Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Robinhood is bringing investing under the social finance umbrella.

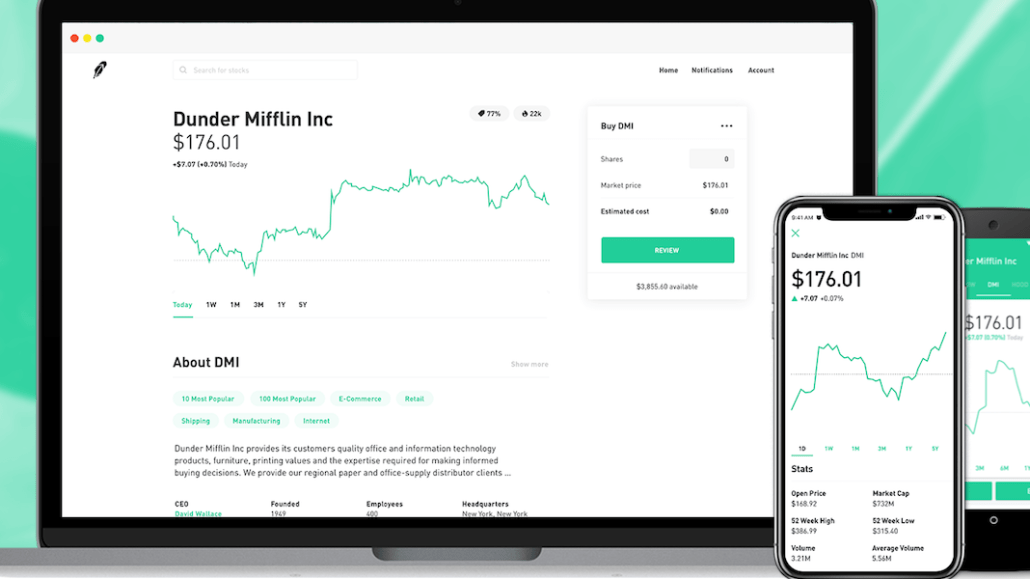

The company behind the popular trading app launched a web platform Wednesday to help to deliver the second part of its mission to make stock trading accessible to everyday people: help them make more informed decisions. It’s adding tools, features and information on other users’ activity that makes the experience feel more like a social network.

Robinhood, which launched in 2013, says it has crossed 3 million users as of Wednesday and more than $100 billion in transaction volume with about 100 employees, according to co-CEO Baiju Bhatt. By comparison, the 42-year-old TD Ameritrade has 11 million funded accounts and more than 10,000 employees as of this September; E-Trade, 35 years old, reported 3.5 million accounts by the end of last year with some 3,600 employees. Robinhood users have saved more than $1 billion in commission fees (typically $7 per transaction) using the fee-free app, Bhatt said.

More in Marketing

TikTok after the legal fight and why it’s coming for Meta’s ad dollars

With legal issues behind it, TikTok is stepping up marketing and making a stronger play for Meta’s ad budgets.

Ad Tech Briefing: Embattled, embittered and determined

Company executives come out swinging as the markets issue their judgements on Wall Street pitches.

Target CEO says ‘busy families’ will be company’s focus as it seeks growth

The company is making tweaks to departments like food and baby, as well as services like same-day delivery.