Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Brows on fleek: Why Anastasia Beverly Hills is the most followed beauty Instagram account

A California-based indie beauty company has found the key to attracting a huge group of followers on Instagram: Frequent updates, fan love and a strong brow game.

Anastasia Beverly Hills, launched in the late 1990s by mother-daughter duo Anastasia and Claudia Soare, doesn’t have the brand awareness of peers like Mac and Benefit. What it does have, however, is the most followed Instagram beauty account on the platform, with 7.5 million followers. The beauty industry average is 1.4 million followers.

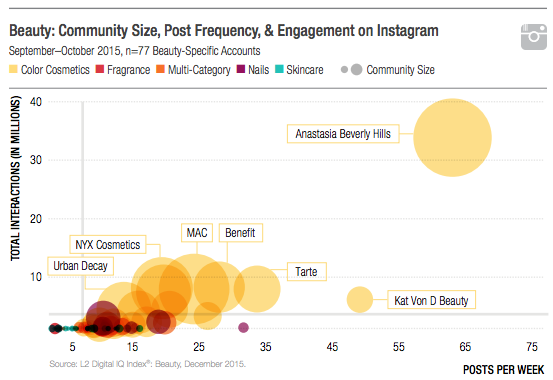

A recent study by digital think tank L2 ranked 106 of the major beauty brands based on their digital prowess, and recognized Anastasia as the stand out on Instagram. Averaging 62 posts per week, Anastasia’s account also sees the highest engagement (measured by gathering number of likes, shares and comments), with an average of 68,000 interactions per post.

The brand’s total interactions account for a full third of Instagram interactions across all brands indexed by L2. In fact, the number of Anastasia’s interactions on Instagram is equal to the combined interactions of the next top five brands — Tarte, Benefit, NYX, Mac and Too Faced.

Anastasia, which began as a line for eyebrow pencils, gels and pigments, now features lip and eye products, but is still best known for its brow products. On social media and in beauty tutorial videos, perfectly sculpted eyebrows have become hot fodder for the makeup obsessed: The top tutorials on YouTube, uploaded within the past year, have reached up to 10 million views, and hashtags on Instagram like #brows and #browshaping garner millions of combined results. The third most used hashtag about eyebrows is #anastasiabrows, with more than 600,000 post results.

As L2 points out (and Anastasia’s brand president Claudia Soare agrees), Instagram has become a go-to marketing platform for the beauty category.

“We don’t have the capacity to run large-scale global advertising campaigns, and Instagram seemed like a magazine for fashion, beauty and fitness,” said Soare to Women’s Wear Daily.

L2 analyst Jenny Shen, who contributed to the beauty report, said that Anastasia is not using Instagram with an especially out-of-the-ordinary approach, but rather, the brand has outdone others with its dedication and frequency.

“The brand engages with makeup enthusiasts, bloggers, and artists by re-gramming user generated content and tagging the fan, establishing a personal connection with many of its followers,” said Shen. “Other brands do this too, but not quite to the same extent as Anastasia — if you scroll through some recent photos, almost every single one tags a beauty influencer.”

Anastasia’s keen efforts on Instagram have seen results. According to NDP’s U.S. Prestige Beauty Total Measured Market retail sales tracking service, Anastasia Beverly Hills was the fastest growing beauty brand between January and June of 2015, both in stores and online. Women’s Wear Daily reported in August that, according to industry insiders, year-over-year sales at Anastasia quadrupled since 2012, the year Anastasia joined Instagram; specific sales figures weren’t disclosed by the brand.

While Anastasia posts frequently on its own Instagram account — the goal is to update at least once every three hours between 7 a.m. and midnight according to Soare — a lot of the brand’s heavy lifting is done by influencers. The brand works with more than 600 influencers, according to L2, and these beauty stars were responsible for 24 percent of Anastasia’s earned media value in the second quarter of 2015, a total of $11.2 million.

While Anastasia stands out on Instagram, its experience shows that a stellar strategy on one social platform doesn’t necessarily translate across to others. On Facebook, which is predominantly a paid platform for brands, L2 points out that Anastasia posts about 32 times a week and sees about 948 interactions per post, below average. (Benefit, for comparison, sees over 14,000.) Its YouTube account only has 12 videos published.

“Anastasia actually doesn’t perform as well on other platforms,” said Shen. “It comes down to spend. Bigger brands have the budget for Facebook and video advertising.”

More in Marketing

‘An ethics issue’: Why some creators are re-auditing their brand deals after Hootsuite-ICE controversy

Hootsuite’s partnership with ICE sparked controversy earlier this year, prompting creators to re-examine their brand deals and ethics standards.

Gary Vaynerchuk built his name telling CMOs they were wrong. Now he’s telling their CFOs instead

Gary Vaynerchuk has a new favorite meeting.

As it ramps up push to fund AI bets, Meta makes a new play for agencies

Even in the age of Advantage+, Meta needs agencies.