Secure your place at the Digiday Publishing Summit in Vail, March 23-25

In Graphic Detail: CMOs at a crossroads of power and proof

CMOs are closing out another year defined by churn and shifting ground. With the pace finally easing, they’re taking a moment to assess the pressures, priorities and swings that will set the tone for the year to come.

Below is how their outlook stacks up, laid out in clear, graphic detail.

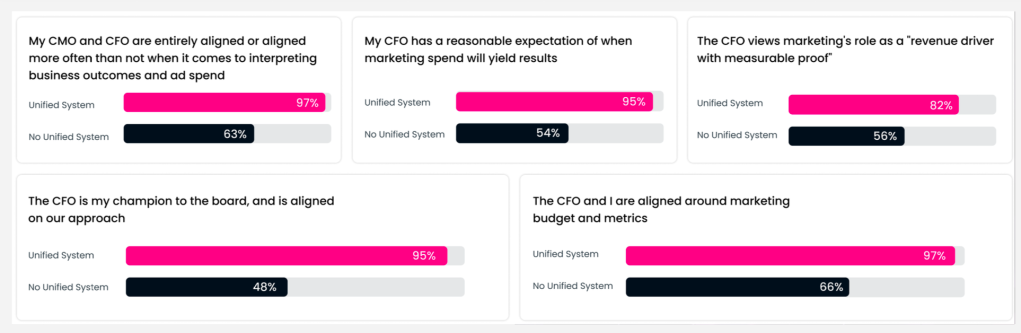

The perennial gap between CMOs and CFOs

It’s a familiar tension, and one that refuses to fade. Only 21% of the 167 marketers surveyed in the U.S. and Canada by Perion and Advertiser Perceptions said they were aligned with their finance teams on budgets and metrics. The number underscores why marketing still struggles to shed its reputation as the soft discipline in the C-suite. Yes, there are pockets where it carries real weight — think Unilever, Procter & Gamble and Coca-Cola — but those remain the exceptions rather than the norm.

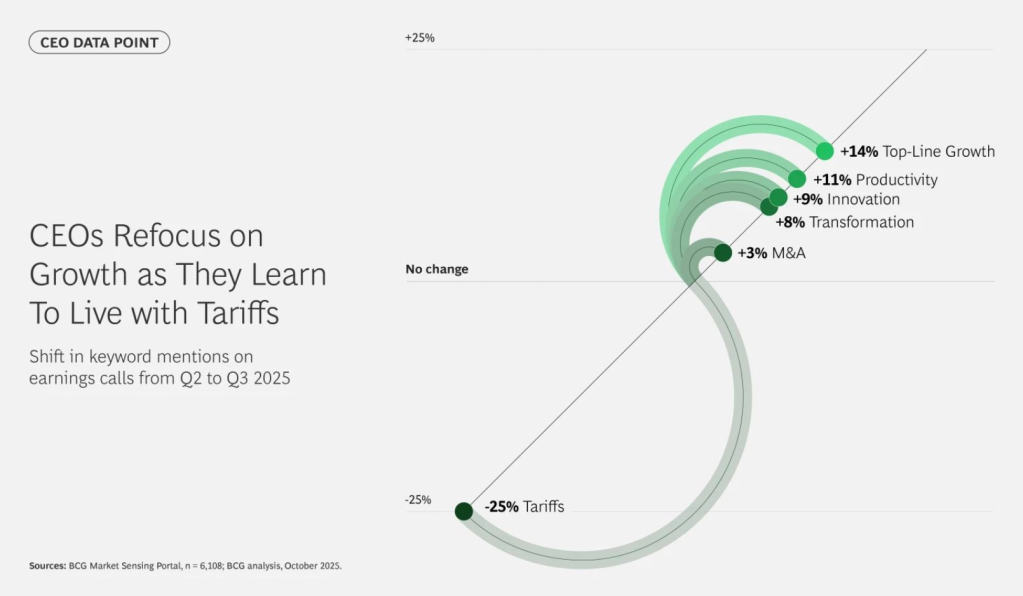

Advertising is more important now than ever (no really)

A clear subplot from this earnings cycle has been the renewed focus on growth inside the boardroom. Boston Consulting Group points to a shift over the summer, with CEOs zeroing in on how their companies push through a dense thicket of challenges and emerge stronger. Advertising is central to that push, much as it was three years ago when leaders leaned on marketing to help cushion pandemic-era price hikes.

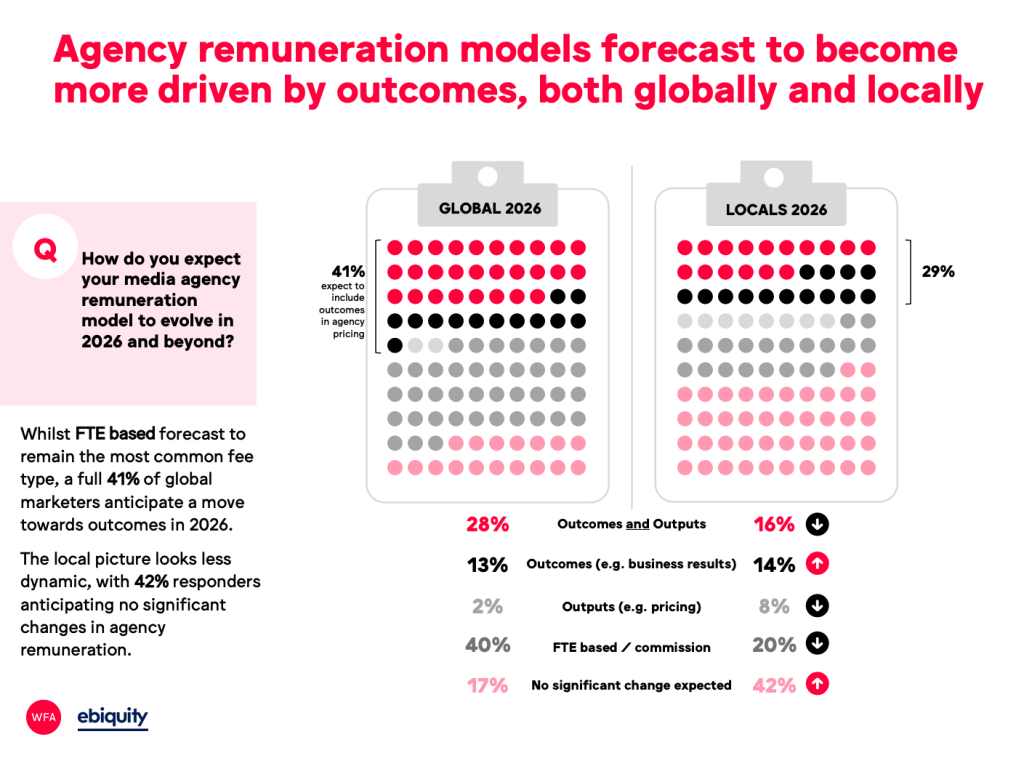

CMOs want more outcome-based models from agencies

Rising pressure to prove marketing’s commercial impact is pushing CMOs back toward agencies with new demands. They want agency models tied to outcomes they can defend in front of their CFOs, framed as evidence of durable value rather than discretionary spend. The theme resurfaces whenever marketing’s standing in the boardroom comes under scrutiny but this moment is distinct. Four in 10 (41%) of the 518 global marketers surveyed by Ebiquity and the World Federation of Advertisers plan to build outcomes into their agency remuneration models next year. The growing influence of AI is accelerating the shift, moving the business away from static headcounts and rigid staffing models toward more automated, streamlined workflows. In that setup billable hours lose their utility.

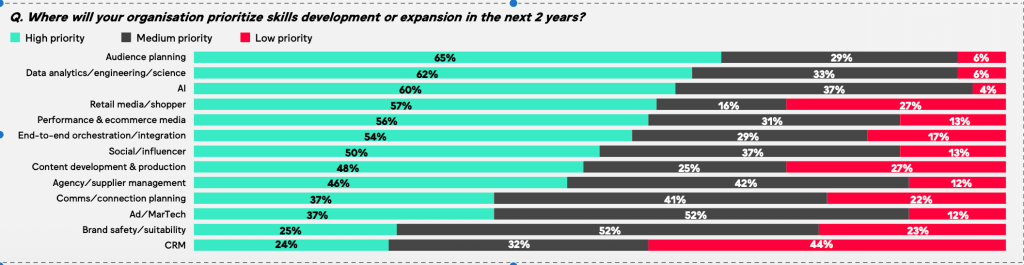

The road to outcomes is paved with missing details

Even as marketers push toward outcomes, many admit they lack the foundation to get there. Only a quarter of respondents in the MediaSense and World Federation of Advertisers study — drawn from 56 of the world’s largest advertisers representing $52 billion in annual media spend — believe they have the right resources and capabilities in place. An even lower share say their technological infrastructure is where it needs to be to effectively scale AI across their media investments.

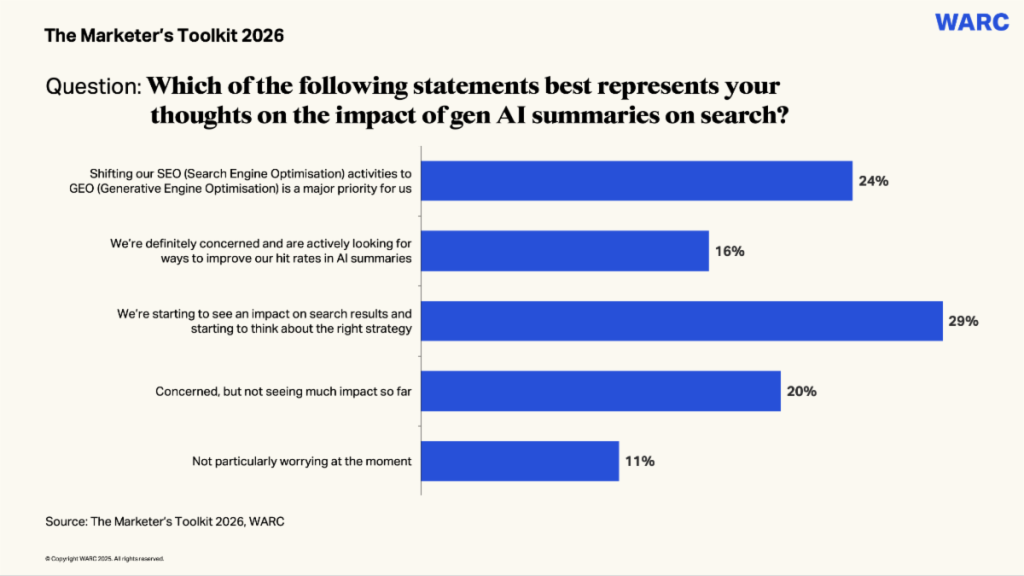

Brands, not just publishers are grappling with their own zero-click moment

Marketers aren’t immune to the same dynamics roiling publishers. Only 11% say they’re “not particularly worried” about AI’s impact on search. Most are already developing AI search strategies with 24% beginning to shift from EO to GEO (generative engine optimization), according to a global WARC survey of more than 1,000 marketers. It’s poised to be a dominant debate next year as AI-driven traffic grows quickly and reshapes how people discover and access content online.

More in Marketing

In graphic detail: How Anthropic’s Pentagon refusal is paying off in downloads, brand trust and enterprise deals

OpenAI’s Pentagon deal seemed to spark uproar among its users, many of whom were against it. Anthropic’s refusal to agree to the terms was seen by users as the more trustworthy alternative.

How AI could disrupt retail media’s $38 billion search ad market

ChatGPT and other AI chatbots could divert shoppers from retailer sites, putting the $38B retail search market at risk.

‘Brand safety is moving from fear to curiosity’: Zefr’s Raddon on content-level accreditation – and what it exposes about the industry

The threat is no longer a discrete piece of bad content that a keyword list or a domain block can catch. Its volume.