Connect with execs from The New York Times, TIME, Dotdash Meredith and many more

‘Everyone wants control’: Traffic soars, but programmatic ad prices drop

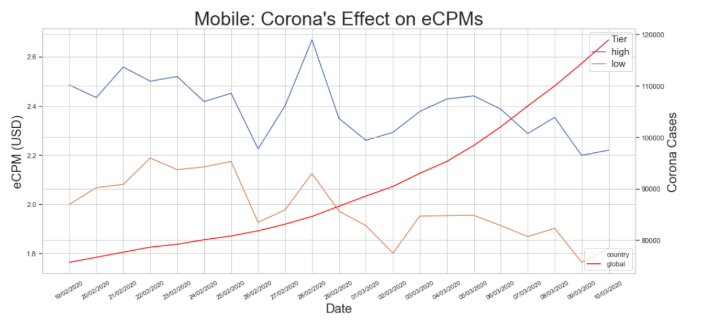

Online ad revenue has shriveled up amid the coronavirus pandemic, but there are early signs of recovery.

Since the onset of the global pandemic, publishers have an abundance of supply with a clear spike in web traffic, up as high as 30%, according to the seven media execs interviewed for this article. The challenge for those publishers is that the content driving the uplift is on the coronavirus, which advertisers have chosen largely to avoid.

“Programmatic pricing is down an average of 10 to 20% globally, CPVs are declining week-over-week and performance campaigns are on the increase – today’s buyers are now more loyal to price than brand,” said Justin Taylor, md at ad tech vendor Teads U.K.

For one publisher, pageviews are up 25 to 30% and yet advertisers have pulled media dollars. With so much traffic to monetize, the exec is sending out an “extreme” amount of ad requests to ad tech vendors to sell their inventory. The problem, however, is those ad requests are going out to advertisers who can afford to be picky about what ads they buy because there’s so much available. And there’s only so low a publisher can go with their ad prices to kickstart demand. The exec wants to stick to a minimum price for those ads bought in real-time auctions but is finding it hard to enforce when their rivals are lowering their own floor prices to attract demand.

Even in markets where CPMs are tanking, there are still advertisers that are paying more for ads that are more likely to be seen.

According to ad tech vendor Browsi analysis of CPMs across three news and sports publishers between 10. Feb and 10. Mar, those impressions that had a viewability score of 70% ore more had CPMs of more than 30% than those impressions that had a viewability score below 70%.

But quality impressions will only go some of the way to stabilizing a programmatic marketplace that’s in flux.

“Our viewability is between 60 to 80% on the majority of our placements so quality doesn’t even help in this case,” said the publishing exec.

In fact, demand for impressions is more likely to come from opportunistic advertisers who see ways to either grow their businesses or replace lost reach at a discount.

“We’re seeing a lot of interest from e-commerce businesses as well as from the long tail,” said the commercial director at a Nordics-based publisher who was not authorized to speak to Digiday. “Big brands have stepped back from our ads, which has left more room for smaller companies so we halved our floor price. We have to get some revenue back in.”

Despite having to sell ads at cut prices, the exec remains hopeful it won’t be for long. So far, the company’s digital ad revenue is 25% down on the same period last year thanks to the pandemic. While the decline isn’t as steep as the exec anticipated, it’s emblematic of how little appetite there is for news among advertisers. Rates for the publisher’s ads in both private and marketplace have dipped over the last three months versus the same period last year as are programmatic guaranteed deals, said the exec.

“We are seeing movement from advertisers that do want to connect with their audiences again, but we expect the downturn to last until May,” said the exec. Regardless of whether the pandemic has peaked, governments will have made moves by the summer to kickstart consumer spending, said the exec.

It’s a viewpoint shared by other media execs who see media dollars slowly but surely trickling back into programmatic, albeit in a more controlled way. Ads in private marketplace deals are seen as safer bets to those in the open marketplace among advertisers that want to lock down inventory and pricing during such a volatile time, for example.

“Everyone on the client side is looking for control now,” said Sam Fenton-Elstone, CEO of media agency Anything is Possible. “They’re pushing for more whitelists, PMPs and contextual controls.

GumGum’s commercial director in the U.K. Peter Wallace expanded on the point: “We’re starting to see briefs come back in again The difference now is that advertisers are thinking more carefully about the suitability of the content their ads appear against.”

For those advertisers running programmatic campaigns amid the pandemic, they’re increasingly using contextual targeting tools to spot any media that’s relevant to their ads while blocking those that are overtly negative.

After advertisers rushed to block all coronavirus-related content, they seem to be loosening restrictions over what content can and can’t feature ads to reflect this new reality. Indeed, a recent tech advertiser that helps businesses with remote working used contextual ad tech vendor GumGum to target coronavirus stories that were related to working from home. Furthermore, coronavirus-related content is being monetized by YouTube after it had initially blocked it from advertisers.

“Advertisers are looking to us to offset sports investments in things like the NCAA March Madness tournament as they’re looking for video players with reach and quality content,” said Andrew Serby, svp of marketing at Zefr, a company that helps brands advertise on video platforms like YouTube and Facebook. “Only a few players have that scale, and being on YouTube and Facebook is a nice landing spot as well as Hulu.”

While money is starting to flow back into the programmatic market, it may be a short-term reaction.

“My concern is that what upticks there are in spend now could be the last bit of spend for the quarter being washed through the system,” said Bill Swanson, vp of EMEA at ad tech vendor Telaria. “Once we get to April, you may see buyers waiting to see how the pandemic plays out. It could be a slow start to the second quarter.”

More in Marketing

In Graphic Detail: Inside the state of the creator economy industrial complex

The creator economy might have started out as an alternative to traditional media, but is becoming more and more like it as it professionalizes.

Shopify has quietly set boundaries for ‘buy-for-me’ AI bots on merchant sites

The change comes at a time when major retailers like Amazon and Walmart are leaning into agentic AI.

WTF is ‘Google Zero’?

The era of “Google Zero” — industry shorthand for a world where Google keeps users inside its own walls — is here.