Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

With Amazon and eBay looming overhead as two industry juggernauts safe from startup “disruption,” investors are often wary of putting their dollars into a new retail company. Still, some are drawing attention: mobile commerce, beauty tech and direct-to-consumer companies are three types of retail startups showing a positive forecast for investment funding.

For instance, Spring, a mobile shopping app, announced a $25 million funding round last week, on the promise of its seamless checkout. GlamSquad, an on-demand service that sends hair and makeup professionals to wherever you need them, has raised $9 million since its launch. And Glossier, a direct-to-consumer beauty line, closed an $8.4 million round in November.

“Investors want to see their money grow as fast as possible,” said Ashley Paintsil, editorial director at FashInvest, a platform focused on emerging growth companies in retail and fashion. “Traditional fashion brands aren’t engineered to scale quickly – fashion tech is much more interesting to investors.”

Here are the areas drawing the most investor interest.

Mobile commerce

For retail, mobile is the up-and-coming platform: Millennials are shopping more frequently on their phones, and retail companies that can figure out how to make that process as streamlined as possible are at the top of mind for investors.

Spring, which houses over 750 brands like Levi’s, Calvin Klein and Opening Ceremony, appeals to investors because it offers a service other apps don’t: seamless checkout. While shopping in the Spring app (which stores your credit card information), you can order an item on the same screen by swiping your finger to pay. The technology helped Spring close a $25 million round backed by investors like BoxGroup, Yuri Milner and Google Ventures.

The appeal of the app lies in its user experience, according to Cheryl Chang, a partner at BlueRun Ventures.

“The technology edge [for retail startups] helps, but the user experience is more important,” said Cheng. “So when you look at Spring, they’re training the consumer to purchase in a different way, while also inspiring them.”

According to co-founder Alan Tisch (who launched the company with his brother David Tisch, a serial NYC entrepreneur), it takes a certain type of investor – one with a vision for the long term – to fund a retail company.

“Some investors are looking for that quick growth curve, but in retail, you’re looking at year-over-year growth over, say, 20 years,” he said. “You have to have the appetite for a long-term vision to invest in a retail company.”

Beauty tech

According to Paintsil, a retail company hoping to raise venture capital must be technology-minded, and now that fashion tech has surged on e-commerce and mobile, investors are looking to beauty companies, too. Companies that get funding, like Birchbox and GlamSquad, aren’t entering the traditional beauty market; they’re tapping into tech to improve it.

“Technology speeds things up for consumers and makes products more interesting and, most importantly, makes people’s lives easier,” said Paintsil.

Birchbox, a beauty subscription service and e-commerce site that lets customers sample beauty products before they buy them, raised $60 million in Series B funding in 2014, bringing the company’s pre-funding valuation to $485 million.

GlamSquad, an on-demand service for professional hair and makeup styling, raised $7 million in its Series A round last year. As a mobile booking company, the model takes innovation in beauty tech onto the mobile platform; according to Paintsil, mobile booking is one of the fastest growing areas in beauty commerce.

Alexandra Wilkis Wilson, GlamSquad’s CEO, said that the company’s ability to scale piqued investors’ interest: The service is currently available in three U.S. cities but plans to expand here and overseas, as well as offer beauty services beyond hair and makeup.

“Mobile commerce is here to stay,” said Cheng. “Consumers are looking for the complete online-to-offline experience, and companies can’t make light of that.”

Direct-to-consumer

According to Cheng, the direct-to-consumer model is compelling for investors, as long as brands don’t try to pass themselves off as “the ‘Warby Parker for fill-in-the-blank.'”

“The Warby Parker model is misleading,” said Cheng. “But the direct-to-consumer model is interesting. To be able to own the channel is very important. When you look at some companies that are able to fit into the economics of the industry, they’re the people who are really driving the industry, and that’s very powerful.”

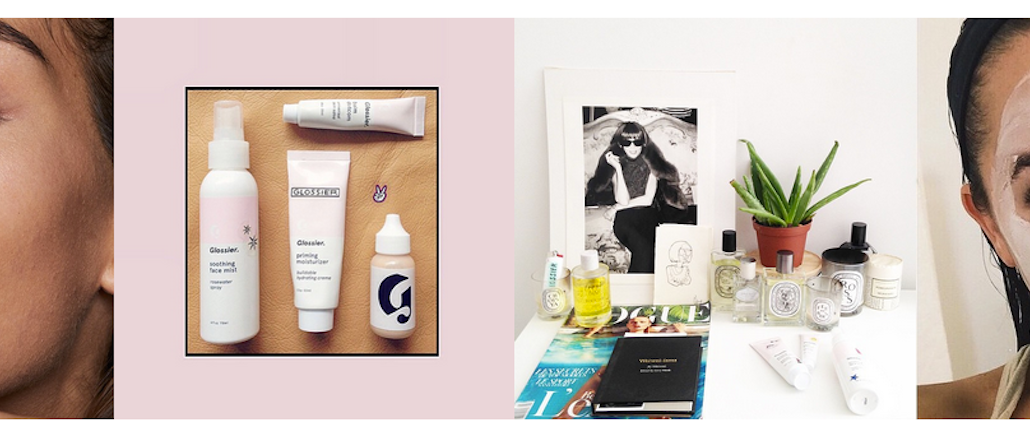

Glossier, a direct-to-consumer beauty line, is growing quickly thanks to their passionate customers. The product line was launched by Emily Weiss, the founder of beauty blog Into the Gloss, which has a dedicated and active readership. A trusted brand, according to Cheng, Glossier boasts of a cult following that companies can use to scale. In November, Glossier closed an $8.4 million funding deal.

Paintsil cites direct-to-consumer companies’ ability to target a niche audience, online, as a reason for their success.

“You’re able to get to your consumer right away,” she said. “You’re giving the niche customer base what they want, and the companies that do really well have that unique customer.”

Images via Glossier

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.