Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Pitch deck: How Amazon is emerging as the proof layer for TV spend

This article is part of an ongoing series for Digiday+ members to gain access to how platforms and brands are pitching advertisers. More from the series →

Amazon is becoming the easiest place to make TV spend defensible inside organizations and is emerging as the proof layer for television — not necessarily the default buying layer.

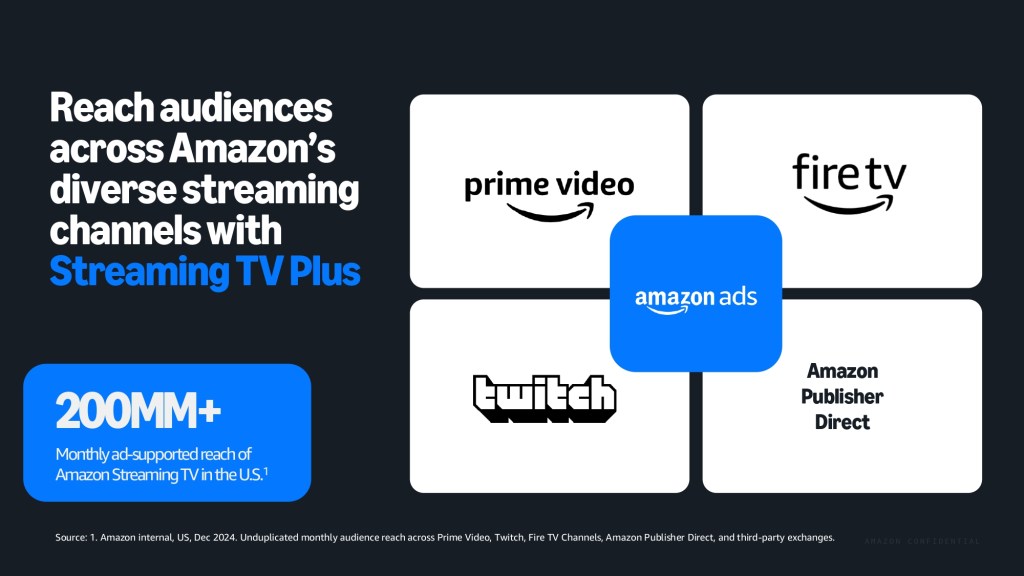

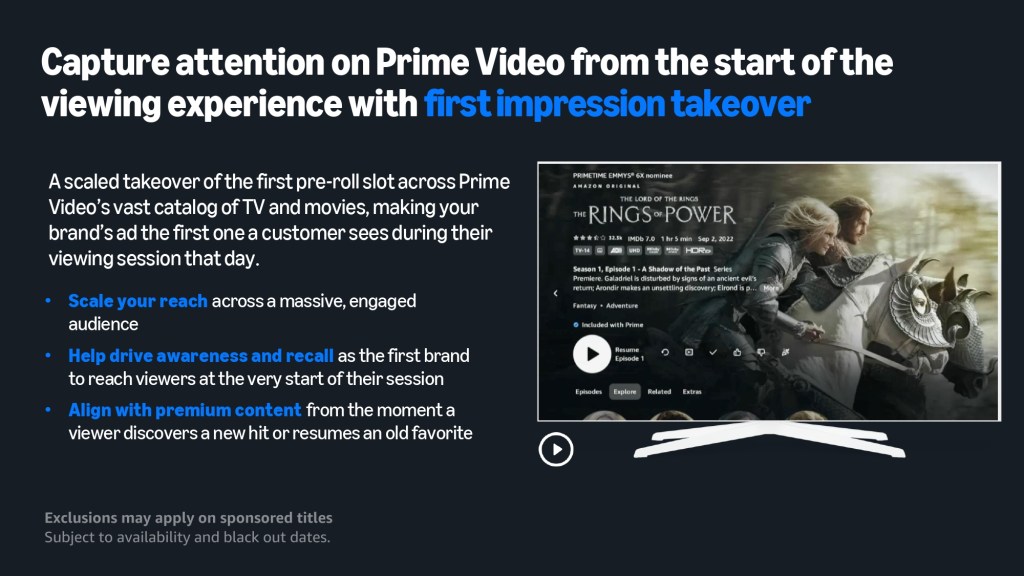

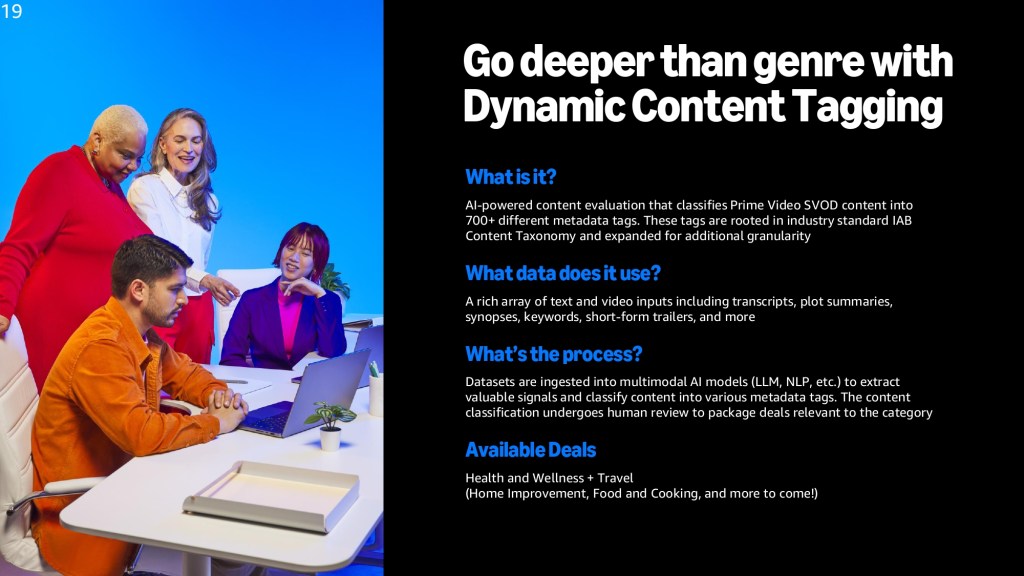

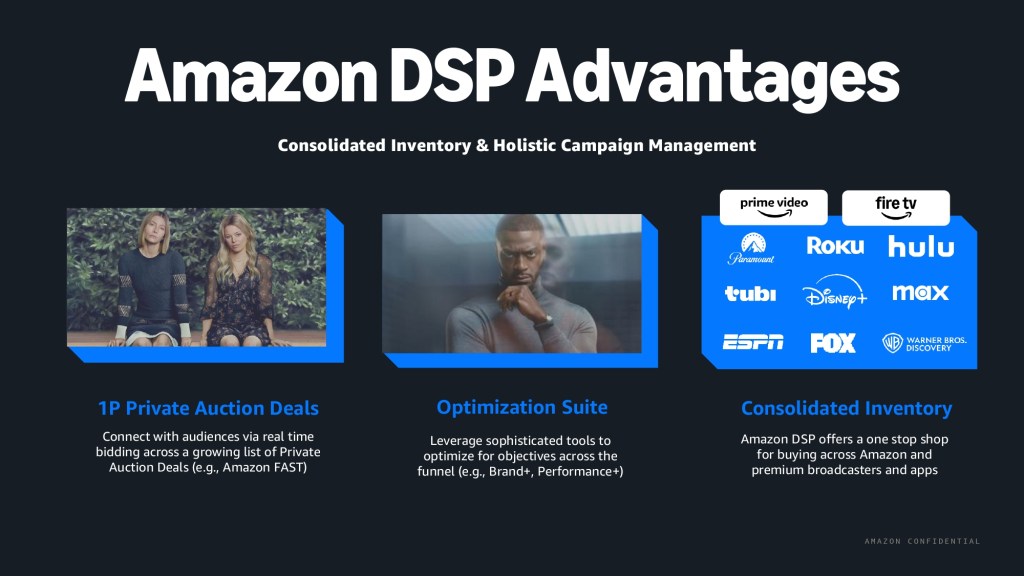

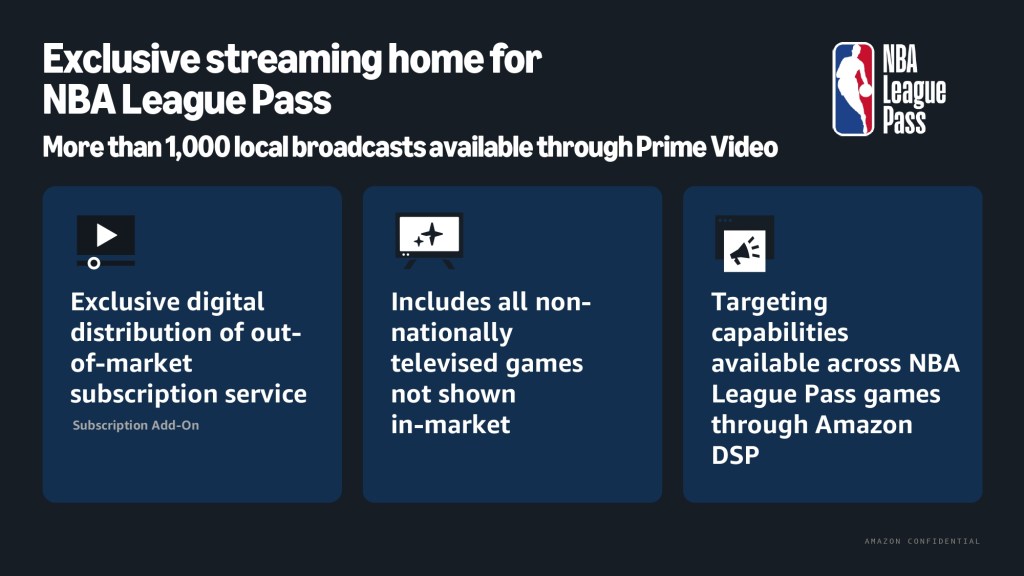

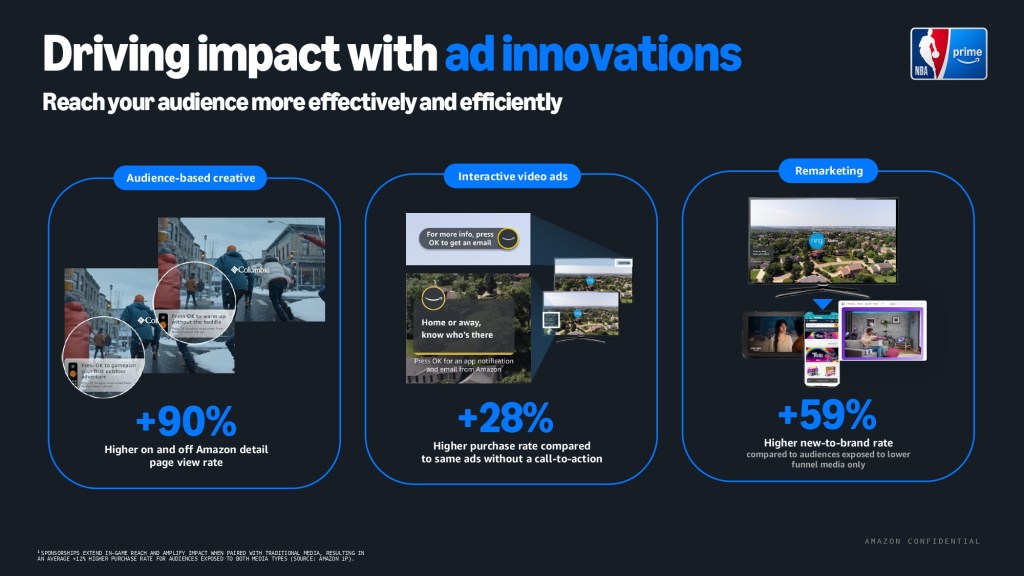

Amazon’s pitch to advertisers goes beyond just inventory, positioning itself as the “first-stop shop” for planning, buying, optimizing and measuring TV, while marketing authenticated, logged-in household reach as the new TV currency, as seen in a recent pitch deck shared with Digiday.

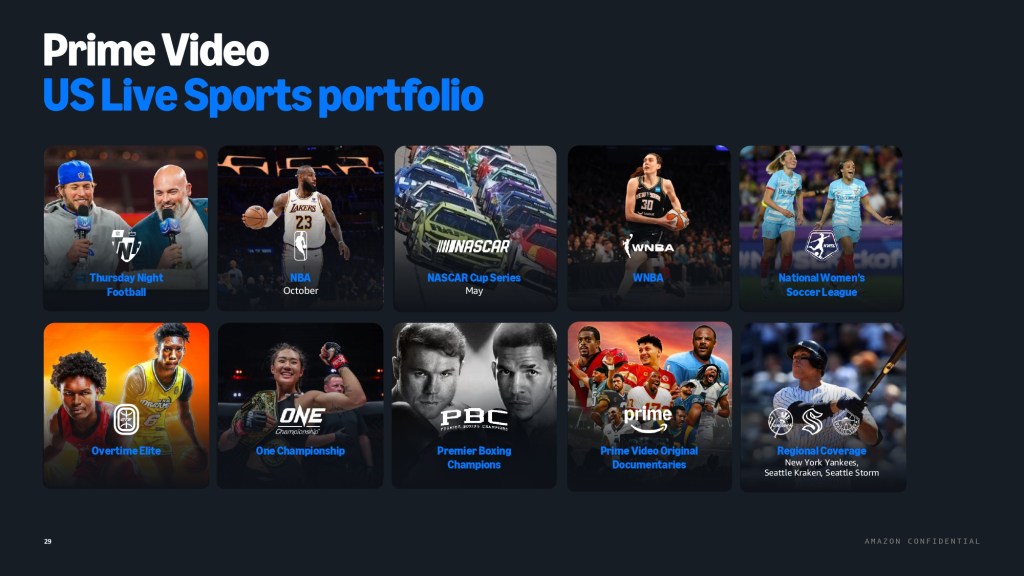

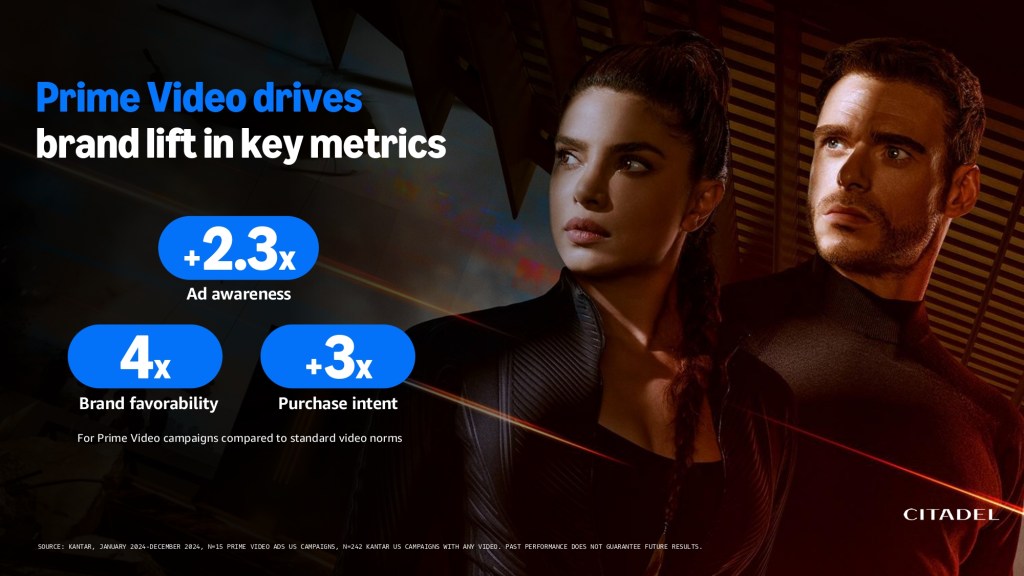

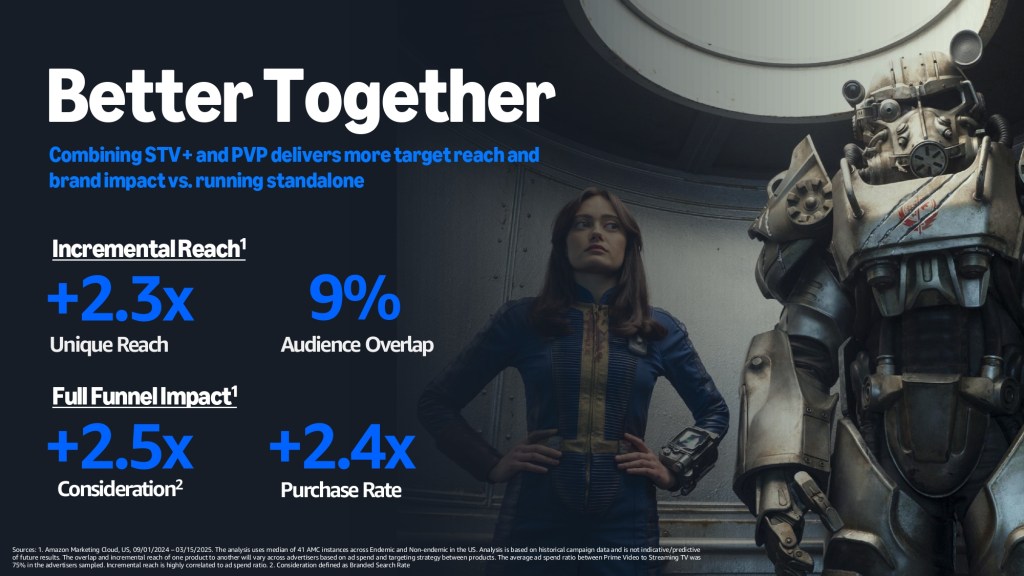

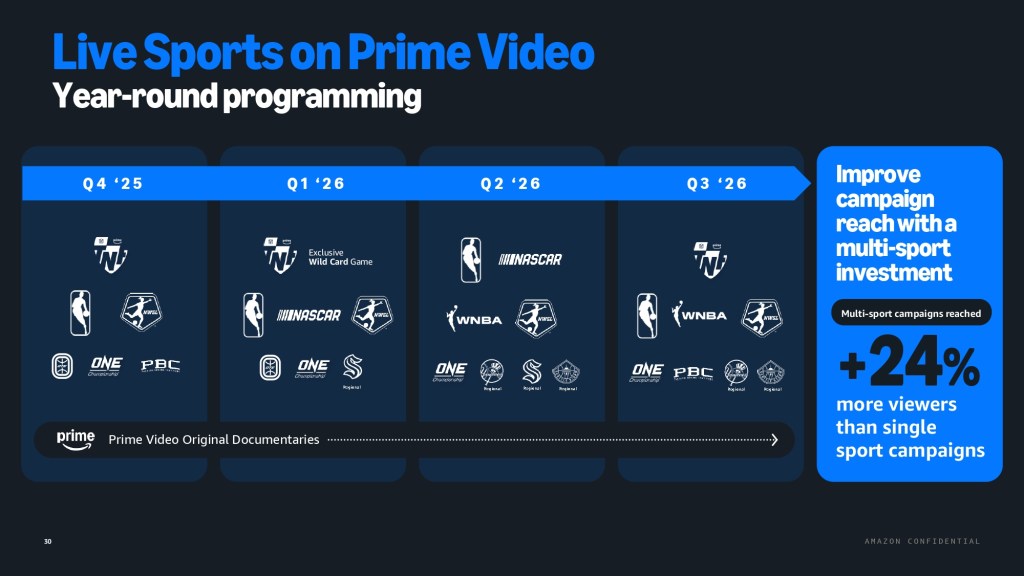

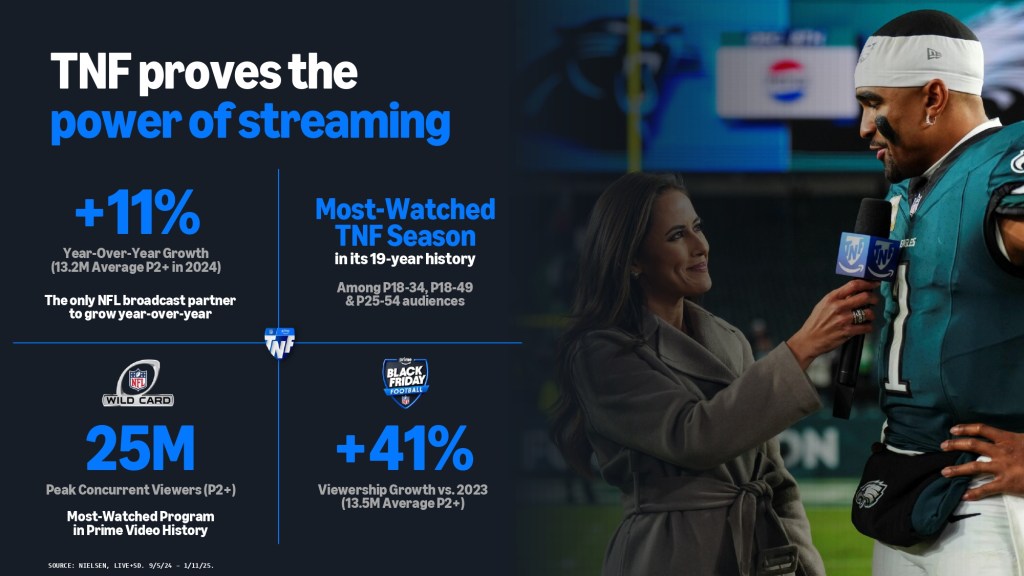

The platform has framed its CTV proposition as performance infrastructure with closed-loop attribution and full-funnel optimization, ultimately connecting ads to outcomes. And its live sports and Prime Video offerings help to scale that model, by providing advertisers with access to Amazon’s highly engaged audiences.

The buyer experience

As things stand, there’s already a strong appetite from advertisers for Amazon CTV as a validation and measurement layer. Though adoption has typically been driven by proof needs, rather than a love for the platform.

“It [Amazon CTV] still feels more like a growing retail media product than a fully open CTV marketplace,” said Adam Singer, vp of marketing at ad tech platform AdQuick.

One key issue is that it’s still viewed as being Amazon-centric and a partially walled garden. As Singer pointed out, “Cross-publisher visibility is limited, and the reporting looks strong, but it doesn’t yet fully plug into broader analytics stacks as far as I see.”

There’s also the problem around tooling, frequency and brand management which feel incomplete for some advertisers. As Collective Measures’ brand media supervisor Nola Ladd pointed out, Amazon hasn’t quite figured out how to deliver frequency relative to a goal.

“This ‘frequency fatigue’ is a common CTV hurdle, as fragmented device IDs make it difficult to cap exposure for a single household accurately,” she said.

Brainlabs’ managing director of programmatic and media, Liz DeAngelis had a similar take.

“Their [Amazon] measurement story still feels incomplete,” she explained. “They have all the right parts, but integrating them remains challenging due to data integrations, brand willingness to open up their data, and the data failing to tell the full story of how marketing drives success.”

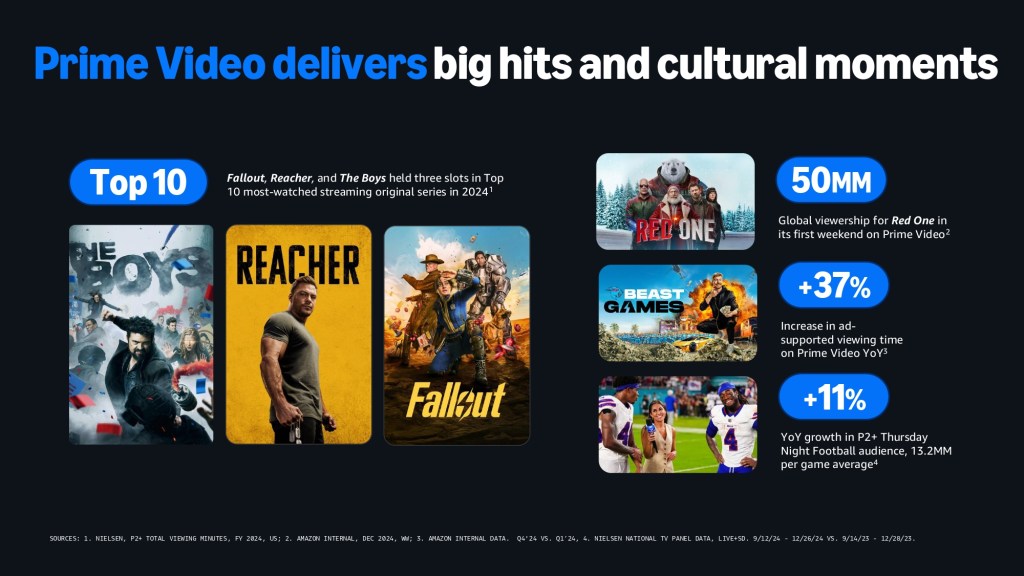

Another downside is premium content itself. Amazon itself believes it holds a premium content offering that is delivered to more than 130 million Prime users in the U.S., with more to come, according to the deck, and includes live sports.

However, some advertisers are yet to be convinced. For now, some say, it’s not always on par with counterparts like Hulu, at least not yet.

“Amazon’s Prime Video inventory is growing fast, even more so if you count integrations (you can get Paramount+ content here too, for example, but it has to be connected with that sub, it’s not default),” Singer said. “So it isn’t yet as broad or predictable at that level.”

And typical of any growing platform, the support and optimization processes for Amazon CTV are still in their infancy compared to its peers.

“Amazon’s self-service CTV offering is still new, and it has room to grow with technical support, optimization insights, levers, and ease of optimization within the UI,” Ladd said. She noted that improving this would actually encourage better adoption because it would help teams feel confident in starting partnerships with the platform.

“Currently, day-to-day contacts with Amazon don’t hold technical expertise themselves, which requires a technical expert to be asked questions on an ad hoc basis throughout a campaign,” she said. “The more Amazon can help advertisers use their CTV offering smarter, the easier it will be for advertisers to make the choice to work with Amazon for CTV.”

Regardless, ad spend still moves into Amazon CTV

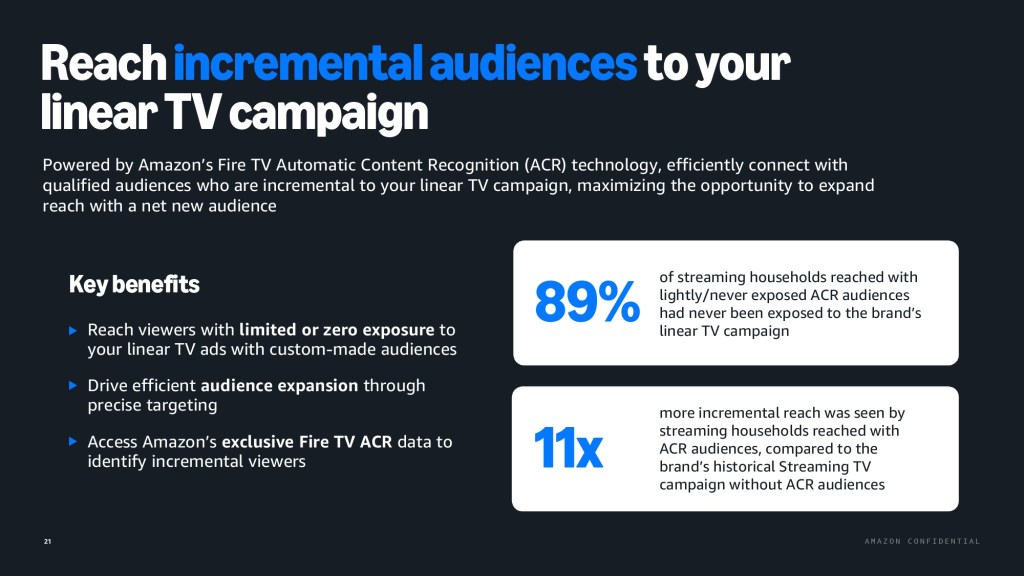

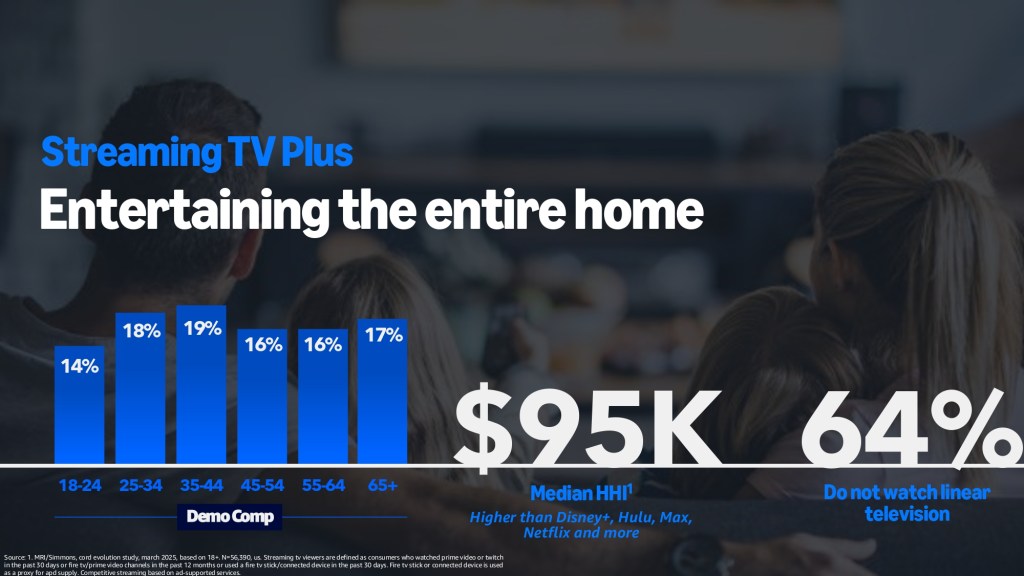

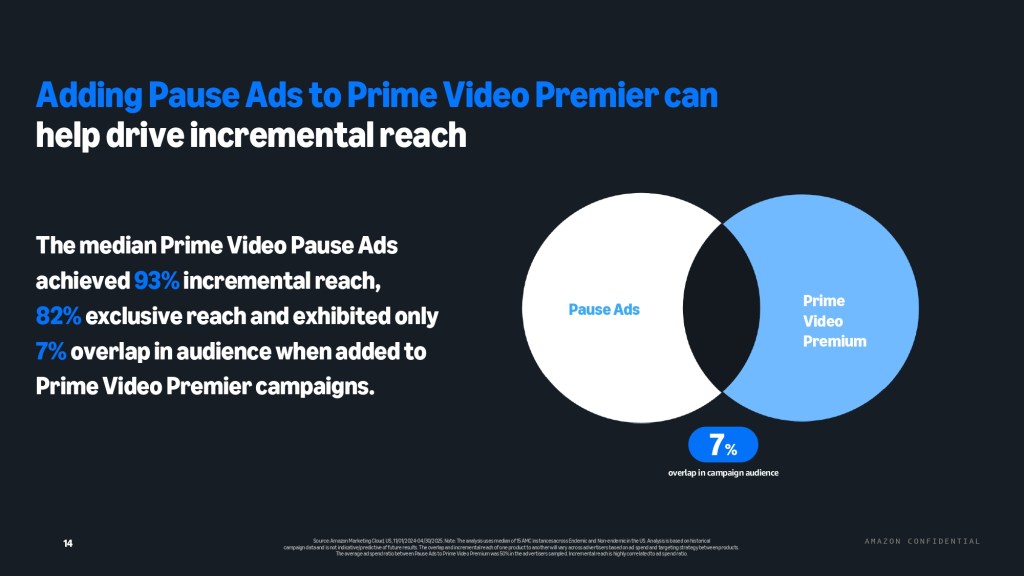

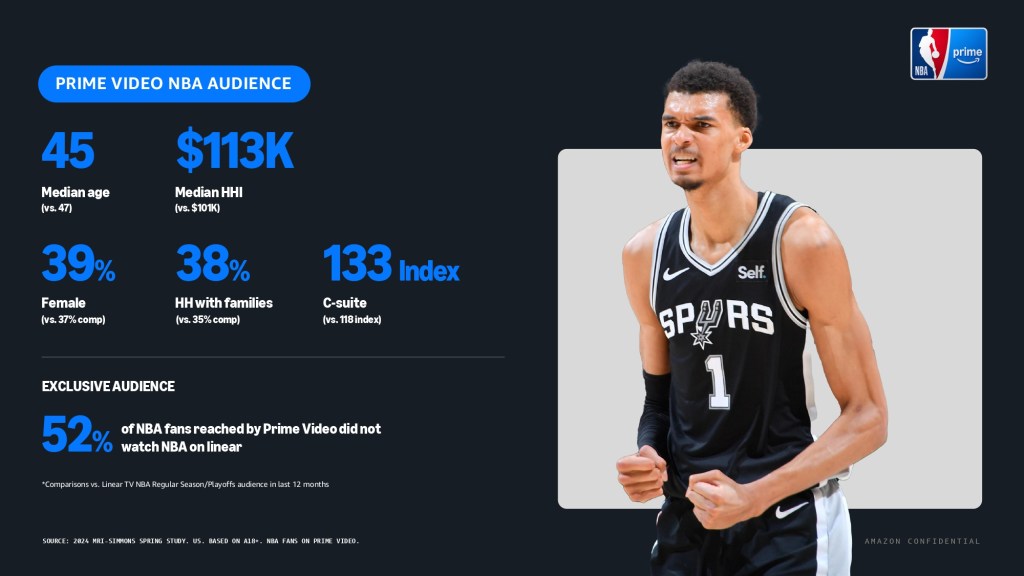

Still, even with these ongoing challenges, agencies are still prepared to move money into Amazon’s CTV via its demand-side platform because finance and performance teams now require defensible return on investment from TV. As Amazon’s deck stated, its CTV offering helps advertisers reach extra viewers they wouldn’t have otherwise reached on linear TV. The platform even goes as far as to say that 64% of its streaming users do not watch linear TV.

For starters, Amazon has become the easiest place for marketers to demonstrate closed-loop proof. As Ladd put it, endemic advertisers can leverage closed loop attribution and the Amazon Marketing Cloud to gain cross-channel insights to understand the impact of CTV on the lower funnel all the way to sale.

By comparison, other TV platforms struggle to provide the same deterministic measurement. From DeAngelis’ perspective, the platform’s CTV offering is one of the most compelling because it offers both premium inventory and first party data for targeting.

“Most competitors offer an either/or choice: [for example] you can buy LinkedIn rich FPD for CTV targeting but you have limited control over inventory, or you can go direct to Disney/Hulu for highest quality content but they offer little in terms of targeting,” she said. “That combination, with closed-loop attribution, is the trifecta for brands selling on Amazon.”

And what better way to achieve those goals, than with competitive pricing.

CPMs on Amazon CTV via DSP are generally between $15 to $45, depending on targeting and inventory. This keeps it in line with Roku (typically between $20 to $40) and Netflix (around $15 to $30), and still below Hulu’s higher range (high $30s up to between $60 to $70 plus).

“I think they are still trying to attract big dollars and increase the uptick in DSP usage adoption so that media CPMs are not astronomical and their DSP rates are among the lowest,” DeAngelis said.

Shifting landscape

Which is to say that it’s the performance-driven focus that advertisers have that is ultimately reshaping how TV is bought. Influence is no longer with the traditional brand teams and instead moved to finance and performance marketers. So while Amazon itself hasn’t caused the shift, its CTV positioning is allowing the platform to benefit from the shift — becoming a structural layer in TV economics before its offering fully matures.

“Success is no longer just about where an ad runs, but what actionable insights and business outcomes it delivers,” Markacy’s vp, consulting, Kevin Cole said. “Whether reaching a live sports viewer primed to purchase merchandise or a Netflix subscriber ready to convert.”

In a provided statement, an Amazon spokesperson touted accessing CTV inventory in one place. “Brands can advertise across Amazon properties, premium TV like Disney, Fox, and Roku, music services including Spotify and iHeartRadio, and throughout the open internet with control and transparency,” the spokesperson said. “Through strategic relationships with key industry players, we connect advertisers to 90% of all US households with authenticated, logged-in reach—providing the ability to holistically plan, optimize, and measure campaigns across all publishers with precision and greater performance.”

Click through the below for the full pitch deck.

More in Marketing

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.

Agencies grapple with economics of a new marketing currency: the AI token

Token costs pose questions for under-pressure agency pricing models. Are they a line item, a cost center — or an opportunity?

From Boll & Branch to Bogg, brands battle a surge of AI-driven return fraud

Retailers say fraudsters are increasingly using AI tools to generate fake damage photos, receipts and documentation to claim refunds.