Retailers are always trying to squeeze revenue out of every Facebook status, tweet and Instagram they post, but it’s the photo-sharing social network that’s presented the greatest challenge.

More retailers are either adopting third-party solutions or launching their own platforms to monetize their images. For some, that means creating an Instagram-like catalog. Others are turning Instagram likes into personalized emails. Most recently, Nike Women rolled out a shoppable Instagram store on the Nike website.

Still, Instagram remains a multimillion-dollar challenge. Here’s a look at how Nordstrom, Target, Michael Kors and Nike Women are peddling products on the social platform.

Nordstrom

Since August 2014, Nordstrom (795,000 followers) has used Like2Buy, a third-party solution powered by Curalate that creates a corresponding shoppable feed for its clients’ Instagram account. The link to a retailer’s Like2Buy page appears in its Instagram bio, the only place within the platform that can connect users to the wider Web.

To shop for something seen on Nordstrom’s Instagram, then, the number of hoops potential customers must jump through depends on what they’re looking for. According to Curalate’s CEO and co-founder Apu Gupta, it’s up to the brands to figure out which images they want to feature on their Like2Buy feed, and where they want to send customers from Like2Buy on their website. Curalate will provide advice, but the power is in the hands of the brands’ social teams.

Nordstrom, for the most part, leads customers to brand pages (like Madewell) or categories (like “jeans”), unless only a single product is pictured in an image. If there are multiple products in one image, the search for a particular item will continue once on Nordstrom’s online store.

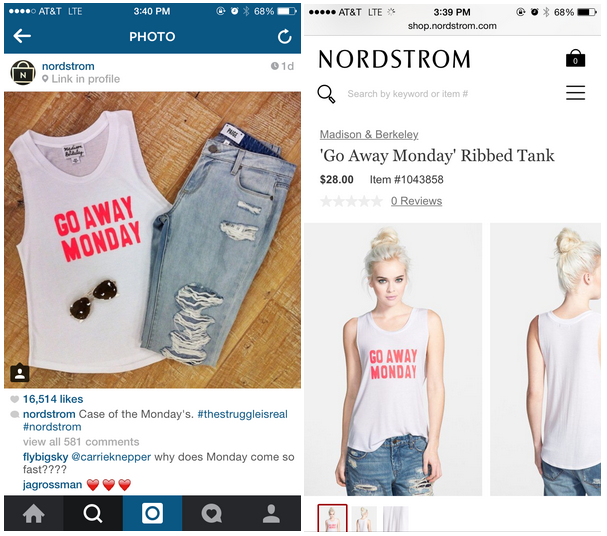

Below, a Nordstrom Instagram (note the “Link in profile” geotag) post featuring three products. On the right, the landing page users are directed to when they click the link.

So even while using a shoppable solution, buying a specific pair of jeans off an Instagram post is still too difficult, according to Sucharita Mulpuru-Kodali, vp and principal analyst at Forrester Research.

“It’s not frictionless,” she said. “It’s asking the customer to do a lot of work.”

Target

Target (613,000 followers) is another one of Like2Buy’s early adopters, but the big-box retailer frequently falters when it comes to connecting customers to the products they want.

A majority of Target’s photos attempt to follow the visually appealing model of a great Instagram post, while pushing just one product.

Take this photo, for example:

If you wanted to purchase anything from this image, you would follow the Like2Buy link from Target’s Instagram bio, then click on the image within Like2Buy, ending on the landing page designated by Target for that image. But the only item at the bottom of that rabbit hole to purchase is “The Hunger Games: Mockingjay Part 1.”

If you were looking for a leather jacket but were instead led on a chase by what’s ultimately an ad for a DVD, that doesn’t translate to a great user experience.

“That frustration is a challenge we’re looking at right now,” said Gupta. “It’s about being able to innovate on these things, and Like2Buy has a lot of responsibility. It’s directly involved in the customer experience.”

Michael Kors

Michael Kors (3.6 million followers) entered the shoppable Instagram game by sidestepping a third-party solution. The designer brand launched #InstaKors in November, a registration-based email subscription that responds to Instagram followers’ “likes” by sending out emails containing the product details from any Michael Kors images they favorited.

This method requires an extra step for registration but allows Michael Kors’ followers to get a customized product list directly in their inbox to browse later. (Like2Buy has a comparable feature in its “My Favorites” column, which collects the shoppable Instagrams users have liked but lacks the straight-to-inbox feature.)

But #InstaKors’ biggest problem is its lack of availability. The only shoppable products are the ones pictured in Instagrams tagged with #InstaKors, but a recent scroll through the feed saw no images tagged with #InstaKors in the past month.

It’s not just Michael Kors, though. This issue – the lack of Instagram posts that are actually shoppable – is a challenge across the board, according to Mulpuru-Kodali.

“The circle of what you love [on Instagram] is going to be huge and what you can buy is going to be tiny, and the overlap of what you love and can buy is going to be even tinier,” she said. “It’s the fundamental problem.”

Nike Women

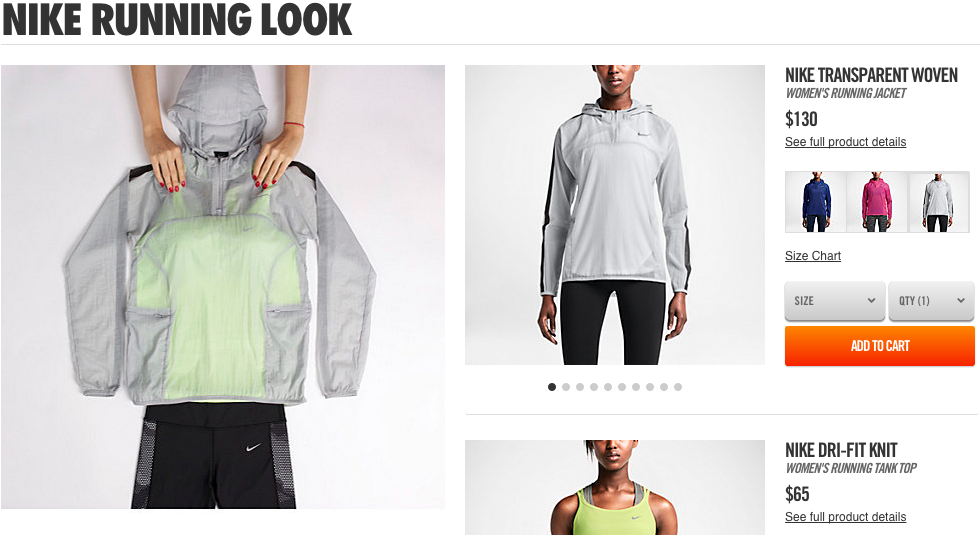

Nike Women (@nikewomen, 1.6 million followers) launched its shoppable Instagram store last week, and its easy-to-use platform might be one of the best social commerce experiences yet.

Similar to Like2Buy, Nike Women provides a link to its shoppable feed in their account bio. The link takes followers to Nike’s website, where the Instagram feed is replicated. Click on the images to shop the looks, and each item pictured is gathered into one product page where you can choose sizes and add whatever you want to buy from the Instagram to your cart, all on one page. The user experience is clean, and finding the actual item that’s sought after is – for once – guaranteed.

Nike Women’s platform suggests it might be beneficial to hold out for a custom product with a better user experience rather than get ahead of the curve with a potentially sub-par product. Regardless, monetizing Instagram is worth a try for retailers.

“This is version one, something that needs to get better over time,” said Mulpuru-Kodali. “People are always going to be inspired to buy when they look at [Instagram’s] beautiful visual sights, and what we do know is that there’s money to be earned.”

But Gupta warned against sitting out the shoppable trend.

“Brands need to start understanding how to engage with consumers, how things work, and they can’t sit on the sidelines.”

More in Marketing

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.

Digiday ranks the best and worst Super Bowl 2026 ads

Now that the dust has settled, it’s time to reflect on the best and worst commercials from Super Bowl 2026.

In the age of AI content, The Super Bowl felt old-fashioned

The Super Bowl is one of the last places where brands are reminded that cultural likeness is easy but shared experience is earned.