Digiday research: When it comes to consumer data, email reigns supreme

Digiday’s sister site, Glossy, held its inaugural Hot Topic event in April, convening brands in the fashion, luxury and beauty industries to discuss data strategy and break down how they’re using data to enhance performance. Speakers shed light on methods they’re experimenting with, as well as the challenges they’ve encountered processing an expansive set of data across numerous platforms and touch points. We surveyed these brand executives to get a pulse on what’s going on in the industry.

Here’s a look at what they said.

Both consumers and brands receive the most value from email feedback

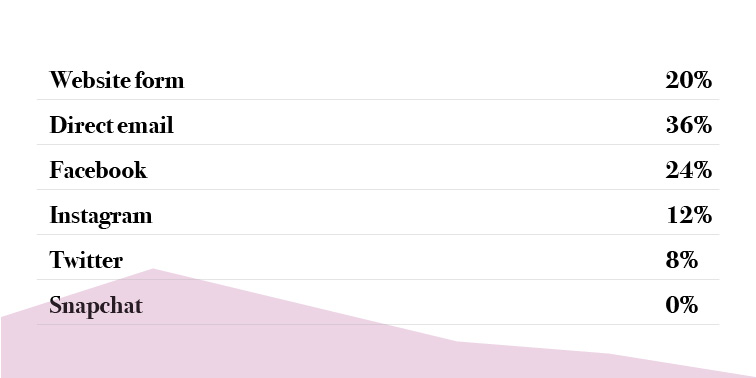

For retailers, customer feedback is vital to improving products and streamlining services. Brands are collecting this information across several platforms, including social media, but by and large, email still reigns supreme. Not only do many retailers receive the majority of feedback via email, but they also find email responses to be the most valuable. While Twitter may allow shoppers to share gripes over flawed products in 140 characters, email allows for more in-depth engagement.

Speaking at the event, Cheryl Kaplan, president at M.Gemi, said prioritizing consumer feedback helps foster relationships that lead to brand loyalty and retention: “Customers ask for specific styles now. They’ve built relationships with our customer service team. They recognize gaps in the inventory and have noticed how quickly we respond to feedback.”

On which platform do you receive most of your customer feedback?

Which platform usually provides the most valuable customer feedback?

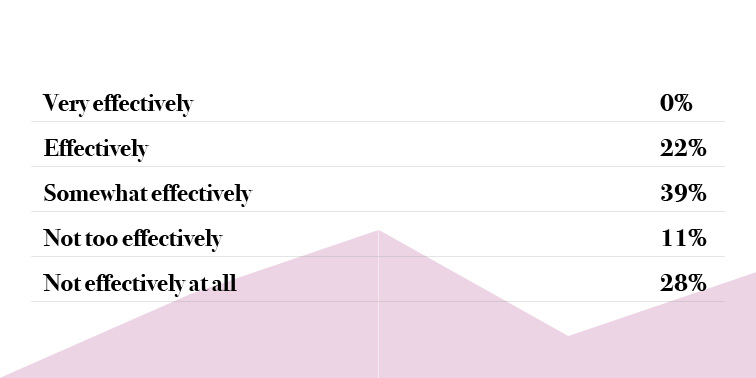

Navigating in-store and online data remains a challenge

Alysia Borsa, svp and chief data officer at Meredith Corporation, put it simply: “Data integration is not easy; it’s complicated.”

Consumers behave differently when shopping in-store versus online, and it can be difficult to extrapolate patterns between the two and use the findings in meaningful ways. In order to tackle this, brands are enlisting the help of data scientists that help companies make smarter decisions about inventory and discounting practices.

“We have a lot of access to data for retail partners. What designers are selling what, subcategories, when the buy wasn’t quite right,” said Lauren Price, senior director of partnerships at Lyst. “It has provided broader insights for markdowns and markdown timing. When customers are looking for sales, that’s important to know.”

How effectively have you connected in-store with digital consumer data?

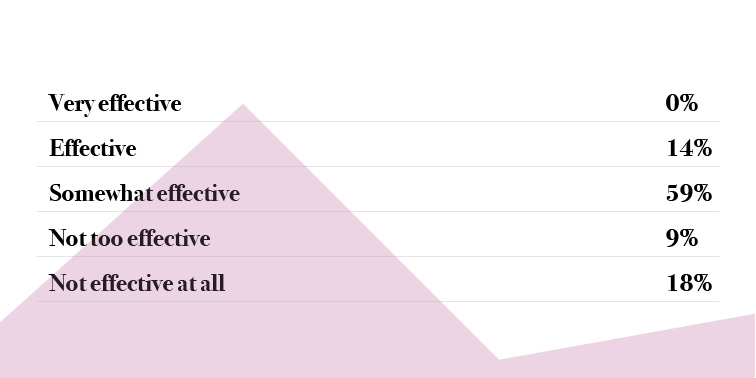

Brands still aren’t sold on chatbots

Chatbots have been a buzzword in the retail industry over the past year, but whether or not they translate to sales remains unclear. For many brands, chatbots remain a relatively inexpensive experimental venture; however, Jaclyn Ling, director of retail and commerce at Kik, said she anticipates bots will continue to grow in popularity, mirroring the success of social platforms like Snapchat. Still, many companies remain wishy-washy on their stance on the efficacy of chatbots.

How effective are chatbots as a tool to engage with consumers?

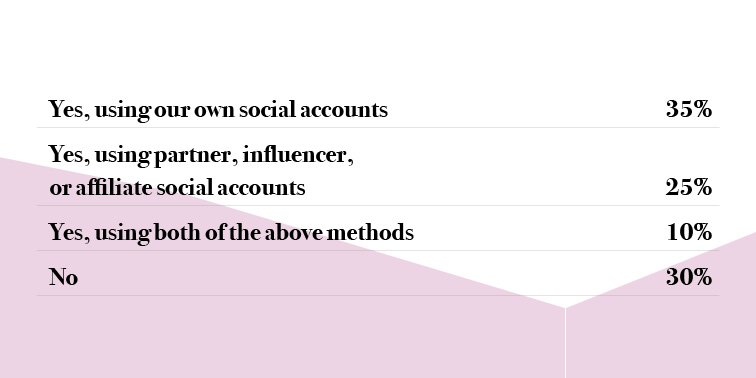

Use of social commerce is varied

New shoppable offerings on platforms like Instagram have made it increasingly easy for brands to link directly to e-commerce sites. As a result, brands are placing more effort on selling directly through their social accounts. Others, however, prefer using partner platforms, affiliate programs and influencer networks. A smaller percentage leverage both.

Are you using social commerce, and if so, on what platforms?

More in Marketing

Zero-click search is changing how small brands show up online — and spend

To appease the AI powers that be, brands are prioritizing things like blogs, brand content and landing pages.

More creators, less money: Creator economy expansion leaves mid-tier creators behind

As brands get pickier and budgets tighten, mid-tier creators are finding fewer deals in the booming influencer economy.

‘Still not a top tier ad platform’: Advertisers on Linda Yaccarino’s departure as CEO of X

Linda Yaccarino — the CEO who was never really in charge.