Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

DMEXCO Briefing: The who’s who of ad tech gathers to prepare for the industry’s next big shift

Digiday covers the annual trade show in Cologne. More from the series →

To receive our daily DMEXCO briefing over email, please subscribe here.

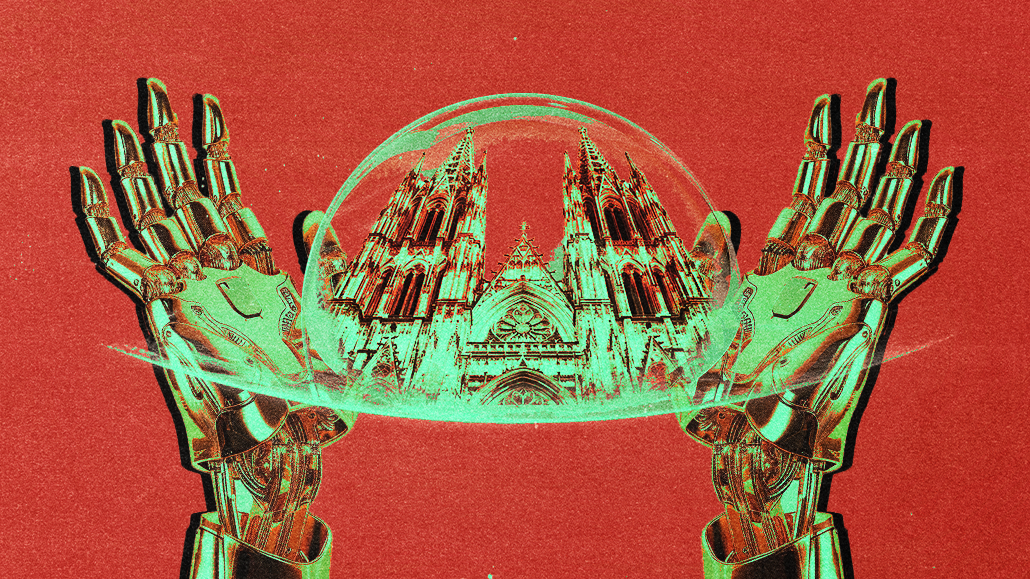

Cologne’s about to transform into a chaotic cocktail of code and Kölsch, where ad tech devotees descend for their annual pilgrimage. Brace for AI buzzwords, bratwurst bonding, and booth fatigue. With phones charged and livers steeled, attendees prepare to navigate this pixelated pandemonium. It can only mean one thing: DMEXCO is upon us.

The who’s who of ad tech are flocking to the conference — a place where hope springs eternal, no matter the industry’s woes. Last year, it was survival without third-party cookies in Chrome; the year before, advertising’s environmental footprint; before that, clawing back from the pandemic.

Whatever catastrophe is on the docket, DMEXCO remains the refuge. And guess what? This year’s no exception.

Even with swirling uncertainties about Google’s ad empire and the future of third-party cookies, the ad tech world marches on with its signature optimism.

In Cologne, this optimism isn’t just a sentiment; it’s the essential catalyst driving conversations and sealing deals in an ever-evolving industry. Actually, scratch that — this is DMEXCO, where nothing’s ever that simple. Expect to navigate a labyrinth of badge-scanning bingo, where every handshake leads to a LinkedIn request and every chat feels like a sales pitch masquerading as casual conversation.

“The feeling from DMEXCO in ’23 was very much a localized event, with great German presence across the industry focussed on making new connections, driving business and making change,” said Peter Wallace, gm of EMEA at contextual intelligence firm GumGum. “This is somewhat different to other events that can be more tempered towards relationship driving. In ’24, I expect there to be a broader EMEA presence with more attendees from the Netherlands and U.K. looking to be present.”

What makes this event essential for execs like Wallace is its unique blend of local charm and global clout. Admittedly, it’s taken on a more localized vibe in recent years, but it still attracts heavyweights like Google, Amazon, and Shopify, along with PubMatic, FreeWheel, and Index Exchange.

If anything, this year’s mix seems even more acute.

“DMEXCO went from German focused to International at the height of its popularity, then back to predominantly German/European,” said Julia Linehan, founder and CEO of ad tech PR agency The Digital Voice. “This year, the balance is looking to shift once again and expect to see a broader mix of businesses heading to Cologne. A month ago, I would have said that there was a muted response by the U.K. and U.S. on attending DMEXCO. However, in the last four weeks, we’ve seen a last minute dash from companies to change plans and make their way to Koelnmesse.”

One reason for the increased international presence is that despite its growing local flavor, DMEXCO remains one of the few places where both the old guard and the upstarts in ad tech can come together to hammer out the future.

With so many big issues on the table — Google’s antitrust headaches, third-party cookies on the verge of extinction — there’s a sense that the decisions made in these two days will reverberate across the industry. As Ville Mikkola, regional manager for AppsFlyer’s business in Germany, Austria and Switzerland, said: “DMEXCO stands out as a crucial indicator of whether the ad tech industry is truly thinking ahead.”

So, while it may have its roots in Europe, the aftershocks of what happens there will ripple through every nook and cranny of the ad tech world.

“There is mounting evidence of the global adoption of data clean rooms, with organizations and policymakers now emerging as some of the key drivers of this shift,” said Lauren Wetzel, CEO, InfoSum. “The renewed sense of purpose after so many years of indecision lays the groundwork for one of the most innovative DMEXCOs yet.”

That’s why companies like his drop a small fortune to be at the Koelnmesse Expo hall. It’s definitely not for the vibes like Cannes — let’s be real. It’s the intent. While Cannes Lions is a sun-soaked week of creativity and celebrity sightings, DMEXCO is a brisk two-day sprint through the so-called “gut of ad tech”.

Think power suits over swimsuits, and tech talk at a booth stand over cocktail chatter on a yacht.

In short, DMEXCO is far more serious than your average ad industry conference, and that’s the point: Attendees are on a mission, navigating the labyrinthine halls with the precision of GPS-guided missiles, their DMEXCO apps as crucial as a map in a maze. Days are divided into 30-minute chunks of small talk and grand pitches, with frequent detours to hunt down the nearest power outlet amidst a chorus of “AI-powered” pitches louder than a bratwurst vendor at Oktoberfest.

As many veterans say, “If Cannes is where deals are scoped out, Cologne is where they’re sealed.”

Sure, it’s a hefty investment. Securing a booth alone can range from €10,000 to €50,000, and with flights averaging €500 to €2,000 and accommodation adding another €100 to €300 per night, the costs pile up quickly. But here’s the thing — these expenses are seen not just as costs, but as investments. The real hope is that the business transacted within those Koelnmesse walls will more than make up for it, turning those significant upfront costs into long — term gains and solidifying the returns on this high-stakes venture. And this year, that’s more true than ever.

“It’s not spring, but change is certainly in the air,” said Wilfried Schobeiri, CTO at ad tech firm Ogury. “What felt like a never ending uncertainty around cookie deprecation is now behind us. Marketers and publishers can better prepare for an ID-less future without Google dictating their terms to the industry; instead consumers are the ones taking the reins as the inevitable, cookie killers.”

DMEXCO 2024: Day 1 agenda highlights

—The hosts of DMEXCO will welcome attendees and present an exclusive study that shows just how attractive the digital economy is as a workplace. The answer to the question “Is the digital economy ready for the future?” will be revealed at the show opening session.

Wednesday, Sept. 18 9:45 AM to 10:00 AM · 15 min. (Center Stage)

Gerald Böse, Chief Executive Officer Koelnmesse

Dirk Freytag, Präsident, Bundesverband Digitale Wirtschaft (BVDW) e.V.

Verena Gründel, Director Brand & Communications DMEXCO Koelnmesse GmbH

—From Curiosity to Customer Connections: The Future of AI-powered Search and Ads

Wednesday, Sept. 18, 2024 10:00 AM to 10:20 AM · 20 min. (Center Stage)

Brendon Kraham, vp, Search & Commerce Global Ads Solutions, Google

—Retail media and beyond: Preparing product data for the next generation of performance marketing

Wednesday, September 18, 2024 10:00 AM to 10:20 AM · 20 min. (Center Stage)

Alwin Schauer, chief revenue officer, Productsup

—Sustainability in the Client-Agency Relationship

Wednesday, September 18, 2024 2:15 PM to 2:45 PM · 30 min. (Agencies Stage)

Iris Althaus, managing director, EssenceMediacom Germany

Claire Gleesen-Landry, head of Commercial Partnerships, Good Measures, Good Loop

Brenda Tuohig, chief commercial officer, Scope3

Seb Joseph (moderator), executive editor of news, Digiday

—Envisioning AI-Powered Customer Experiences to Fuel Your Impact

Wednesday, September 18, 2024 11:40 AM to 12:00 PM · 20 min. (Center Stage)

Ragy Thomas, founder and co-CEO, Sprinklr

Jim Cooper, Editor-in-Chief, Digiday

Here is the complete agenda for DMexco 2024

More in Media Buying

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Canadian indie Salt XC expands its U.S. presence with purchase of Craft & Commerce

Less than a year after buying Nectar First, an AI-driven specialist, Salt XC has expanded its full-service media offerings with the purchase of Craft and Commerce.

Ad Tech Briefing: Publishers are turning to AI-powered mathmen, but can it trump political machinations?

New ad verification and measurement techniques will have to turnover the ‘i just don’t want to get fired’ mindset.