Agencies get excited about Instagram ads in Stories and new analytics tools

Only five months after Instagram released Stories — a feature that, well, borrowed from Snapchat — the photo-sharing platform announced today that it will be letting 30 brands place ads within Stories and is offering them a free analytics tool called “Stories Insights.”

Agency executives were largely enthusiastic about the two features.

“Instagram was nowhere near Snapchat for a while but it is innovating fast,” said David Song, managing director for agency BARKER. “Now it is time for Instagram to expand ad offerings and make money.”

Currently more than 150 million Instagrammers use Stories every day, and 70 percent of its users are following a brand on the platform, according to company stats. And with those eyeballs, the network is now eager to monetize. Ads within Stories are very similar to those you see between your friends’ Snaps. Each ad is no longer than 15 seconds.

“It is the first time that we have offered full-screen ads,” said Vishal Shah, director of product for Instagram. “We found common interest between people and businesses and we want to carry that over to Instagram.”

Instagram is testing this new ad format with 30 brands including Nike, Unilever and Capital One. During the initial test, the platform is focusing on one objective: Reach. These 30 beta partners will be able to see relevant reach metrics available through Power Editor, Shah noted. A global rollout will follow over the next few weeks.

As an added bonus, the a new ad format on Instagram means that Facebook has more inventory to sell in its Audience Network. The price for each impression of ads within Stories — like other ad formats in feed — is auction-based, so the more targeted, the more expensive an ad can be.

“It’s smart of Instagram to start with a bidding system based on impressions. When it has more metrics I suspect that it will start selling ads based on clicks,” said Song.

While it is too early to know how expensive an ad within Stories can be, Song believes that Instagram is now a formidable competitor to Snapchat. Snapchat Lenses, for instance, can cost hundreds of thousands dollars for a two-week buy. And the price for Discover can go up to $20,000 per day for a brand to just be there, according to Song. Some agencies also see Snapchat’s ad-sales approach as experiencing “growing pains.” Snapchat told Digiday that its ads options are usually under $100,000 and geofilters start at $5.

“Snapchat is a smart company but products like Discover and Lenses are just too expensive for what they can do. Discover is basically licensing the space rather than advertising,” said Song. “A big difference is: You buy Snapchat ads at a fixed price range without impression guarantees but you buy Instagram ads based on impressions.”

Michelle Feldman, media manager for agency Carrot Creative, also believes that ads within Stories are great to the point where “ad targeting and placement continue to extend across platforms.” From a production perspective, Feldman thinks that brands should make their Stories ads short and sweet as they need to catch viewers’ attention right away.

“You really need to design something that speaks to the platform,” said Feldman. “I think ads in Stories should be as natural to Instagram as possible, but at the same time, appealing to human eyes.”

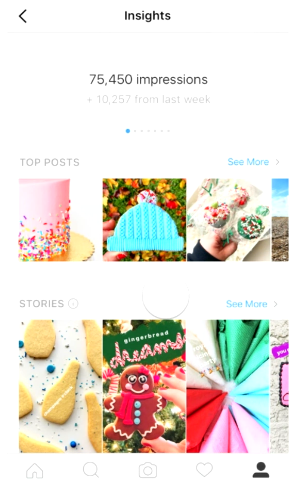

Ads within Stories aside, Instagram is rolling out a free analytics tool called “Stories Insights” for business profiles today. So brands will be able to see the reach, impressions, replies and exits (the number of people who leave your Story) for each individual Story.

This will make advertisers’ work easier because so far, analytics for Stories has been completely manual, said Liam Copeland, director of decision science for social agency Movement Strategy.

“As insights are built out and offered to partners, we’ll be ready to integrate deeper data into our Story reporting,” he noted.

Instagram opened advertising to businesses of all sizes back in September of 2015. This year, Instagram’s ad revenue is projected by eMarketer to reach $3.6 billion worldwide, up year-over-year 96 percent from 2016. This will represent 12.3 percent of Facebook’s global ad business this year. In comparison, Snapchat will generate $935.5 million in worldwide revenue this year, says the research company.

More in Marketing

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.

Digiday ranks the best and worst Super Bowl 2026 ads

Now that the dust has settled, it’s time to reflect on the best and worst commercials from Super Bowl 2026.

In the age of AI content, The Super Bowl felt old-fashioned

The Super Bowl is one of the last places where brands are reminded that cultural likeness is easy but shared experience is earned.