Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Anastasia Beverly Hills, a family-owned beauty company, is proof that when it comes to building a social media presence, small can be beautiful.

Anastasia is not only the top beauty brand on Instagram but also the most active beauty brand on Snapchat.

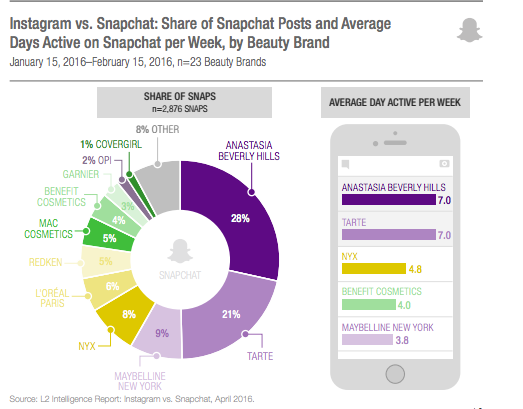

According to a new report from L2, California-based Anastasia represents 28 percent of the share of beauty brands’ snaps on the platform — more than any other beauty company. In comparison, CoverGirl is 1 percent, MAC is 5 percent and Nyx is 8 percent. It’s also one of two beauty brands that snaps seven days a week. The other is Tarte, which has 21 percent of share of snaps.

And while facets of its Snapchat strategy are simply ported over from Instagram (post often and post a lot), Anastasia also uses its brand’s Snapchat account to double as a personal account for Anastasia Soare, its namesake and co-founder. That avoids duplication and sameness: Nyx, Benefit and Tarte, which focus on beauty events, for example, were all at Michelle Phan’s Gen Beauty event in January, so their snaps tended to look the same. Anastasia avoids that.

Instead of posting product shots, it puts up a Snapchat story with Soare in a plane heading to Orlando for an event, or a shot of her mingling with guests during a product launch. Few brands can get away with that, said Jenny Shen of L2’s beauty team. “Most brands don’t have a cult of personality, but because she has a glam life and works with stars doing makeup and travels a lot, that has resonated,” she said.

Niche and indie brands are growing the fastest in the high-end beauty market, according to the NPD Group, and Anastasia leads those brands based on dollar sales both in total market and online.

Instagram is the favored social platform among beauty brands, and Anastasia’s is the most-followed beauty brand there. It averages eight posts a day. About 88 percent of its photos are from influencers and other fans — including repurposing posts from makeup artists or bloggers. The brand works with influencers for product launches.

But Snapchat may be closing the gap for beauty brands. L2 has found that beauty and fashion brands average 26 posts a week on Snapchat, outpacing Instagram volume. About 79 percent of beauty brands with Snapchat accounts are snapping actively.

In comparison, 96 percent of beauty brands are on Instagram. One possible reason for increased Snapchat interest is that brands are switching gears in preparation for an algorithm coming to Instagram’s feed, said L2 analyst Claude de Jocas.

Research has consistently found that brands that post more on Instagram also get more reach — that is, as long as Instagram provides organic reach, something that will soon end with the impending algorithm the platform has said is coming.

“Brands, especially small ones, kind of got burned by Facebook a few years ago, so they recognize the danger of putting their eggs in one basket. So they’re not going to be exclusive on Instagram,” de Jocas said. That plus the fact that Instagram is a place for well-produced, editorial photos while Snapchat is much more freewheeling means brands with fewer resources and money might find Snapchat more alluring.

“It’s interesting to see that the brands that do the stuff the best are the ones without the big budgets to run a YouTube pre-roll or do a ton of display or Facebook ads,” said de Jocas. “They’re experts at this channel because they have no other option.”

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.