Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Armed with technology, advertisers can spend less and still grow sales

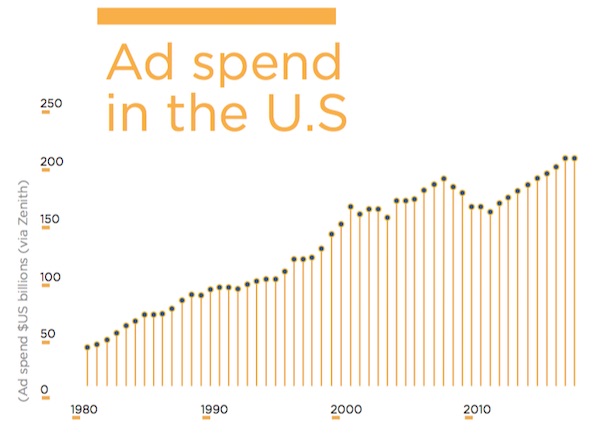

For almost a century, ad spending has hovered around 1 to 1.5 percent of GDP, and this year will be no different, if the forecasts are right. Zenith Media, one of the most widely cited forecasters, projects that this year’s total ad spend will reach $197 billion in 2017, based on the belief that advertising’s share of the gross domestic product will remain constant.

But what if these forecasts are wrong?

As technology has improved, the ability to reach specific audiences has become more efficient and cheaper. Display ads are getting cheaper, and brands like Unilever and Procter & Gamble are showing it’s possible to slash ad budgets without seeing drops in sales, says media industry analyst Rebecca Lieb. Brands are getting choosier about how they spend digital ad dollars at a time when TV ad spend — which accounted for the bulk of total ad spend over the past half century — is beginning to decline.

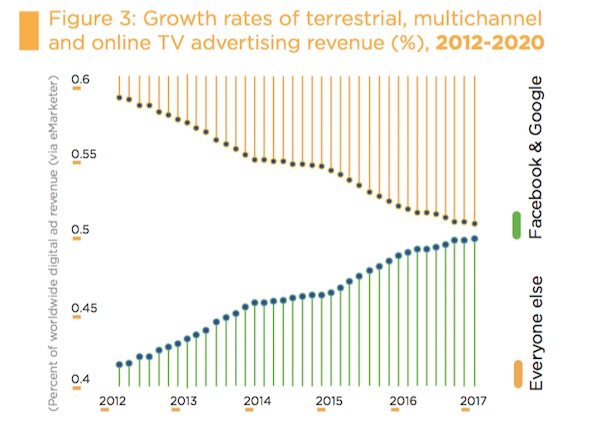

Experts predict the growth in digital spend will offset the decline in TV spend. But maintaining digital advertising’s current level of growth is a bit unsustainable, says Pivotal Research analyst Brian Wieser.

Ad spend usually grows 2 to 3 percentage points annually, but lately it’s grown about 5 percentage points per year. The majority of this growth comes from Google and Facebook, which reap more than half of all digital display and mobile ad dollars. A slowdown from either of these companies could end the precipitous growth in digital ad spend.

If brands spend less on advertising, they’ll likely spend that money toward using consumer data to reach people through direct marketing tactics like targeted emails, Wieser says.

Should ad spend decline, marketers will spend more resources on analyzing data to figure out new ways of driving organic engagement, says Cheryl Huckabay, the head of brand media at ad agency The Richards Group. Attribution and measurement companies will become even more valuable as marketers try to understand the value of the customers they already have.

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.