Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

TikTok wants to prove it is an effective ad platform — quickly.

TikTok’s ad platform, available in beta to a select number of agencies, is testing interest-based targeting, custom audience and pixel tracking, according to four advertising executives. Those options are in addition to targeting by age, gender, location, operating system and network on the device. Sales leaders at the short-form video app have been telling agencies they plan to release this beta version of its self-serve ad platform more widely in July, sources said. (Adweek first reported plans for a biddable option and more targeting in February.)

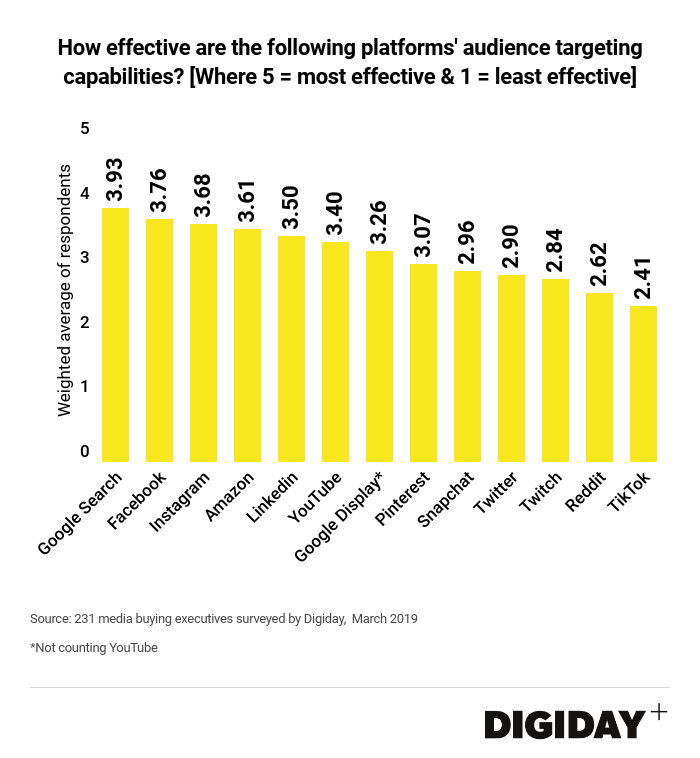

With these updates to its ad system, TikTok is looking to attract marketers who are interested in the app but wary of its performance. In a March Digiday+ survey of 231 media buying executives, respondents ranked TikTok as the platform with the least effective audience targeting capabilities.

A TikTok spokesperson said the company is testing various features for brand partners while the main focus is on creating a good experience for larger TikTok community.

An agency executive, who had a pitch meeting with TikTok last month but has yet to buy ads on the platform, said interest-based targeting would make them more confident of ad buys on TikTok since they could simply be more precise. The move better positions TikTok as an effective buy rather than simply a “shiny object” that marketers are intrigued by due to its young audience with high engagement, the executive said.

Though, another agency executive who has chatted with TikTok said they had low expectations for the functionality — at least in its infancy. TikTok’s current capabilities won’t be as good as Facebook’s due to the newness of TikTok, the executive said.

“Interest-based targeting can be very effective, depending on how built out the platform’s targeting abilities are. Newer platforms sometimes offer interest-based targeting but have a tough time actually fulfilling on it because their data is still new,” the executive said.

TikTok representatives did not elaborate on what specific categories are offered in their meetings with new partners, sources said. One buyer said they expected the options to be similar to Snapchat’s lifestyle categories. Snapchat’s lifestyle categories, which were released in September 2016 alongside lookalike audiences and audience match, include 117 segments such as “American Football Fans,” “Movie Theater Goers” and “Online Shoppers.” These categories are based on a Snapchat user’s activity within the app, namely what types of content they spend the most time on.

TikTok’s content algorithm is currently powered by a similar recommendation system, per sources. The app is able to recognize what content is in a video, like a dog or a coffee cup, which is useful not only for recommendations in the feed but also could power the advertising system. Unlike on Snapchat, users on TikTok can like and comment on videos, which also provides signals for content recommendations similar to Facebook, Twitter and YouTube.

Even with the limited targeting options, some brands are currently buying ads on TikTok. A spokesperson from GrubHub, which was one of the early advertisers on TikTok, told Digiday last month that ad performance has continued to “meet or exceed our expectations.” Other marketers like Red Bull and Sony are testing the app with their own accounts. Publishers like ESPN and NBC News also have created their own accounts.

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.