Discover ad and edit content is hit or miss, which makes advertisers more interested in using influencers or Live Stories on Snapchat. With influencers, advertisers can be part of longer videos, and get data on the influencers themselves, like follower count and engagement rate.

“There are definitely some publishers who are struggling to tell the right stories on Discover,” said Cicero, speaking of the ads on Discover. “You don’t hear of a ton of innovative stuff coming out of Discover.”

Another agency exec said advertiser demand for Snapchat hasn’t let up but expressed impatience about the inability to buy it on a self-serve, automated basis and get access to a data dashboard.

“The bigger question is, when are they going to build in back-end technology so it’s scalable,” this person said, speaking anonymously for fear of hurting the agency’s relationship with Snapchat. “There’s no programmatic interface, no self-serve analytics. You have to talk on the phone. There’s no ad tech, and that’s something worth exploring.”

More in Media

The case for and against publisher content marketplaces

The debate isn’t whether publishers want marketplaces. It’s whether the economics support them.

Urban Outfitters shifts its influencer strategy from reach to participation

Me@UO is Urban Outfitters’ new creator program leverage micro-creators with smaller, engaged communities that are passionate about the brand.

Media Briefing: Without transparency, publishers can’t tell if Google’s Preferred Sources feature benefits them

Six months in, Google’s Preferred Sources promises loyalty-driven visibility, but leaves publishers guessing at the traffic impact.