Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Nonprofits are facing a stark drop in donations after being forced to postpone traditional in-person fundraisers and with the coronavirus crisis wreaking havoc on the economy and individuals’ personal finances. An analysis of iSpot.tv data, prepared for Digiday, shows many charitable organizations have increasingly turned to TV to continue getting their message out there.

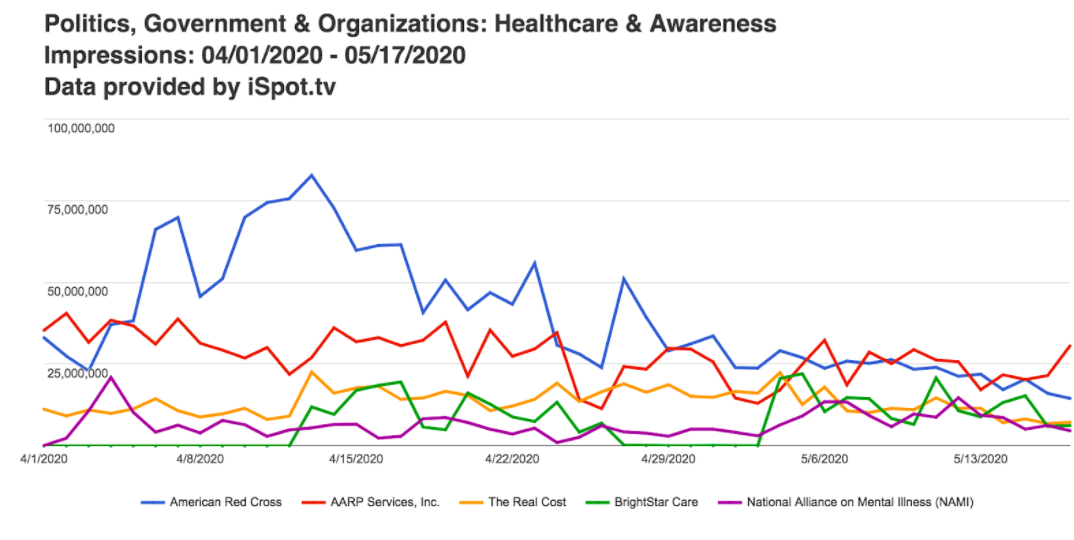

According to iSpot.tv’s data — which captures impressions on national and local TV, plus video-on-demand and over-the-top services — healthcare and awareness nonprofits increased TV ad impressions to 5.63 billion from April through May 17, 2020. That figure was up 155% on the same period in 2019 and included an increase in weekend day programming and primetime slots. Healthcare and awareness organizations in the analysis included American Red Cross, AARP Services, The Real Cost and BrightStar Care.

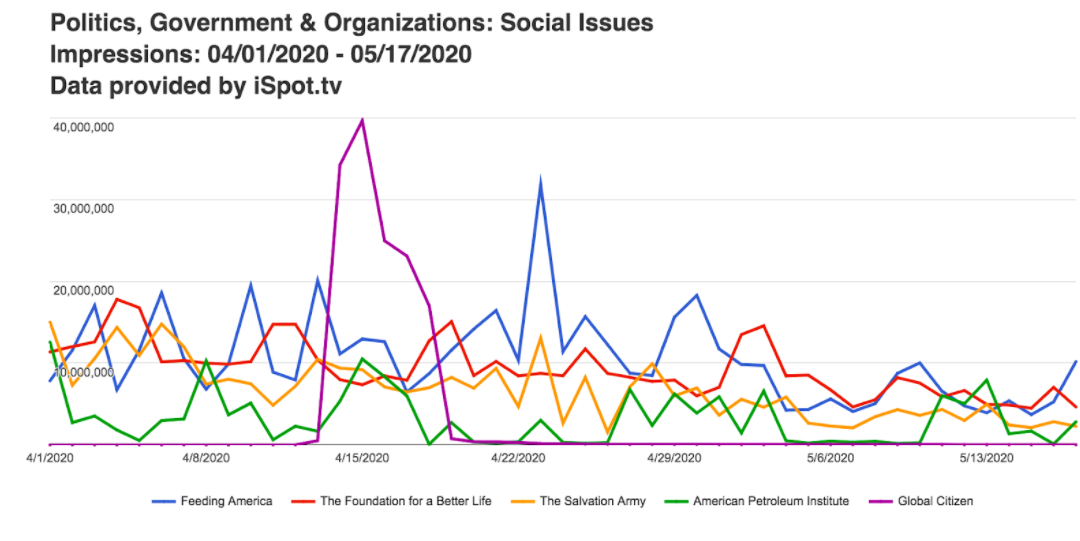

Meanwhile, social issues organizations increased impressions by 132% over the same period to 2.3 billion, according to iSpot.tv. Those organizations include the likes of Feeding America, Salvation Army, Global Citizen and Habitat for Humanity. Last year, 50 social issues organizations aired at least one ad on linear TV — versus 61 this year. Those organizations were also getting a higher impression in primetime — specifically Sunday primetime — than last year.

The sharp increase in impressions didn’t necessarily mean those organizations were spending more on advertising than a year ago. Airtime is negotiated at a discounted rate for non-profits on a per-network basis, making it difficult to capture whether overall spend was up or down. ISpot.tv does not estimate ad spend for nonprofits within its dataset.

Plus, the supply and demand nature of the TV market means that while viewership soared as shelter-in-place measures were implemented, the pullback in spend from some advertisers in sectors like travel and entertainment meant rates have declined.

“Most mainstream advertisers are pulling back significantly on TV and radio, which opens up two things: one, inventory availability; two, decrease of costs,” said Parks Blackwell, vp of client development at marketing agency PMG, which is currently working on a digital campaign expected to go live early summer for nonprofit organization United Way. “Networks need to fill the space and are much more willing to provide that either at no cost or low cost.”

American Red Cross has been running separate spots encouraging Americans to give blood during the crisis, which includes the lines, “We need heroes now” and “You can make a difference.” The organization accounted for 34.6% of all impressions in the healthcare and awareness sector over the period analyzed. It was among the top 100 brands on TV by impressions, above brands including Dunkin, Rocket Mortgage and Lexus, according to iSpot.tv. American Red Cross increased its TV impressions to 1.9 billion from April through May 17 2020, up 33% versus the same period last year.

“The American Red Cross quickly produced new PSAs to raise broad public awareness about the need for blood donations during this pandemic, while also reassuring donors about new safety measures in place at our blood drives and donation centers,” said an American Red Cross spokesperson. “Media companies across all platforms stepped up and supported our PSAs at unprecedented levels giving our message the highest reach and frequency of any campaign we’ve ever run.”

Elsewhere, AARP reoriented its marketing in March to focus its messaging around the coronavirus. It moved money allocated for the fourth quarter to instead be spent during April and May, including some additional buys on television and radio. AARP’s impressions were up 23% through the crisis period, compared to the same time period last year. Its commercial, featuring CEO Jo Ann Jenkins talking directly to the camera about how AARP has pivoted to providing useful information about the coronavirus, landed 471.7 million impressions in the time period analyzed.

Nonprofits are facing an unprecedented challenge: Revenues have plummeted and at the same time, demand for their services has skyrocketed, said Rick Cohen, chief operating officer at the National Council of nonprofits.

“Nonprofits that utilize advertising do so with the double mission of reaching potential donors and ensuring that people know how to access their services, if they need them,” said Cohen, who also serves as the Council’s chief communications officer. “With so much about our everyday lives being different right now, there are new needs to address and a need to reach more people than ever, whether to help them or to ask for their support.”

A similar story has been playing out in the U.K., where charities have been quick to adapt their appeals to focus on the current crisis.

In the first three to four weeks of the crisis, the drop in overall advertiser demand and increase in audience supply led to TV ad rates that had not been seen for 40 years, said Marcus Orme, CEO of U.K.-based media agency Medialab, which works with a number of nonprofit organizations.

“In the early days of the U.K.’s Covid-19 pandemic, the cheaper pricing did not immediately drive significant performance impact for charitable organizations as consumers adjusted to and started to take in the enormity of the crisis,” Orme said.

That began to change in April, according to Orme. TV networks were also quick to adapt and began to remove traditional barriers to TV investment like creative development and production, reducing costs and increasing the speed at which ads could get on air — to less than a week in some cases.

“Audiences continued to grow and consumers started to tune in to and react to the growing number of charity emergency campaigns on TV, which started to drive impressive response rates,” he added.

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.