Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

On TikTok, DTC brand Crumbl Cookies looks to trends to target Gen Z

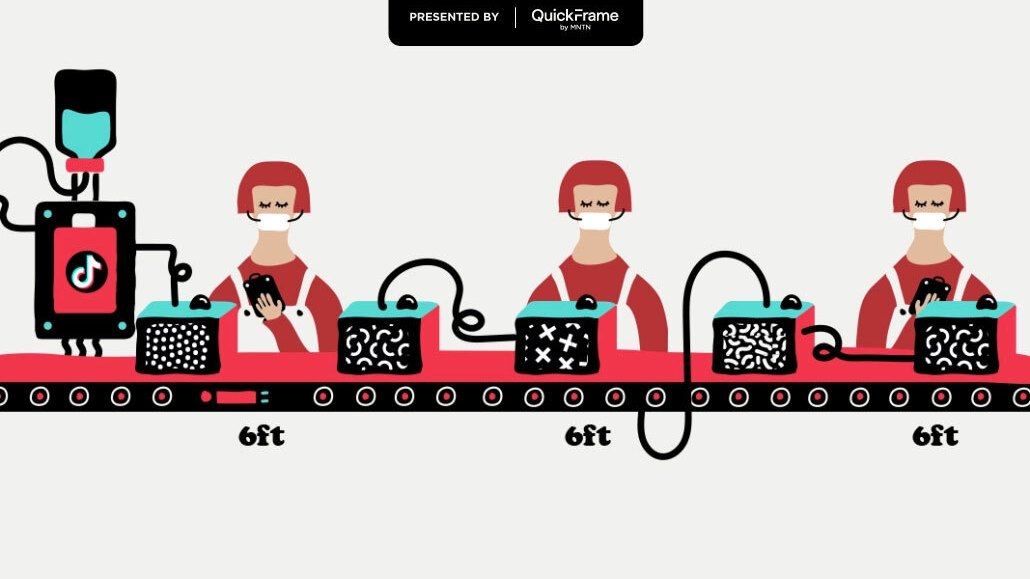

Direct-to-consumer brand Crumbl Cookies is turning up its TikTok activity and leveraging an organic, trend-focused approach to better target Gen-Z.

To accomplish this, Crumbl is producing more creative and eye-catching content for the short-form video app. The brand has 3.03 million followers on Instagram, 1.59 million followers on Facebook and over 650,000 Twitter followers. But Crumbl is focusing this year on TikTok (where it has 6 million followers), tapping into organic growth that emerged as conversations about Crumbl were already happening on the platform (the brand gained 1.3 million followers from June 2021 to June 2022), as well as posting its own cookie-themed content.

“We run a handful of tests each month as we constantly evaluate which platform is the most effective at driving awareness, consideration and purchases, and then allocate marketing dollars accordingly,” said Mai Pham, vp of marketing at Crumbl.

It is unclear how much of Crumbl’s advertising budget is allocated to TikTok, as Pham declined to share overall budget specifics. According to Pham, the brand is spending 70% to 80% of its budget on broadcast and 20% to 30% on digital for its most recent campaign. “It’s important also to note that impressions are a lot cheaper on digital versus broadcast. So while our budget for digital is cheaper, we are garnering a significant number of impressions there [on digital],” said Pharm.

When Crumbl launched in 2017, its primary focus was targeting mothers and families on Facebook and Instagram. But since Gen Z users generally gravitate toward TikTok, Crumbl shifted its focus there to capture a newer, younger audience. “We were able to showcase new content on TikTok that really focused on the creation of the cookie,” said Pham. “As with anything, we test and learn, and we found that TikTok’s community gravitated towards our content.”

Crumbl isn’t alone in its TikTok efforts. Nectar Hard Seltzer and the NFL also recently took to the platform to reach Gen Z with original, creative content with the goal of getting in front of younger consumers.

“While food and baking is a saturated space on the platform, Crumbl’s videos have a higher production quality than a large portion of TikTok content, which allowed them to capture the attention of viewers right off the bat,” said Emily Farrugia, creative strategist at advertising agency FUSE Create. “Their ability to develop a distinct brand look and feel helps to increase recognition in a platform that is content versus user focused.”

Finding ways to tap into trends as well as differentiate the brand is key, according to agency execs. “What is interesting about Crumbl Cookies is that they clearly master the way to engage their audience on TikTok while focusing closely on the indulgent nature of the product,” said Ulli Appelbaum, founder and chief strategy officer of boutique firm First The Trousers Then The Shoes. “By doing so they create a clear brand association in consumers’ minds around ‘indulgent cookies’ and that seems to appeal to consumers.”

In addition to its TikTok efforts, Crumbl will debut its first-ever TV spot on ESPN during the college football and NFL seasons, with the goal of becoming a game day dessert, rather than the savory foods more often associated with football like chips, wings and pizza. The new ad features Michael Buffer, a famous ring announcer for boxing, professional wrestling and NFL matches, saying, “Let’s Get Ready to Crumbl” — a play on his famous slogan.

With its Gen Z audience, Crumbl is aiming to be responsive and transparent and intends to tweak products with feedback from its social media accounts. “We are actively listening to the feedback of our customers and adapting our product as needed,” said Pham.

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.