Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

‘Our focus is on our own footprint’: DTC brands are pumping the brakes on wholesale partnerships

It’s a common journey for DTC brands to start selling online-only before making a few partnerships with wholesale retailers, but those partnerships do not come without their own tradeoffs. Increasingly, brands are refocusing on direct sales, as wholesalers push them to sell at a scale outside of their means.

It’s a common journey for DTC brands to start selling online-only before making a few partnerships with wholesale retailers, but those partnerships do not come without their own tradeoffs. Increasingly, brands are refocusing on direct sales, as wholesalers push them to sell at a scale outside of their means.

The Arrivals began its sole wholesale partnership with Nordstrom in September, but had to pull back on the partnership a bit after Nordstrom aggressively pursued a much larger wholesale launch than the brand desired, said David Hauser, head of finance and operations at The Arrivals. While The Arrivals is currently sold at only six Nordstrom locations, the retailer initially pushed to get the brand to sell in nearly 40 stores. This is consistent with Nordstrom’s recent strategy of snapping up as many online DTC brands as possible for their brick-and-mortar debut.

“Nordstrom was quite aggressive with how many stores they wanted us to be in and we had to pull back a little bit,” said Hauser. “For us, especially because we do everything in-house, it’s important to own our brand identity. We pulled it back to six stores so that we could have a bit more control over everything that happened.”

In many ways, Nordstrom’s aggressive push mirrors the way Sephora interacts with DTC beauty brands. The retailer is notorious for snapping up new indie beauty brands, sometimes within a year of their launch, and pushing them to sell at scale to the point where many of those brands have to seek outside funding in order to keep up.

Other brands that have experimented with wholesale have cited retailers’ pushes to scale as being harmful to a new brand. Without naming specific retailers, Jessica Davidoff, the CEO of direct-to-consumer handbag brand State, said wholesalers often push DTC brands to do large debuts that are difficult for a smaller brand to manage.

“There are times when a major retailer can get excited about a new startup, and they want to do an exclusive and sell hundreds of bags at one store when it’s still really early in a brand’s life,” she said. “That’s a lot of bags to sell to meet expectations.”

Controlling the narrative

In addition to the problems of scale, wholesale also makes it more difficult for newer brands to control how their brand and product is framed and presented to customers.

“We’ve had a lot of success with wholesale, but with direct, we can control our own story and our messaging in a way we can’t in wholesale,” said Davidoff. “We can push the entire collection, instead of just whatever small subset the stores buy from us. From a storytelling perspective, DTC is really helpful.”

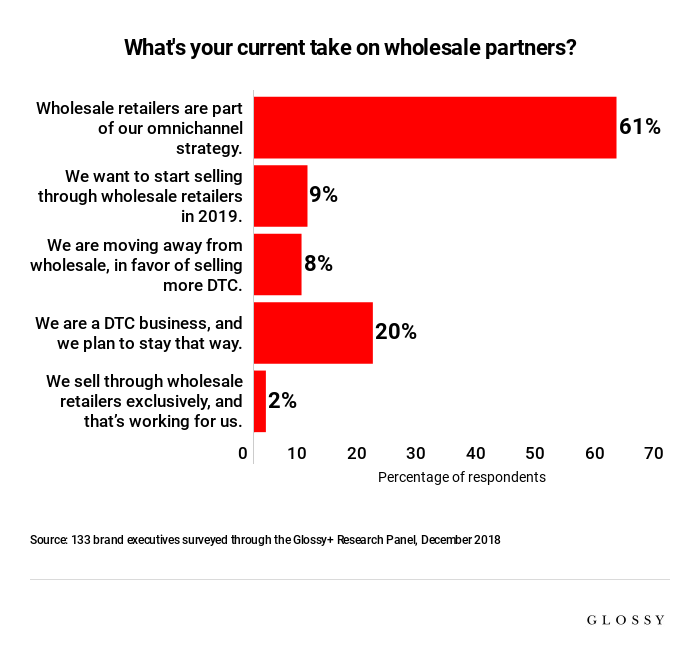

Davidoff said State is working to bring its current split of 65 percent wholesale and 35 percent direct up to an even 50-50. The move toward more direct-to-consumer retail is a trend across fashion. The three biggest luxury groups, LVMH, Kering and Richemont, all significantly increased the share of sales that came from direct-to-consumer compared to wholesale over the last year. According to Glossy’s own research, only 9 percent of surveyed brands are planning to start selling through wholesale in 2019.

Retailers have come up with alternative strategies to entice DTC brands to sell through them, like Bloomingdale’s with its Carousel concept which lets DTC brands set up their own pop-up shops within Bloomingdale’s on a rotating basis. Doing so gives those brands more of an opportunity to bring their own visual flair and storytelling to their wholesale partnership.

A visibility boost

Of course, there are upsides to wholesale, especially for newer brands. For one, when brands are still trying to build up an audience, being sold in a place like Nordstrom can massively boost to visibility. Davidoff cited a correlation between the wholesale relationship State struck with Bloomingdale’s in Hawaii and a huge increase of sales in that state — a place where the brand previously had almost no presence whatsoever.

“That’s the major tradeoff; you give up some control,” Davidoff said. “Even the way they photograph for their websites is out of your control. Going direct, you can control the messaging, you can explain the value proposition in your own way. Take our giveback program that we talk about on our web site. At Nordstrom or wherever else we sell, we don’t have control over that story. At the same time, Nordstrom has done huge things for us, especially helping us with awareness.”

The Arrivals had similar results working with Nordstrom: It saw purchases from customers outside of the brand’s target audience.

“This was an opportunity to try out wholesale and try to reach a demographic that could not get to our New York location normally,” said Hauser. “But our website and retail locations have done super well, so we don’t need to rely on wholesalers entirely.”

For brands navigating the space between direct and wholesale, it can be easy to get sucked in by the allure of selling in a big-name department store. But going wholesale comes with its own drawbacks that continue to make a DTC business model attractive and worthwhile.

“Our focus is really on our own footprint first right now,” said Hauser regarding The Arrivals’ future DTC plans. “We are focused on our pop-ups and possibly a permanent location soon. The most important aspect is controlling the brand. What DTC provides is that direct communications feed and control of the narrative.”

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.