Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Instagram is proving Facebook is no one-trick pony.

In upcoming years, Instagram’s ad revenue is projected to take off as it becomes a larger part of Facebook’s overall business. Agencies are increasingly turning to the platform and diversifying their spend as Instagram rolls out new products. And although Snapchat has emerged as a threat, Instagram’s projected revenues still significantly exceed their competition.

Here are five charts that summarize where Instagram is at with their advertising.

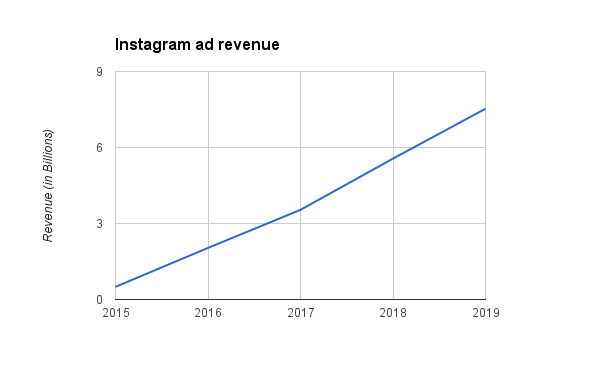

Ad revenue growth

According to forecasts from various financial institutions, Instagram’s ad revenue is projected to skyrocket. On average, these reports predict that Instagram ad revenue will jump from about $2 billion in 2016 to about $5.5 billion in 2018.

“Instagram has only been advertising in a major way for about one year, so it’s just getting started in terms of monetization,” said eMarketer principal analyst Debbie Williamson. “There is still a certain amount of pent-up demand to advertise there.”

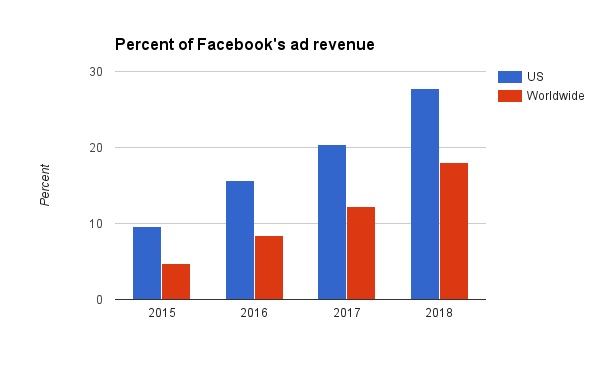

Growth within Facebook

As Instagram’s ad revenue grows, it will make up a larger chunk of its parent company’s overall ad revenue, according to eMarketer. One reason Instragram could rise within Facebook’s network is that as a less mature platform, “Instagram may not be as saturated yet when it comes to ad load and usage,” said Steve Rubel, chief content strategist at communications marketing firm Edelman.

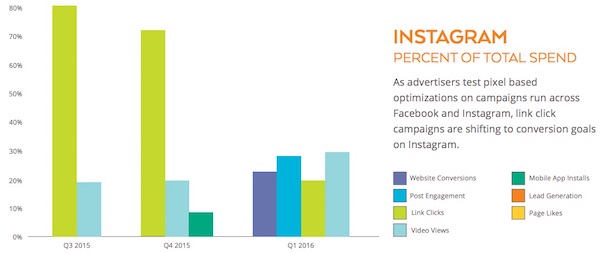

Diversification of ad spend

From its Snapchat-like Stories to opening up shopping features, Instagram has rolled out several ad products this year. These new products “make it pretty easy for advertisers to extend their buys,” Williamson said.

As Instagram branched out with new ad products, advertisers diversified how they spend on the platform. According to a report from social marketing company Kinetic Social, ad spend on Instagram is no longer dominated by link click campaigns. This year, advertisers started to spread their Instagram spend across campaigns based on conversions, engagement and video views.

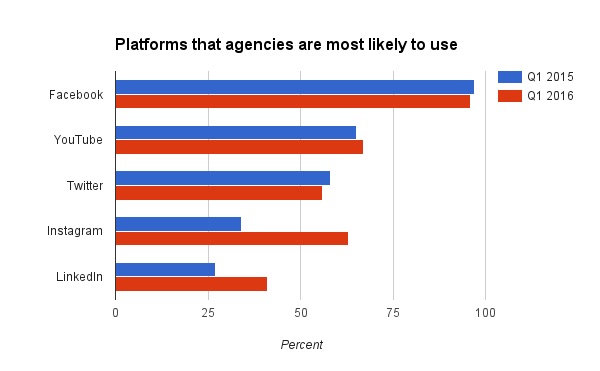

Adoption by agencies

Media industry software company Strata surveyed 83 ad agencies on which platforms they use in their campaigns. From 2015 to 2016, Instagram’s use grew the most, although Snapchat was a notable absence in the survey.

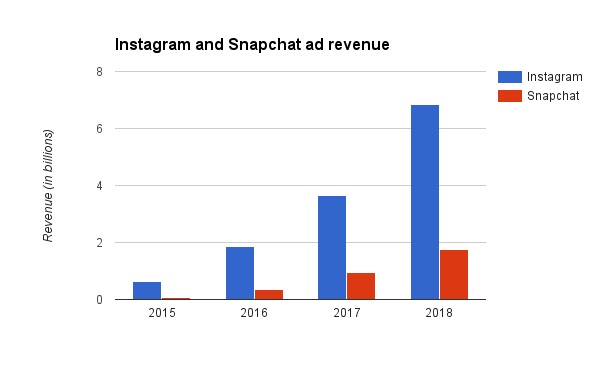

Competition with Snapchat

Snapchat is the hot new thing, and lately, Facebook and Instagram have tried desperately to copy its features.

“Snapchat has moved from being just a shiny object to actually being a platform that has long-term staying ability,” said Chris Wallace, managing partner and managing director of Mindshare San Francisco, in an eMarketer report. “I think that Snapchat is a threat to Instagram, definitely.”

Although Snapchat is a serious competitor, Instagram’s revenue is predicted to dwarf Snapchat’s. Because unlike Snapchat, Instagram gets the benefit of operating under one of the largest companies on the web.

“All the rigor of targeting and measurement on Facebook already is, or will be, coming to Instagram,” Williamson said. “And that just makes Instagram that much more comfortable for advertisers.”

Photo courtesy of Creative Commons

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.