Secure your place at the Digiday Publishing Summit in Vail, March 23-25

The creator economy is getting too big for investors to ignore, expected to be valued at $480 billion by 2027, according to Goldman Sachs. That may be why private equity firms are elbowing holding companies and other corporations for a piece of the growing pie.

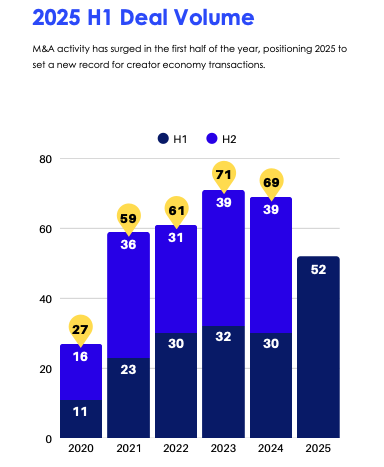

M&A activity is up year over year, potentially positioning 2025 as a new record for creator economy transactions. In the first half of 2025, 52 M&A deals were completed. That figure is up from 30 transactions in the first half of 2024, making a 73 percent year-over-year increase, according to Quartermast Advisors, a boutique M&A advisory firm. Key players in those deals are private equity firms, hold cos, influencer marketing agencies and other companies looking to cash in on creators, even as economic uncertainty looms.

For example, Quartermast points to Publicis buying Captiv8 back in May for $175 million. In February, the hold co acquired BR Media Group, a Latin American influencer marketing and content company, for a reported $100 million. There’s also private equity firm PSG’s purchasing a majority stake in Uscreen, a video membership platform, for $150 million. The list goes on.

All signs point to a maturation of the creator economy. Creators are becoming new media companies, storefronts and brands in their own rights, pulling in a steady stream of ad dollars and signaling future growth that’s safe to bet on.

“We are at this point now where every CMO understands that they need to be working with creators,” said Jasmine Enberg, vp and principal analyst, social media and creator economy at eMarketer. “Most no longer are dismissing their content as lower quality, and influencer marketing really has become a core part of marketing strategies.”

A safe bet in an uncertain market

Tariffs and geopolitical tensions have made for a volatile marketplace, in which buyers are looking for a safe bet. That bet is shaping up to be the creator economy, which has shown no signs of slowing down —especially as AI powers creators’ workflow, content creation, influencer discovery for agencies and more.

Influencer marketing and the creator economy aren’t new. Post-Covid, the space exploded and only now has the dust settled enough for marketers to start figuring out what incremental growth, return on ad spend, scalability, conversion and other metrics look like. To really drive the point home, marketers are hiring agencies of record to manage influencer and creator relationships.

In the U.S., influencer marketing spend is expected to top $13 billion by 2027, up from $10.5 billion this year, per eMarketer’s research, which was published in June. That spend persists even as the market has softened in recent years to account for economic headwinds.

“In a really simple way, people are going to buy things that are fast-growth and attracting attention from brands doing good quality work … especially in a market that has slowed in its growth in recent years,” said Matthew Lacey, partner at M&A advisory firm Waypoint Partners.

Private equity firms stake their claim

Consolidation points to maturation. Call it a sign of the times, and investors have been put on notice. While hold cos like Publicis are snapping up smaller agencies and creator-first ad tech, so too are PE firms looking for a high-growth opportunity and stability in an otherwise uncertain market.

As Quartermast’s reporting points out, there has been a surge in growth equity investments and M&A activities by private equity-backed companies in recent months. Summit Partners backed the $250 million deal in which influencer SaaS platform Later acquired influencer e-commerce platform Mavely in January. Then in February, PSG announced a $150 million investment in Uscreen to drive the platform’s next phase of growth. In April, digital entertainment platform Fixated announced the acquisition of talent management firms CAMP Talent and Moondust Management. The announcement came on the heels of Fixated’s $12.8 billion investment from Eldridge industries.

According to WY Partners’ Media & Technology M&A Quarterly review, private equity firms and venture capitalists are striking the most deals in the M&A space — 138 deals in comparison to 60 deals in software and 7 in global markets from the likes of WPP, IPG and others.

Tech’s AI surge

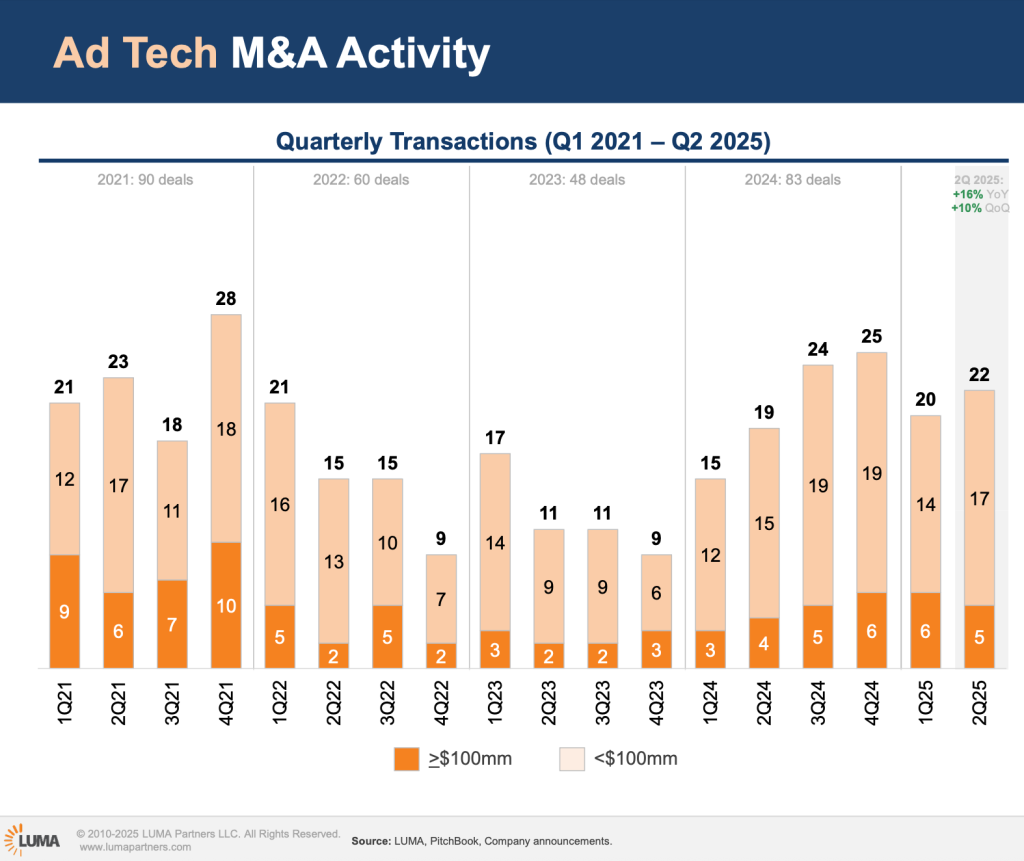

Software (SaaS), ad tech and creator tech platforms are dominating this most recent wave of M&A activity — especially given the infusion from AI, per LUMA’s Q2 2025 Market Report. With the advent of generative AI, companies are likely feeling the pressure to keep up with new technologies.

Quartermast’s research points to a similar phenomenon, specifically in the creator economy in which software companies accounted for more than a quarter of all transactions in the first half of 2025.

“An acquisition decision is usually speed to market, ‘We know that we can de-risk the play if we buy this,’” said James Creech, founder of Quartermast Advisors. Essentially, PE firms are backing tech-buys and hold cos are snapping up tech platforms to get ahead of the tech curve efficiently. “We could try to stand this up on our own. But we know that they have a brand, they have customers, they’ve got revenue. They’re experts in this particular category. We can bolt it into our solution. That’s the play,” he added.

Expect the trend to continue

Aside from the usual suspects of tech players, hold cos and influencer agencies non-endemic buyers are throwing their hats in the ring. Case in point: Food delivery company Wonder announced a deal to acquire digital publisher Tastemade back in March. Further back in February, clothing brand Sown Again brought influencer Noah Beck on as co-owner and creative director.

Consolidation, however, means indie agencies now find themselves facing the decision to partner, sell or compete. Those that have been acquired, including one agency founder who requested anonymity, said acquisitions typically imply a need to step up and accelerate performance, as they are often growth opportunities expected to drive profit.

“Any sort of M&A always requires you to step up and accelerate. Typically, these acquisitions are all happening because they’re growth opportunities and growth acquisitions,” said the anonymous exec.

Still, if the first half of this year signals anything, per Quartermast’s research below, it’s that 2025 is on par to become a record year for creator economy transactions.

More in Marketing

‘The conversation has shifted’: The CFO moved upstream. Now agencies have to as well

One interesting side effect of marketing coming under greater scrutiny in the boardroom: CFOs are working more closely with agencies than ever before.

Why one brand reimbursed $10,000 to customers who paid its ‘Trump Tariff Surcharge’ last year

Sexual wellness company Dame is one of the first brands to proactively return money tied to President Donald Trump’s now-invalidated tariffs.

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.