Secure your place at the Digiday Publishing Summit in Vail, March 23-25

To compete with Facebook and Google, publishers step up their ad-targeting game

The competitive pressure from Facebook and Google is forcing publishers to get more personal with their advertising. Many are embracing the people-based marketing mantras of those Internet giants, trying to prove that they have the same ability to know their audiences and deliver targeted ads.

Tired of losing out to Internet rivals that assume a greater portion of ad dollars every year, top digital media properties like News Corp and Condé Nast are getting into this ad tech game, too, making their subscriber bases available to brands with better targeting.

It was a prominent topic of discussion at Advertising Week, where publishers shared ways they’re tapping into their subscriber data for advertisers.

“There are certain advantages that legacy media companies have especially because of our subscriber files, tens and tens of millions of them,” said Edward Menicheschi, CMO and president at Condé Nast. “We’re in their homes; we know them.”

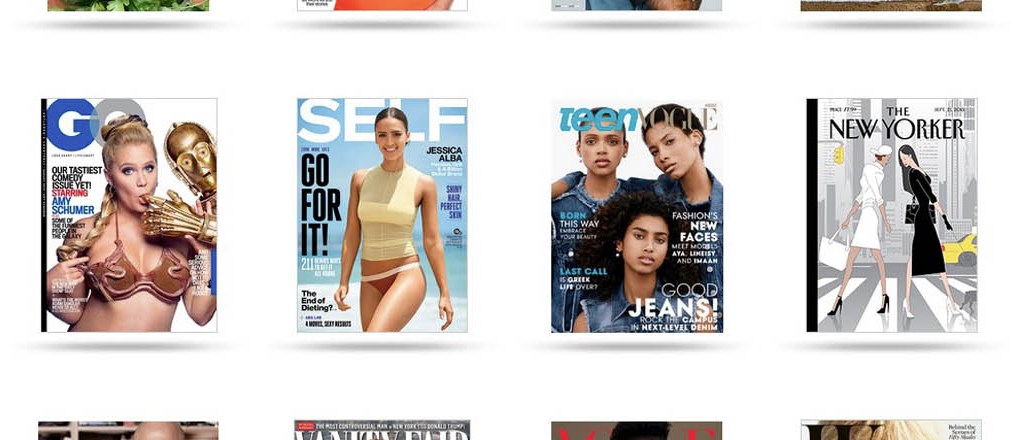

The Condé Nast exec, with publications like GQ, Vanity Fair and Vogue under his purview, discussed the data potential. Condé Nast recently bought 1010data, a $500 million deal that’s meant to give it more data insights. With its huge subscriber files, the publisher turns them into audiences with names like “Forever 21,” women who share their daughters’ youthful exuberance, as Menicheschi put it. Advertisers could also target “Streamers,” young males who never watch TV.

Condé Nast is not alone in its efforts to turn its audiences into people-based marketing targets, following the lead of Facebook, Twitter, AOL, Yahoo and Google.

“While digital display advertising is growing overall, we are hearing from the vast majority of publishers that their ad revenues aren’t keeping pace,” said Kathy Menis, senior vp of marketing at Signal, a data-focused digital marketing platform used by brands and agencies. “They’re fighting for ad dollars with walled gardens like Facebook and Google, which can offer large, customized, addressable audiences to advertisers,” she told Digiday in an interview. “This is the new battleground.”

Facebook and Google are known as “walled gardens” because they essentially keep their proprietary data to themselves, offering restricted access to their user information, on their terms.

Signal surveyed publishers and found that 80 percent of them are concerned about their ability to keep up with Facebook’s and Google’s ad products. Also, 80 percent said that matching these data capabilities was a priority for them, including developing cross-device targeting that can hit the same subscriber with messaging on any screen.

Marketing agency Merkle just launched a new ad-targeting platform that will work with News Corp, among other premium publishers, according to Merkle’s chief strategy officer, John Lee. The platform, MerkleOne, lets brands like MetLife import their email lists to find their customers on sites like The Wall Street Journal, Lee told Digiday.

The system works much like Facebook custom audiences and Google’s recently announced Customer Match service, where the advertiser brings its first-party data and connects with the desired audience found using the platforms’ third-party data.

“It’s the best of both worlds, premium inventory and one-to-one precision targeting,” he said. “It’s guaranteed, above-the-fold inventory, targeted at an individual level.”

Image courtesy of Condé Nast.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.