Did you get the creeps just hearing the melody of “Jingle Bells” during a commercial this week? It’s that time of year again. The week after Halloween is when most companies begin their holiday ad blitz. Already, Lowe’s and Target ads have been spotted, while Starbucks has its red cups and nutmeg-crème-brûlée-chestnut-praline concoctions brewing. Here’s what you can expect when it comes to consumer spending this holiday season.

Nielsen’s 2014 holiday sales forecast found that the trends are mostly consistent with 2013 — about a quarter of consumers have already begun holiday shopping. Early shopping is mostly driven by women. About 70 percent of men “planned to wait,” compared to the 27 percent of women who have already started.

Consumer confidence is trending upward, a sign that the hangover from the 2008 recession is slowly wearing off. But Nielsen’s consumer confidence index found that it’s still pretty volatile. The X axis reflects the consumer confidence, defined as how optimistic consumers are feeling based on how they buy and spend.

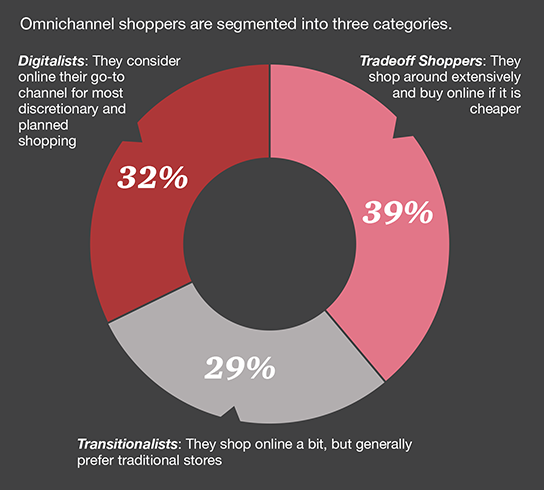

When it comes to where they shop, PwC’s 2014 holiday outlook found that 2014 may be the year where omnichannel “comes of age” and consumers make online pre-planning a part of the holiday-shopping process. With 41 percent of shoppers planning to increase online spending this year, the consultancy has come up with a new way to segment omnichannel shopper profiles.

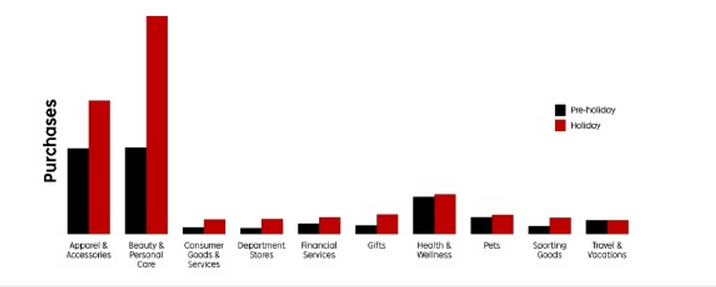

A study by Rakuten Marketing found that more consumers are looking for value online — and not waiting for specific sale days like Black Friday to go shopping. Purchases made online soar during the holiday season, with an average increase of 80 percent across verticals. The most growth in online shopping has been seen among beauty brands and at department store sites.

When it comes to online shopping, mobile and tablet accounted for what Rakuten calls a “substantial” share of purchases made before Christmas. However, there is a growing divide between tablet and smartphone shopping. Tablets have a conversion rate of 6.4 percent, while smartphones’s rate is only 1.5 percent.

More in Marketing

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.

Digiday ranks the best and worst Super Bowl 2026 ads

Now that the dust has settled, it’s time to reflect on the best and worst commercials from Super Bowl 2026.

In the age of AI content, The Super Bowl felt old-fashioned

The Super Bowl is one of the last places where brands are reminded that cultural likeness is easy but shared experience is earned.