Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Poshmark’s founder Manish Chandra made a prescient bet in 2011: mobile would become the center of shopping. Around the same time, fashion marketplaces like Tellusfashion (now LookBible) and Google’s Boutiques.com (Google.com/shopping) were gaining traction, Chandra the following year launched a mobile-only marketplace app to buy and sell second-hand goods.

The marketplace has become a destination for sellers to pawn used clothing from their closets, and for shoppers to get discounts on name-brand items. Poshmark reports “millions” of users — the company doesn’t specify exactly how many — and according to company data, the average user spends 20 minutes on the app per session and opens it seven to eight times a day. There are currently more than 10 million items for sale in the marketplace, and Poshmark’s biggest sellers have made over $500,000 in a year. The app is currently ranked 8th in the App store’s lifestyle category, with a 4.5 star rating.

“Mobile devices are second nature to our shoppers, which leads to faster transactions and continuous engagement,” said Chandra.

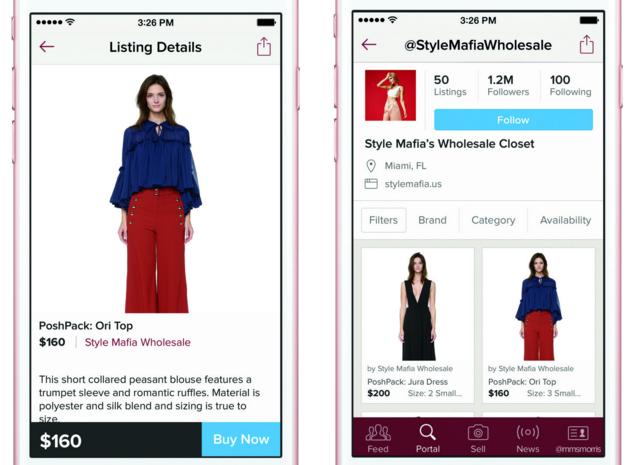

Now, Poshmark is expanding its mobile store by partnering with wholesale retailers to sell new products in the marketplace, alongside the existing network of individual sellers. Retailers like the Miami-based boutique Shop Mafia and accessories brand Snob Essentials have begun selling on the platform.

“We’ve seen how our approach to peer-to-peer commerce drives sales for some time,” said Chandra. “This expansion will give brands access to consumers while we support our community’s growth.”

In the Poshmark app, real-time interactions between buyers and sellers help foster confident purchases. A Tory Burch satchel for sale by a user with the account name “Nhi’s Closet” has 34 comments from potential buyers, who are trading pink heart emojis back and forth, inquiring about more photos or different colors, and talking about similar items in their closets. These conversations continue once a purchase is being made.

“There’s an immediate back-and-forth dialog that’s missing in e-commerce,” he said. “The seller is there, they talk to you — we’ve effectively created an experience where every seller acts like a personal stylist.”

That connection made through mobile messaging is something that Chandra believes is lacking on the Web, as well as something Style Mafia founder Simonette Pereira said she found attractive. With only one showroom in Miami, Style Mafia can now reach a mobile, global consumer base without expanding physically or investing in the digital logistics of a mobile store.

Poshmark, which raised a $25 million funding round in April, has reported that its gross revenue is $200 million for the year. Competitor ThredUp, which operates a similar online marketplace for reselling men’s, women’s and children’s clothing, reports that 45 percent of its revenue comes from mobile.

Recent expansions have also positioned the company in front of more high-end shoppers. Top brands on Poshmark include Zara, J.Crew, Nike and Lululemon, but other designer goods from names like Coach, Louis Vuitton and Kate Spade also have showrooms (grouped collections) on the platform. Earlier this year, Poshmark launched both an Apple Watch app and Poshmark Concierge, a service that will verify that items selling for more than $500 on the site are legitimate. Some Snob Essentials items go for more than $1,000.

“A lot of retail stores are showing flat or negative growth,” said Chandra. “Mobile is taking place of many things we used to do, including commerce, and shoppers should realize they can shop full-blown fashion with us.”

Images via Poshmark

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.