Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Publicis buys Mars United Commerce to solidify its prowess in connected commerce

As if it’s not already the dominant agency holding company, Publicis just announced an acquisition that strengthens its commerce abilities, by purchasing Mars United Commerce for an undisclosed sum.

Formerly the Mars Agency, Mars United Commerce (MUC) is an independent commerce marketing company that helps guide marketers on how to best reach consumers in online and offline shopper ecosystems. With more than 1,000 employees in 14 “hubs” across the world, there are various estimates of the firm’s annual revenue — somewhere between $75 million and $185 million.

Publicis already has made several investments to strengthen its core abilities in commerce, retail media and commerce media in general, with the acquisitions of Profitero in 2022, CitrusAd in 2021 and, of course, Epsilon in 2019. To say it’s long been a focus for the French-owned holdco feels almost like an understatement.

Neither Mars United Commerce nor Publicis would comment on the acquisition, but Digiday has learned MCU will be offered alongside Publicis’ end-to-end suite of commerce capabilities and made available to all clients and agency teams globally.

In a press release, Publicis pointed to three primary areas in which MUC’s abilities will be joined with Publicis’:

- Strategy and insights, where Epsilon’s first-party data matched with MUC’s shopper data “will give clients 360-degree insight into purchase journeys and new opportunities to motivate shopper behavior change;

- Media and activation, where MUC’s data can inform Publicis Media’s choices for its clients on retail media, marketing and merchandising investments;

- Performance and measurement, where Profitero’s analytics platform insights on e-commerce can help “give clients a complete view of their commerce marketing performance — online and offline —and an unmatched ability to drive brand growth.

Throw into the mix Publicis’ recent acquisition of Influential, an influencer and creator agency, and that growing part of the marketing equation can also be factored in, said Publicis CEO Arthur Sadoun in the announcement of MCU’s acquisition.

“Publicis is uniquely positioned to help our clients understand both existing consumers and future prospects, and connect that knowledge at an individual level to the new media channels that work hardest for their business: connected TV, commerce and creators,” Sadoun is quoted as saying in the release. “All of this, in clients’ own ecosystems, giving them control over their customer relationships and transparency in their investments and outcomes.”

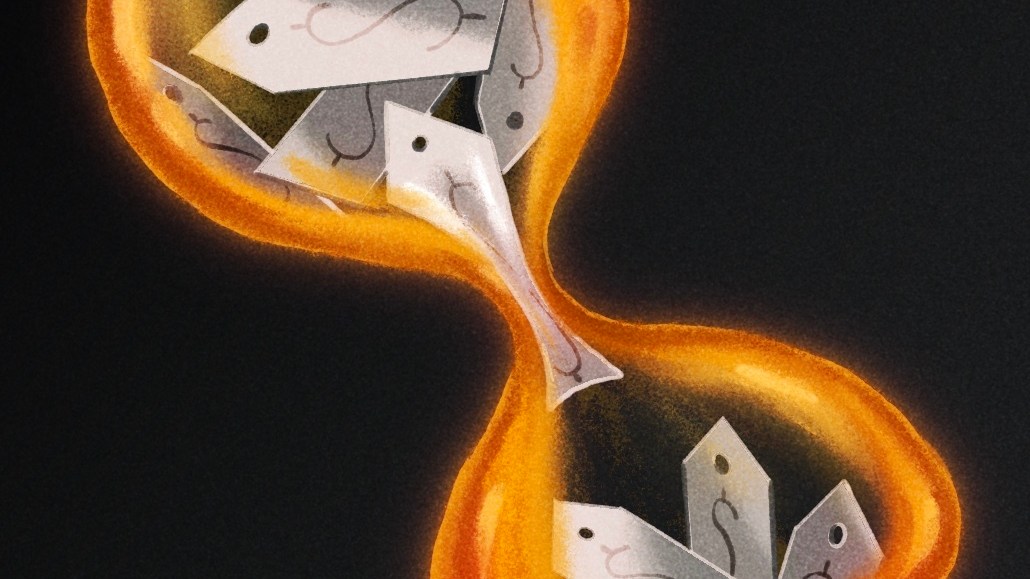

Control is no small issue here. As retail media networks grow in number and power — some say too much, since there are more than 200 in operation at this point — some brands and clients feel they’re being strong-armed into spending on RMNs if their products want to see better shelf space in-store, or better positioning online.

Observers see Publicis’ assemblage of tools that essentially track consumers before they shop, during the shopping experience, where media is effectively exposed to them and their post-purchase habits, may help level that imbalance of power.

“The balance between interest and transparency is a delicate one, and the over-abundance of technology could tip that balance inadvertently in one direction or the other,” said Jay Pattisall, vp and senior analyst at Forrester.

Pattisall also sees the move as a counterpunch to Omnicom’s acquisition last year of Flywheel, which gave that holding company more skin in the game in controlling more aspects of e-commerce on behalf of its clients.

“We’re likely talking about a similar amount of scale in retail and commerce media than that of Flywheel, and when combined with the existing activity inside Publicis, there lies the real power of matching media impressions to retail transactional data and creating a more of a closed loop form of attribution in in its retail media and commerce engagements for its clients,” said Pattisall. “By better connecting media impressions to customer transactions and understanding where to find either existing customers or prospective customers in paid media contact points and pull them through a more holistic or total commerce experience … they can match up the pre-purchase moments with the post purchase moments.”

More in Media Buying

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Canadian indie Salt XC expands its U.S. presence with purchase of Craft & Commerce

Less than a year after buying Nectar First, an AI-driven specialist, Salt XC has expanded its full-service media offerings with the purchase of Craft and Commerce.

Ad Tech Briefing: Publishers are turning to AI-powered mathmen, but can it trump political machinations?

New ad verification and measurement techniques will have to turnover the ‘i just don’t want to get fired’ mindset.