For teen-aimed retailers, Instagram is lit.

A new report by L2 found that in the second half of 2015, brands began to post more on Instagram than they did on Facebook, year over year. One obvious reason was that changes in Facebook’s algorithm have made it less likely that their posts would be seen. But another was also that certain brands, especially those targeting teens, found that the more they posted, the more people interacted with them.

According to L2, which looked at 155 brands with more than 300,000 followers — what the firm considers a “scaled” community — brands are now posting about 10 times per week on Instagram, compared with about seven times a week to Facebook.

But retail brands aimed at Gen Z, especially teenagers, are finding a positive correlation between post frequency and engagement. That makes sense: 33 percent of teens call Instagram their go-to social platform, according to a recent Piper Jaffray study.

And Instagram is also important because it lets retail brands include user-generated content and curate it, said Laura Tierney, social media director at McKinney. And being able to link out and create shoppable feeds, via third-party programs like Like2Buy, also helps these retailers move from content to commerce.

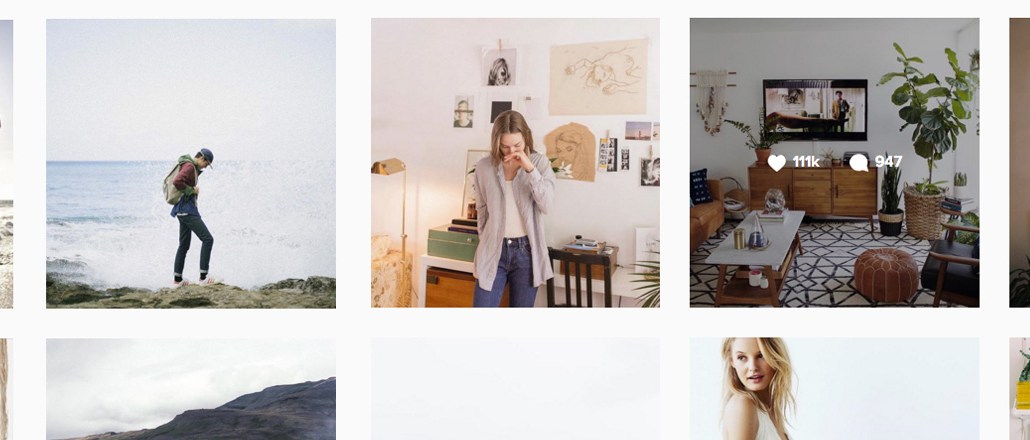

According to L2, Abercrombie (including Hollister), Aeropostale and Urban Outfitters are among the top brands on Instagram that have increased their post volume and yet still retain high engagement numbers — on average, over 100,000 per post. Here’s a look at how they did it.

Abercrombie & Fitch: 2.7 million followers

Facing sliding sales, Abercrombie & Fitch moved to a digital-first approach with a focus on interacting with consumers online. Today, the brand uploads an average of three photos a day on Instagram and upwards of 25 posts a week, up from one a day in the fourth quarter of 2014.

“Teenagers are online all the time, and they have a short-term memory, so it is good to post multiple times a day to keep them engaged and stimulated, until inspiration hits for them to shop the brand’s website,” said Rony Zeidan, founder at branding agency RO NY. Tierney said that with teens that she works with, Instagram is the “go-to app.”

Abercrombie’s social presence also reflects corporate changes at the company. It ousted its CEO, Mike Jeffries, in December, ushering in a new era that includes fewer shirtless models and clothing over a size 10. Zeidan said that that rebranding shows: Abercrombie’s posts feature more traditional fashion imagery than its competitors do.

Aeropostale: 3.2 million followers

There are almost no product images on Aero’s Instagram page. Instead, it’s all about shots of late-night pizza parties and photos of friends at the beach. Zeidan said that is the approach that works for teens, who go to Instagram to document their loves, not be sold to. Aeropostale is “speaking their language,” he said. On Instagram, it posts four times a day and on average has over 100,000 comments and shares per post. Tierney said that Aeropostale also mixes things up with candid photos of actual models, which gives its profile an aspirational feel.

live love dream ❤️ A photo posted by AERO (@aeropostale) on

Zeidan said that for a brand like Aeropostale, which often wants to tell a story, Instagram works because it requires relatively few resources. “You can tell a story in one image, almost no words, and you can create an immediate emotional reaction,” he said. “You need to be very truthful in representing what your brand stands for in order for it to resonate and create engagement.”

Urban Outfitters: 4.1 million followers

Urban lets its Instagram community shop its feed with “UO Community,” a dedicated webpage that features items from its Instagram feed with a direct link to buy them.

Zeidan said that Urban Outfitters, which targets younger teens than Abercrombie does, has made Instagram and Snapchat its focus.

Snapchat account information is prominently displayed at the top of Urban’s Instagram profile, and rather than just pushing product, the brand will intersperse images of scenic mountain ranges or healthy salads. For example, for the New Year, the brand started a #UOGoals movement to encourage people to share their health and fitness goals for the year.

More in Marketing

Star power, AI jabs and Free Bird: Digiday’s guide to what was in and out at the Super Bowl

This year’s Big Game saw established brands lean heavily on star power, patriotic iconography and the occasional needle drop.

In Q1, marketers pivot to spending backed by AI and measurement

Q1 budget shifts reflect marketers’ growing focus on data, AI, measurement and where branding actually pays off.

GLP-1 draws pharma advertisers to double down on the Super Bowl

Could this be the last year Novo Nordisk, Boehringer Ingelheim, Hims & Hers, Novartis, Ro, and Lilly all run spots during the Big Game?