Secure your place at the Digiday Publishing Summit in Vail, March 23-25

The shifting tectonic plates of the internet have focused attention on the leading publicly listed ad tech companies, with the fortunes of such entities considered a bellwether of the wider sector.

Upon initial viewing, everything was positive for the companies in this cohort over the 90 days to June 30 — after all, this was the period when Google announced that the “cookie-pocalypse” wouldn’t be happening after all — with increased earnings overall.

However, as the markets have consistently shown this year, stock prices are often moved more by narrative than by evidence, with several members of this cohort experiencing significant stock price reductions based on short seller reports in recent months.

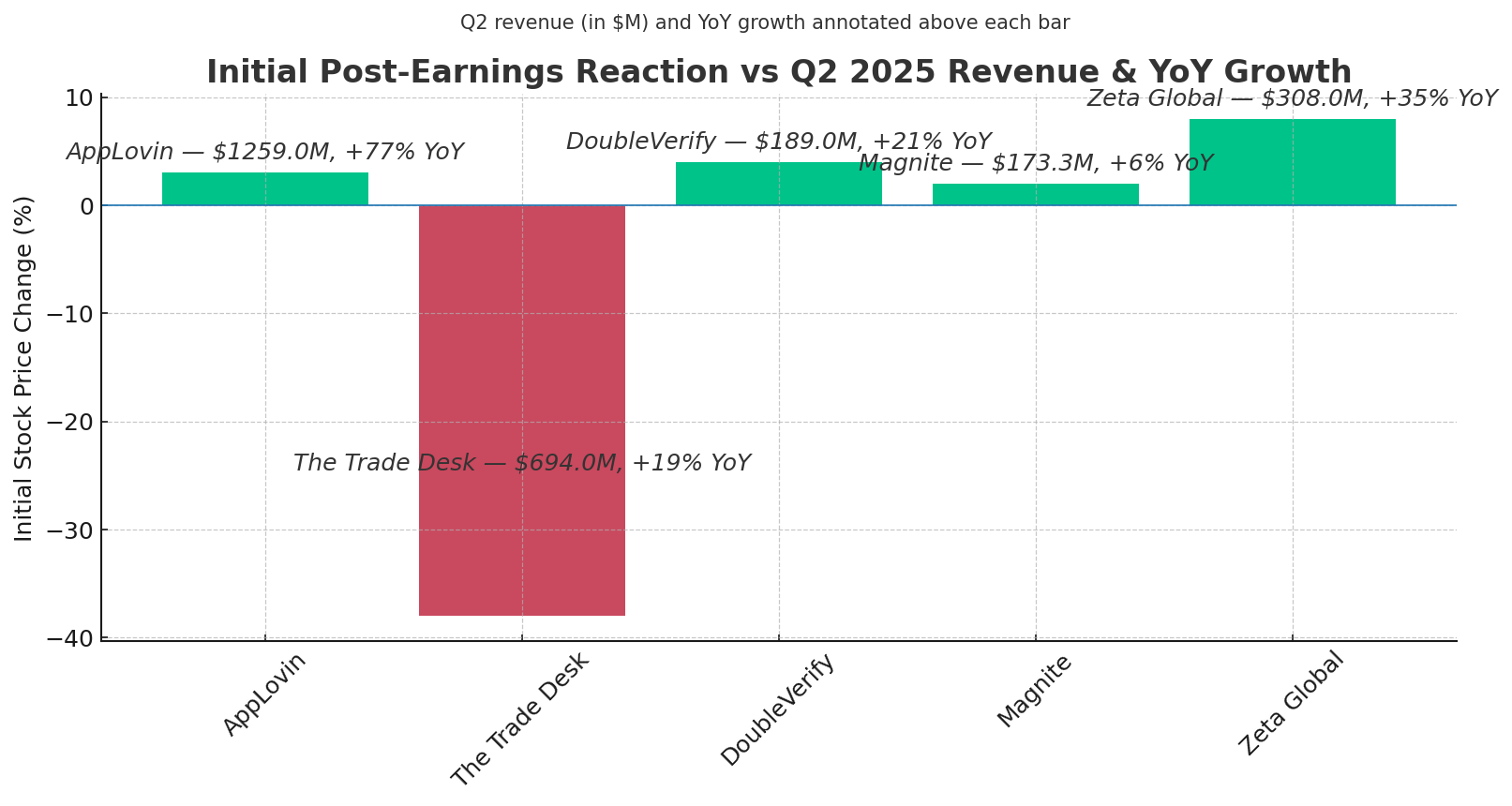

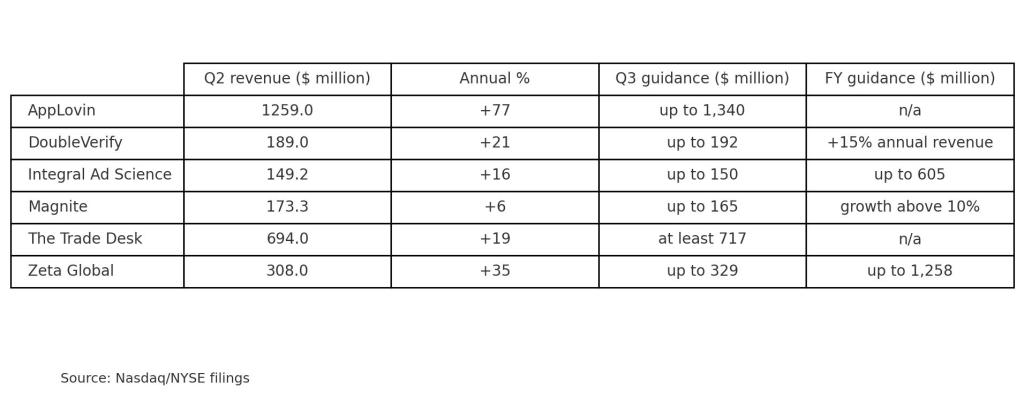

AppLovin is one such company, and despite posting a 77% annual leap in revenue during the recent period, nearing $1.3 billion, these would appear to be impressive numbers (for most), but Wall Street’s fast-money traders aren’t so easily convinced.

Despite this, the company’s stock dipped slightly in the immediate aftermath of its Q2 earnings disclosure, with investors’ appetite for more seemingly satiated by its designs on the SMB sector, given its intended Q4 rollout of a self-serve platform. See slide one, above.

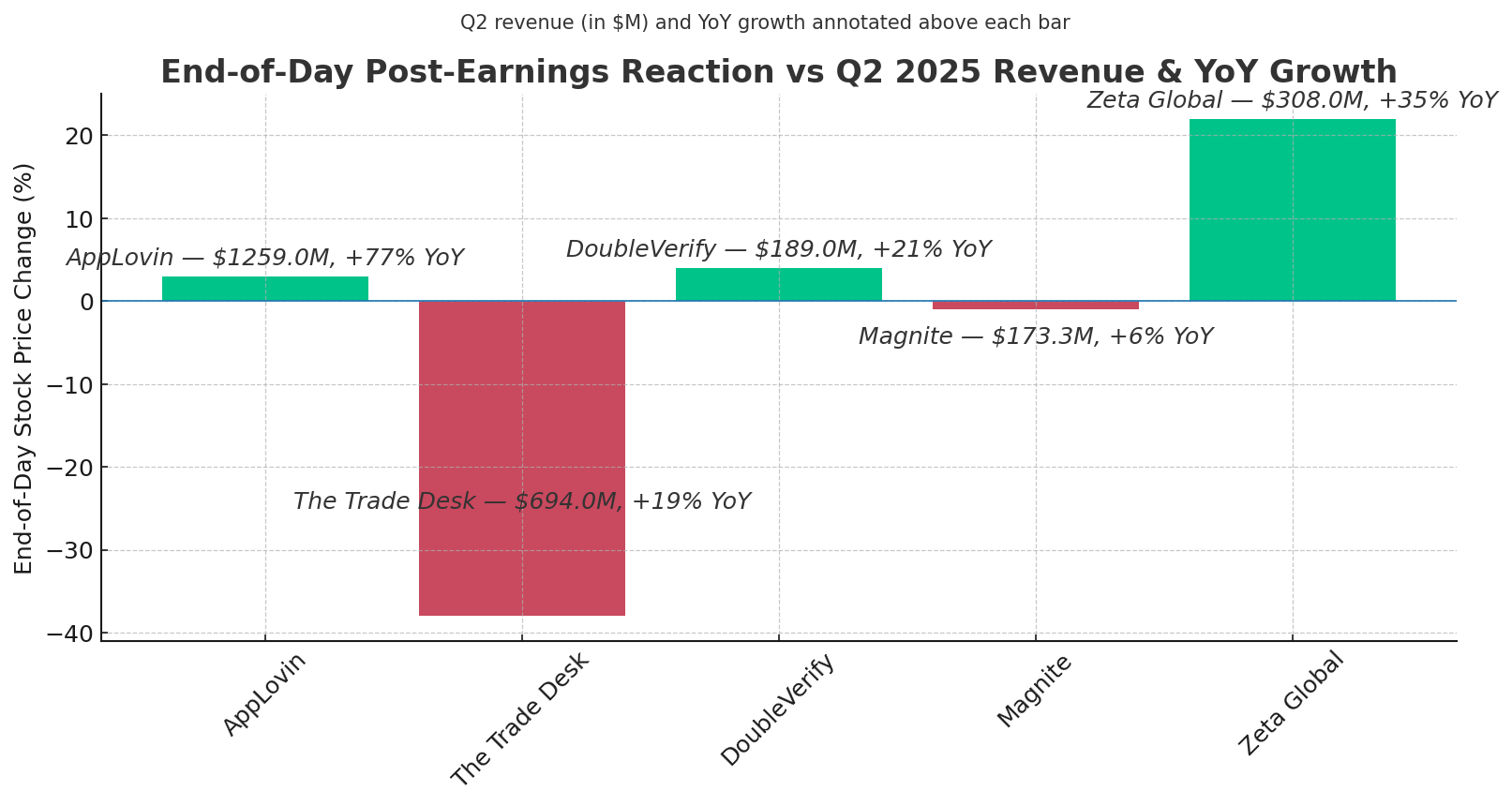

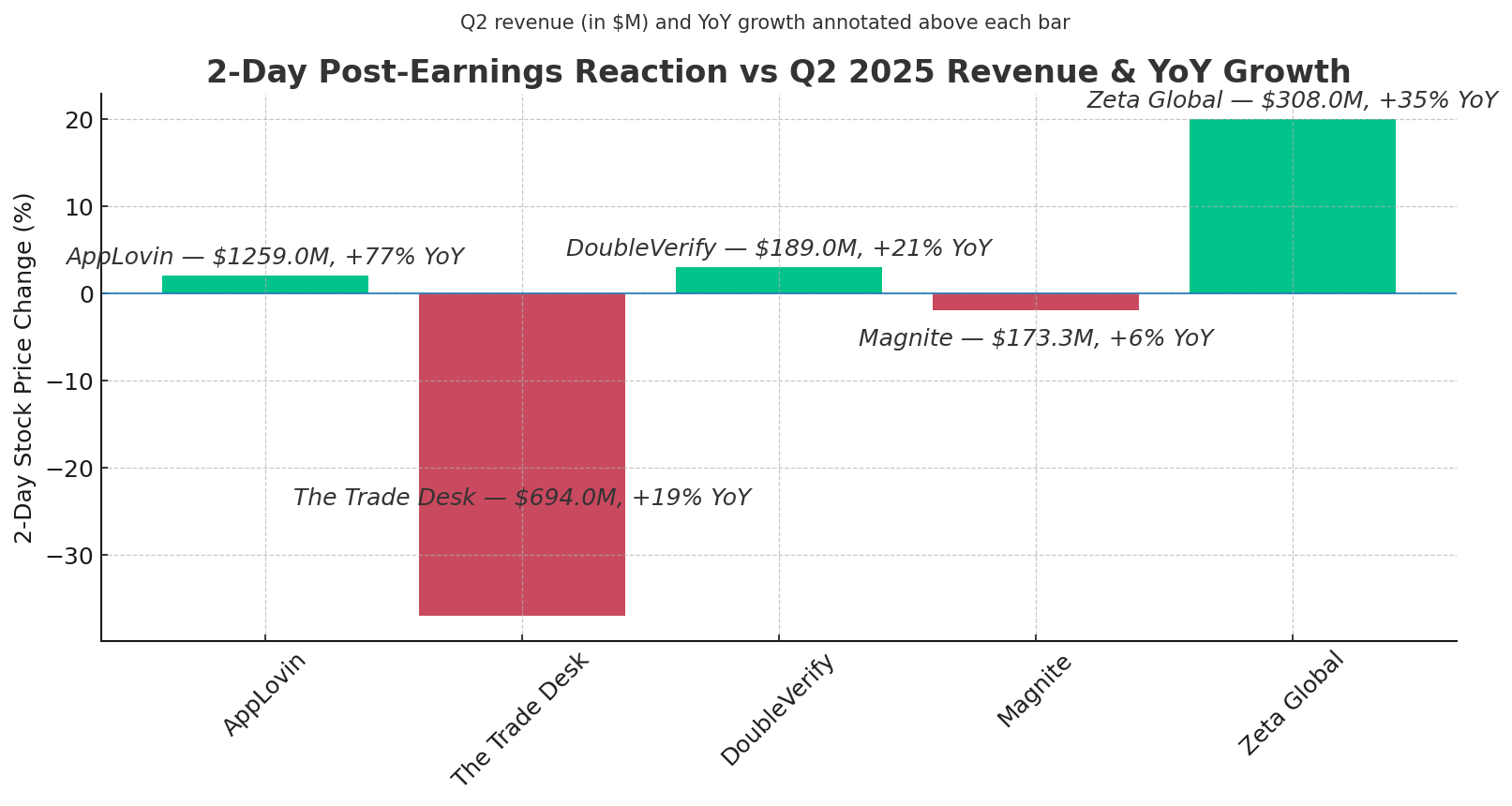

However, the top-line narrative was The Trade Desk’s stock price taking a notable plunge – the second such plunge for the demand-side platform this year — following its Q2 earnings, with even the more somber reactions of industry analysts unable to calm the markets.

Its stock remained almost 40% below the market-opening levels for days after its August 7 disclosure (see slide two, above), with investors seemingly spooked by Amazon’s designs on the DSP market sector, even if media buyers maintain that perceptions about its ascension may be over-inflated.

Of course, The Trade Desk is setting its stall out on CTV, with publicly listed Magnite offering a similar pitch to Wall Street investors. However, as the charts demonstrate, its August 6 earnings disclosure was deemed “muted” by analysts, with several expressing concern at the limiting factors in CTV demand growth. See slide three, above.

Elsewhere, Wall Street investors seemed satisfied with the narrative of ad tech’s leading ad-verification pairing, i.e., DoubleVerify and Integral Ad Science. See the table above.

Here, analysts primarily focused on their ability to maintain relevance in the face of the internet’s shifting sands, specifically away from the open web and toward more closed environments, such as CTV & LLMs.

However, even here, seemingly the most stable of market sectors, this duarchy can’t rest on its laurels, as some of the most storied names in ad tech now eye ad verification.

More in Media Buying

Omnicom Media North America CEO Ralph Pardo on integration and disintermediation

Ralph Pardo, CEO of Omnicom Media North America, explained how far along the holding company is in absorbing IPG’s agency brands, as well as why they were kept alive.

Ad Tech Briefing: Criteo named first ad tech partner to OpenAI’s ChatGPT ad pilot

This Ad Tech Briefing covers the latest in ad tech and platforms for Digiday+ members and is distributed over email every Tuesday at 10 a.m. ET. More from the series → Earlier this week, Criteo confirmed it is the first ad tech partner to integrate with OpenAI’s advertising pilot in the U.S., available in ChatGPT’s […]

The agency holdcos have an AI story, but not an AI business model

The holdco platforms need to deliver on the promises made — and so far, clients aren’t seeing it.