Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Advertisers are still waiting for the Pinterest promised land. It hasn’t quite come yet, and some brands and agencies are concerned it might be too late as more aggressive rivals such as Snapchat and Instagram come along.

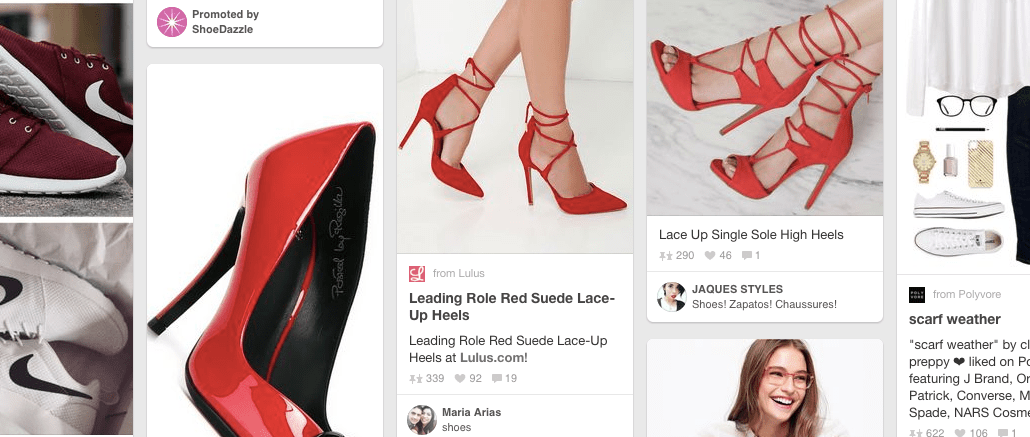

It’s not that Pinterest hasn’t offered a compelling platform with a unique value: Its 100 million monthly users go there to pin products they desire. They curate digital boards with hoped-for clothes, vacations and homes, all of which advertisers see as the ultimate sign of purchase intent.

Still, Pinterest was founded six years ago this month, and its ad evolution has been slow, according to the demanding standards of fast-growth digital advertising. Even brands that have been early to the platform’s more unique ad units, like the GIF-style Cinematic Pins, said that Pinterest can be slow to give feedback about how campaigns perform.

For instance, on Wednesday, Pinterest released its first case studies from the GIF-like Cinematic Pins feature it launched in May. Wendy’s was not one of the brands featured in the studies, but it has tested them. “The Pinterest results are somewhat inconclusive in terms of impact. At the time we launched with the Cinematic Pins, reporting was very limited in comparison to the reporting and insights we’re able to get back from other platforms,” Wendy’s agency VML said in a statement, adding that the “PR gloss from being first to market with this new technology” was success enough.

“Evolution-wise, it’s probably where Tumblr was three or four years ago, saying, ‘OK, now we’re starting to plop some ads on it, and who wants to be the guinea pig?'” said Azher Ahmed, director of digital at DDB Chicago.

Pinterest has been extremely wary of introducing ads, because it wants to maintain the purity of the user experience. “I understand the hesitation over turning it into a zoo with brand stuff splattered everywhere,” Ahmed said.

That mentality, however, has kept the biggest ad budgets from diving too deep into the platform. One holding company executive, speaking on background, said the biggest clients still can’t spend a billion dollars there, because the platform won’t support it yet. The brands demand a technological scale that Pinterest has just not yet been ready for, without better targeting tools and measurement.

Tinker, tailor, API

Pinterest is still tinkering with its ad platform — application programming interface — and developing how it measures ads and reports back to brands on their effect.

For instance, Pinterest still doesn’t offer a fully independent verification system that tells advertisers how widely ads were viewed, according to sources. This type of reporting is something more brands demand from digital platforms. Pinterest has been responsive in the face of other shortcomings, most recently when it enabled advertisers to target consumers from their e-mail lists, a common form of data targeting employed on other platforms.

Pinterest officially launched its ads API in September, and even that was a tightly managed rollout with a few select partners, a kind of bespoke approach to automated advertising. In developing the API, there was some confusion over whether advertisers would be able access it directly or need to go through third-party ad tech partners, one source familiar with the platform said.

“When they rolled out the API, they didn’t do it in a way that was clear and intuitive for marketers and brands to figure out how to actually take advantage, and that slowed them down,” the source said. “What ended up happening, because it was such a rocky rollout, we had clients who were happy to spend money there, but they said this is too difficult, and they had to move on. It’s not the kind of thing you want to happen.”

At the same time as the API launch, Pinterest also changed its ad strategy, having decided to scale back the types of advertisers it would service. It told brands and agencies that it would focus on helping consumer product and fashion brands, while turning away from sectors like finance and telecom.

‘Methodical and deliberate’

Michael Akkermann, head of marketing developer partnerships, said Pinterest purposely kept its ad technology launch to a core group of partners. “With the API, we took a very selective invitation-only approach. Some companies open their API and allow anyone to give to it,” Akkermann said.

To start, Pinterest worked with only eight ad tech partners, such as 4C, Adaptly, Ampush and Kinetic Social. By contrast, when Instagram opened its API last year, it had more than 40 buying partners. “Some say slow, I say methodical and deliberate. The worst thing you can do is put something in the market and have to pull it back in,” Akkermann said.

The site also wanted to avoid flooding users with promotions and ruining the mood.

“My team is here to support the market with the needs and requirements they have. We have people dedicated to agencies and agency relationships to make sure this is a robust ecosystem of numerous different players, and making sure people understand the value of Pinterest,” Akkermann said.

Akkermann manages relationships with marketing partners, and his team has more than doubled since he came to the company in the summer, but he did not say exactly how big the team is.

One of the big new offerings coming soon from Pinterest is video, which has become the must-have ad product for any digital player.

Pinterest answered competitors’ video offerings with the Cinematic Pins, which are a unique format with short, GIF-like motion as users scroll down the screen, and then they stop moving when the user stops scrolling. In the case studies about campaigns from L’Oreal Paris and Reese’s, Pinterest said Cinematic Pins performed better than Promoted Pins with lifts in brand awareness and purchase intent.

Plain old video, though

Finally, though, Pinterest will introduce traditional video formats. It is testing a new video ad unit that is expected to launch to more brands in the third quarter, according to sources with direct knowledge of the tests.

Video is one of the ways to appeal to the broadest advertising base and demands less hand-holding from Pinterest’s team — advertisers already have video assets in their arsenal.

Despite the perceived setback from some corners of the ad world, Pinterest continues to be a top app on the download charts and reportedly expects $2.8 billion in ad revenue in 2018, and cleared $169 million last year. If it can reach its full ad potential, it could make a Facebook-like $10 per user, according to internal company documents reported by TechCrunch last year.

Kate Rush Sheehy, strategy director at RG/A, works closely with brands like Royal Caribbean on Pinterest campaigns. For her brands, it has lived up to the promise, she said. “We still prioritize Pinterest as a super part of the mix because it is a commerce-oriented channel,” she said.

When brands post content to Pinterest, the posts have a longer shelf life than they would on any other social platform. With a client like a cruise line, and mom’s pinning vacation plans to its pages, Pinterest seems a natural fit for marketing.

As far as “blowing up” with ad sales, it has the right pieces in place, Rush Sheehy said. Just put a pin in it for now.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.